Feb 14, 2022

Larry Berman: Is Russia investable?

By Larry Berman

Larry Berman's Educational Segment

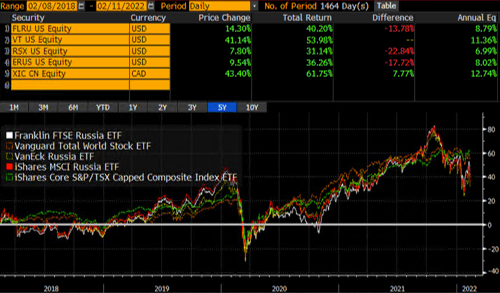

The answer depends on your time frame and what you are hoping to achieve. If you think the future is about technology (as the world innovates), health care (as we age), and consumerism (as populations grow), then find another place to invest (with ETFs anyway). If you are looking for a way to play energy, mining and financials (stick with the S&P TSX), you are getting similar exposure with much less political risks. Returns in the past few years have been similar to the world index as we can see in the charts and tables below. The S&P TSX has done well recently due mostly to the higher energy exposure. Russia was actually doing much better than the world indexes until the troop build up in recent months started to escalate geopolitical risks. It’s been close to one year that troops have been building.

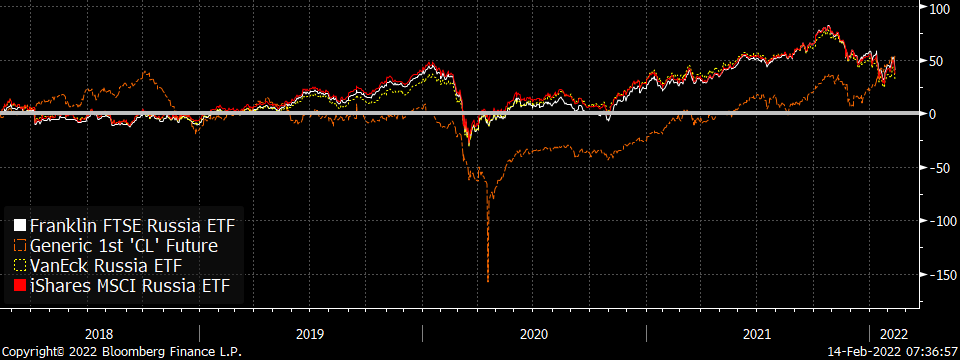

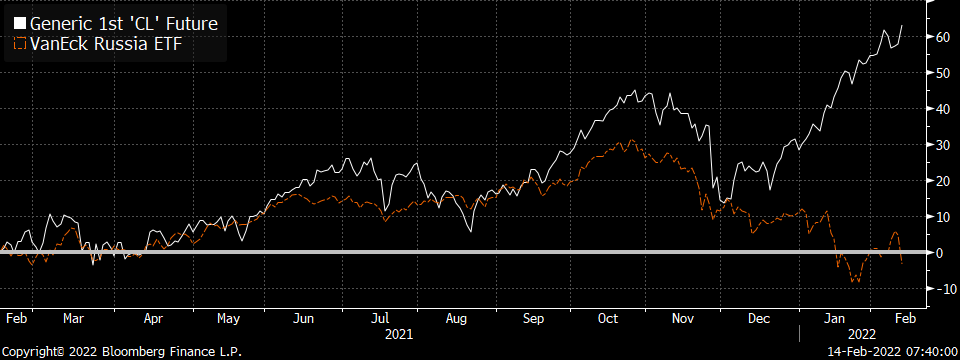

If you are looking to play the huge position that Russia has in the energy sectors, there are better places to invest (by far) and the correlations in recent years have not be great. This is not a good reason to invest in Russia. There are very few!

With the exception of Q3/21 when WTI oil prices jumped 30 per cent from mid $60s to mid $80s, the correlations have been weak. We can see this when we zoom in to the past year and look at the recent divergence with energy prices.

No matter what ETF index we look at (RSX, ERUS, FLRU), the biggest weights are in energy, mining, and financials. Do you really want to own any of those with all the sanctions coming?

There are a few stocks that can work into weakness. MBT (Moble Telesystems - Wireless), which is did own for parts of 2021 (do not own it now) and YNDX (Yandex - Russia’s Google), which I do not own now, but looking at it coming out of this conflict. Beyond these, we think Russia should be avoided except for the obvious speculative interest in playing the volatility in the conflict, which I would not recommend for most.

Our Spring virtual roadshow is starting Feb. 24 through April 28. Keep an eye on The Investor’s Guide to Thriving website for more information on how to sign up in the coming weeks. The theme will be Berman’s Call deep dives. More in-depth looks on combining fundamentals and technical to mine for investment ideas. Should be a great series.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com