May 21, 2023

McCarthy Says Debt-Limit Talks With Biden Will Resume Monday

, Bloomberg News

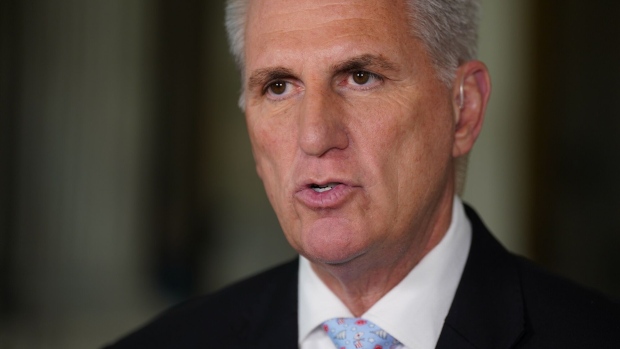

(Bloomberg) -- Debt-limit negotiators resumed discussions in Washington ahead of a meeting on Monday between President Joe Biden and House Speaker Kevin McCarthy, as time grows short to avert a US default.

Biden called McCarthy from Air Force One earlier Sunday on his way back from an international summit in Japan, setting the stage for the fresh talks.

“It went well, we’ll talk tomorrow,” Biden told reporters after returning to the White House.

Negotiators for the two sides entered McCarthy’s office around 6 p.m. on Sunday and left more than two hours later. White House Office of Management and Budget Director Shalanda Young and Biden adviser Steve Ricchetti did not comment to reporters about the status of negotiations, but Ricchetti said they planned to continue working Sunday night.

McCarthy stressed in comments to reporters at the US Capitol that the two sides don’t have an agreement as the country nears a catastrophic default that could come as soon as June 1.

“Time is of the essence,” the speaker said. But he added that he was more hopeful of a deal after talking with Biden about solutions to bridge their differences, calling their discussion “productive.”

Investors are girding for more volatility in markets this week as the two sides grapple for a deal.

Asian shares crept higher while US and European stock futures inched lower. Investors are weighing a likely pause in interest rate hikes by the Federal Reserve against the risk of US default. Contracts for the S&P 500 and the Nasdaq 100 were fractionally lower, adding to small declines on Friday.

Traders Brace for Volatility With US Debt Deal Elusive

Treasury Secretary Janet Yellen said earlier Sunday that the chances the US can pay all its bills by mid-June are “quite low.” Yellen underscored the urgency of the situation, telling NBC that there are tax payments expected then that are substantial and “getting to that date is the problem.”

The current standoff over the debt ceiling has the potential to put more strain on the US economy, which is already vulnerable to a recession after a series of interest-rate hikes by the Federal Reserve, according to Bloomberg Economics.

A US default would risk triggering a market selloff, a surge in borrowing costs and a blow to the global economy. A temporary walkout from the debt-limit talks by Republican negotiators sent stocks down on Friday.

Biden told reporters in Japan Sunday before his departure that he proposed to cut spending and that the onus is now on Republicans to shift their demands. The president insisted he wouldn’t agree to a deal that protects tax breaks for the wealthy and the fossil-fuel and pharmaceutical industries while cutting health-care and education funding.

“I fundamentally disagree with the idea that we should accept Republicans’ conditions for doing the basic work of paying our bills,” the president said in a fundraising email sent to supporters on Sunday before he arrived at the White House. “In recent days, Republicans have started to listen more and more to their MAGA extremist colleagues and are back to demanding unreasonable, slashing cuts.”

Goldman Says Treasury Will Drop Under Its Cash Minimum June 8-9

Republicans have lowered their demands on spending caps from 10 years to six years, according to two people familiar with the talks, but the White House still wants the deal to last two years.

One of the people said the GOP is still seeking a large increase to defense spending next year, something that would deepen cuts to social services. Democrats have demanded that defense, which is about half of all federal discretionary spending, not be fenced off from cuts.

McCarthy and his spokesman didn’t reply when asked about the GOP spending cap offer.

Representative Garret Graves, one of the Republican negotiators, told reporters Sunday the GOP will insist on a multiyear spending limit and such a cap is a “foundational” focus of the talks. Energy permitting changes are “irrelevant” without a deal on caps, he said.

Graves said the two sides already have “made a lot of progress” in their discussions but had “a setback” on Saturday.

Asked about the possibility of a short-term extension to avoid a debt default, McCarthy dismissed the idea.

(Updates with Biden return to Washington, new remarks and market data)

©2023 Bloomberg L.P.