Mar 27, 2023

MicroStrategy Pays Off Bitcoin-Backed Loan From Silvergate

, Bloomberg News

(Bloomberg) -- MicroStrategy Inc., the biggest corporate owner of Bitcoin, paid off the remainder of its $205 million Bitcoin-backed loan from Silvergate Bank with proceeds from the sale of shares and purchased about $150 million more of the cryptocurrency.

The loan from the failed crypto-friendly bank was retired about two years early, releasing about 34,619 coins that were held as collateral, the enterprise-software maker said in a US Securities and Exchange Commission filing on Monday. MicroStategy disclosed that it raised $339.4 million this year through the sale of shares.

Michael Saylor, the co-founder and executive chairman of MicroStrategy, began investing in Bitcoin in August 2020 and has made its acquisition as part of the company’s strategic focus. The latest purchase of 6,455 tokens from Feb. 16 through March 23 was the largest acquisition by the Tyson Corner, Virginia-based firm since April 2022.

The average purchase price of MicroStrategy’s cache of $4.14 billion of Bitcoin is $29,817. Bitcoin traded at about $27,700 as of 10:08 a.m. in New York. The digital asset has jumped about 67% so far this year.

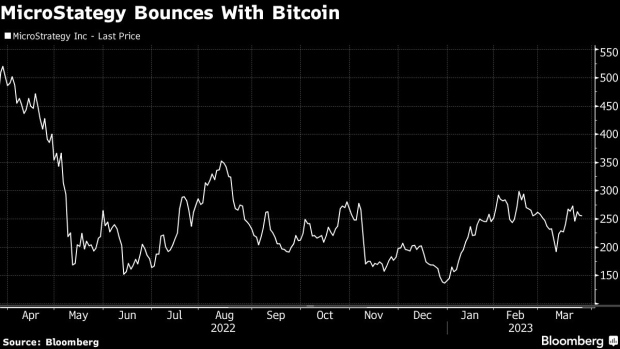

Shares of MicroStrategy rose less than 1% to $258.98 in New York. The stock has jumped more than 80% this year, after falling 74% in 2022.

--With assistance from Tom Contiliano.

(Adds information on purchases beginning in the second paragraph.)

©2023 Bloomberg L.P.