May 5, 2021

Lumber futures extend record rally to top US$1,500 for first time

, Bloomberg News

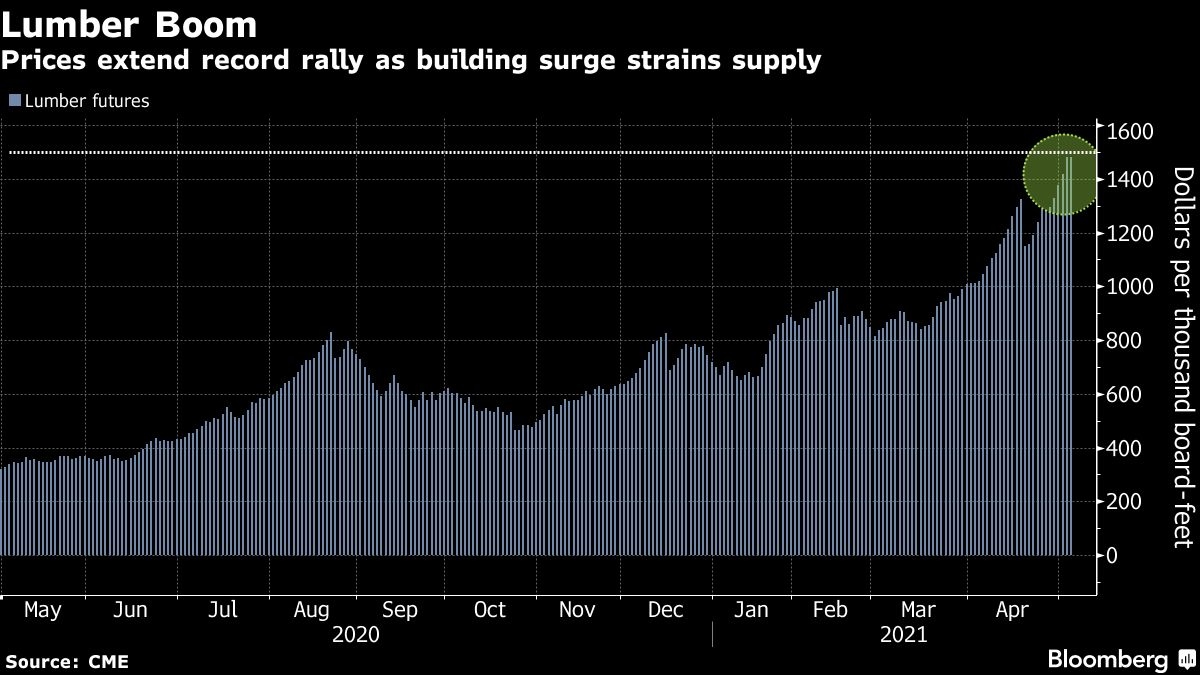

U.S. lumber futures extended their steep rally to fresh record highs, shooting above US$1,500 as sawmills try to keep up with surging demand.

The extended rally comes as voracious home construction demand sends builders scrambling to secure the wood they need, while lumber producers struggle to bulk up their inventories and labor shortages from truckers to construction workers exacerbate the situation.

Prices have quadrupled in the past year, vaulting higher on an unexpected surge in home building and renovations that caught sawmills off guard amid the pandemic. Weyerhaeuser Co. reported a record quarterly profit last week, having sold out of some products for the next five to six weeks, while Resolute Forest Products Inc. said its order book exceeds its inventory.

“The buying frenzy with escalating prices continued yesterday,” William Giguere, who buys and sells eastern spruce with mills for Sherwood Lumber in Massachusetts, said in a note on Wednesday. “The only thing that kept buyers in check was when there was nothing else to buy. It seemed that the tighter material was, the stronger the urge it was to buy.”

The rally, which some expect could continue even higher, is hitting pocketbooks and potentially pushing first-time home buyers out of the market, as North America heads into its peak building season. It has lifted the price of an average new single-family home by US$35,872 over the past 12 months, according to the national Association of Home Builders.

July lumber futures on Chicago Mercantile Exchange rallied as much as 4.3 per cent to US$1,544.50 per 1,000 board feet, the highest-ever for a most-active contract. The May contract, which will expire May 14, rose 1.9 per cent to US$1,639.