Jan 31, 2022

Gong hei fat choy: Chinese and U.S. monetary policy diverging

By Larry Berman

Larry Berman's Educational Segment

The year of the tiger is likely to be better for China than the year of the mid-term elections will likely be for the U.S. In 2021, China spent most of the year trying to repair bad debt issues in its real estate sector and policy was focused on the common prosperity narrative. Chinese credit expansion collapsed. In 2021, the U.S. goosed fiscal spending that was more than monetized by the Federal Reserve balance sheet and now needs to tighten financial conditions as the policy combination contributed to ignite an inflation cycle. U.S. equities led the world equity bubble while Chinese stocks suffered. We had cautioned about the Chinese tech bubble last year at this time at the peak of the meme stock craze.

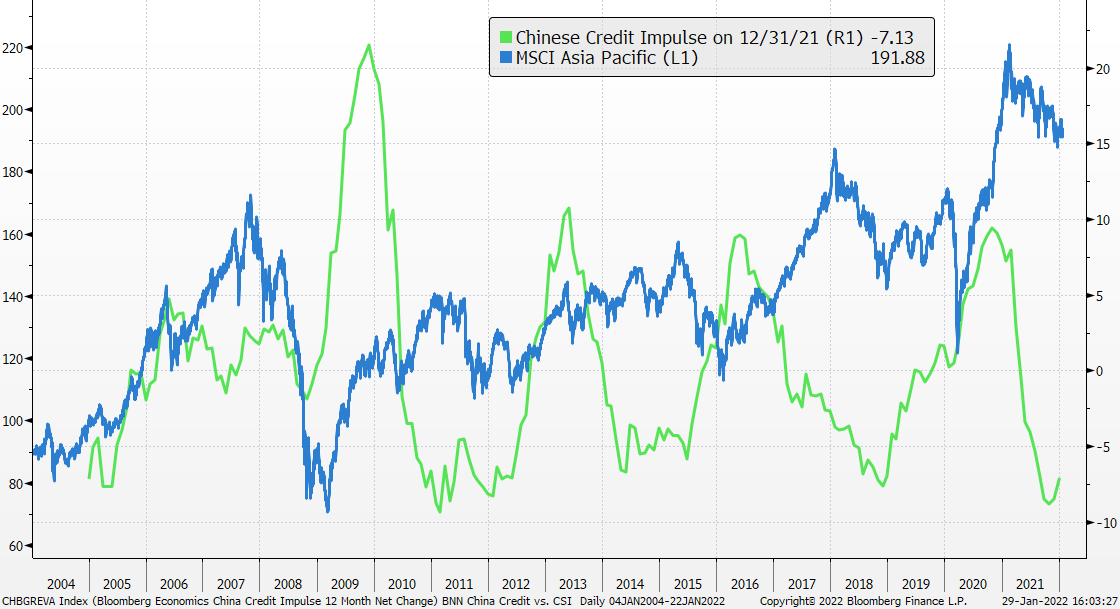

The Chinese credit impulse cycle tends to drive and lead returns in the Asia Pacific region. In the past few months, the Chinese credit impulse has turned up. It can take a few years to get going, but equities in the region tend to expand when this happens.

