Feb 15, 2023

Japan’s Trade Deficit Smashes Record Amid Global Slowdown

, Bloomberg News

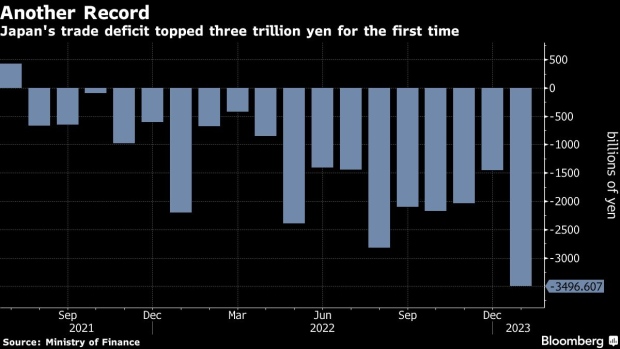

(Bloomberg) -- Japan’s trade deficit surged to a record in January, as one-off factors including the lunar new year holidays dragged on exports amid a backdrop of a slowing global economy.

The trade gap jumped to ¥3.5 trillion ($26.1 billion) from ¥1.45 trillion in December, topping ¥3 trillion for the first time in comparable data going back the late 1970s, the finance ministry reported Thursday. The deficit far exceeded the previous record, although it was smaller than analysts’ estimates.

Export growth slowed sharply to 3.5%, with chip-making equipment among the largest drags, in a sign of weakening global tech-sector demand. The value of shipments to China sank 17.1%, dragged down by cars, auto parts and chip machinery. Exports to the US and Europe also grew at a weaker pace of 10.2% and 9.5% respectively.

Imports meanwhile continued to show double-digit gains with a 17.8% increase from a year ago, as costly energy shipments continued to inflate the import bill. Japanese firms also likely tried to secure inventory from China before lunar new year celebrations.

The record deficit casts a cloud over Japan’s economy, as it struggles for recovery momentum with a new Bank of Japan governor set to take over from Haruhiko Kuroda and his decade of monetary easing. While one-off factors contributed to the deficit, the government and the central bank will need to keep a close eye on how much growth is slowing abroad.

“Japan’s exports are unlikely to show a strong pickup so the overall economy will probably continue to have a lackluster recovery,” said Takeshi Minami, chief economist at Norinchukin Research Institute. “That will be a headache for the BOJ when they consider normalization.”

China’s sudden turnaround on its virus policy has also meant a hit to Japan’s exports, as Covid cases surged following the end of China’s Covid-Zero policy, causing disruption across the country. Shipments to China and other Asian countries account for more than 50% of Japan’s overall exports.

What Bloomberg Economics Says...

“Looking ahead, we expect the trade deficit to narrow sharply in February, driven by a year-on-year jump in exports. The average of the shortfalls in January and February, though, will probably be on par with the deficit in December 2022.”

— Yuki Masujima, economist

For the full report, click here

The data also showed that the average exchange rate last month was 132.08 yen to the dollar, 15% weaker than a year earlier. Although the weaker yen and higher oil prices — the two main factors behind the prolonged trade deficit — have faded compared to last year’s peak, their effects still appear to be lingering.

Another round of expanding import bills may trigger further price hikes. Nationwide inflation reached a 41-year high in December, as companies, especially food manufacturers, passed higher costs onto their products. Accelerating inflation has eaten into consumers’ purchasing power, a trend reflected in household spending’s second straight month of declines in December.

“What’s not certain is how quickly the deficit will shrink as the global economy is expected to slow further from here,” said Norinchukin’s Minami. “There’s less pessimism emerging over the global economic outlook, but I would say the effect of a rapid tighteing by central banks will hit harder in the coming months.”

(Updates with more details from the release, economist comments)

©2023 Bloomberg L.P.