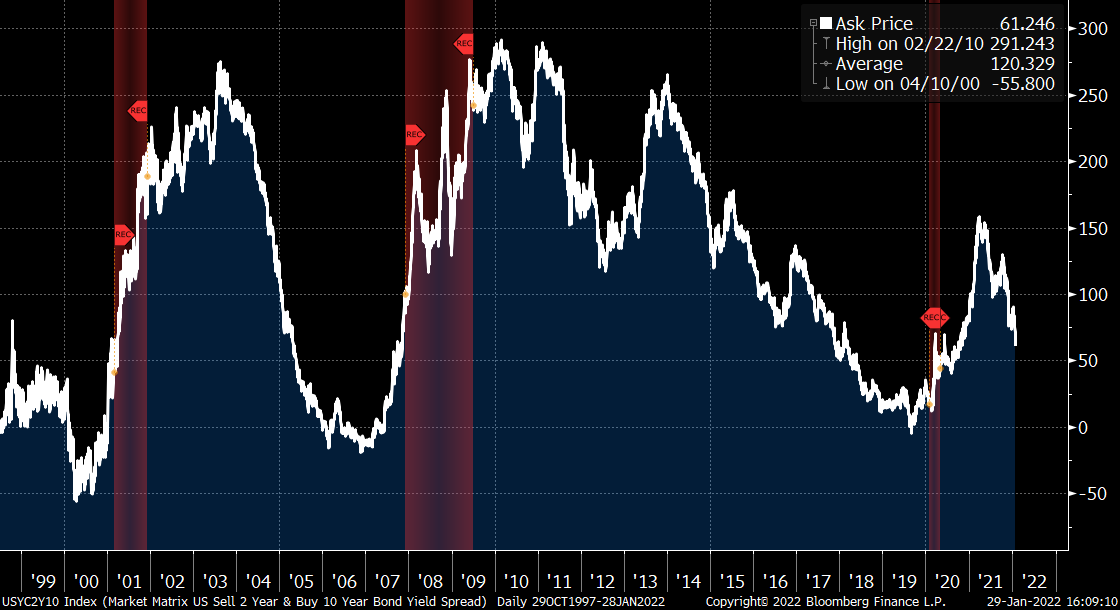

On the other side we have a hawkish federal reserve looking to tame inflation. The slope and trend of the yield curve tells us a lot about forward growth prospects. The chart shows the two-year versus 10-year yield curve. When asked about the message from the yield curve last week, Powell said they consider it among many inputs. The interesting thing to know is that every recession in the past 50 years has been caused by the federal reserve making financial conditions too tight. The complication this time around that they did not need to deal with before are the supply side issues monetary policy cannot solve. To say they are between a rock and a hard place is an understatement. The path of inflation expectations, real yields, and the slope and trend of the yield curve will matter for fed policy. We expect they will not be able to raise rates at the pace the market is pricing in today without throwing the economy into recession. Fuel prices are now significantly eating into discretionary spending. $1.55 per litre in Ontario on the weekend and north of $1.80 in B.C. is starting to get into European petrol pricing dynamics. This is not an environment for the North American economy to boom. It also may be helpful to know that U.S. stocks tend to have their worst returns in a mid-term election year. Even more so this time around since it appears that Congress will likely flip back to the GOP.

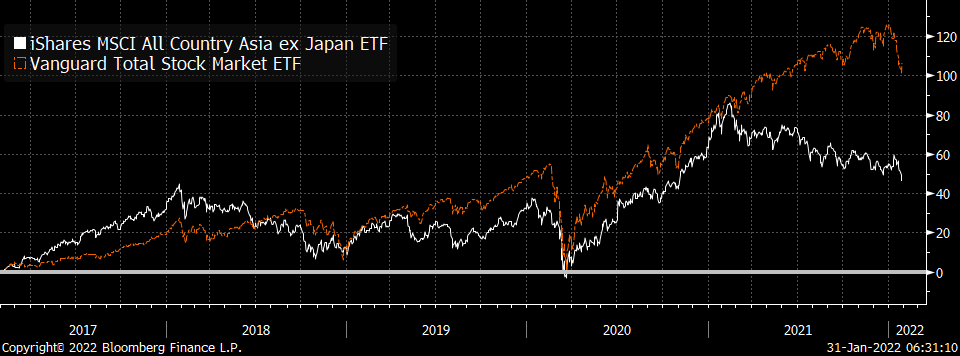

If you are looking for happiness and prosperity in 2022, put Asian equites on your radar. There are not many good choices in ETFs in Canada. U.S. listed iShares AAXJ (Asia ex Japan) divergence with the Vanguard Total US market (VTI) is dramatic. It has to do with significantly diverging policy, which looks to mean revert in 2022.

Our spring virtual roadshow is starting Feb. 24 through April 28. Keep an eye on The Investor’s Guide to Thriving website for more information on how to sign up in the coming weeks.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com