Oct 12, 2023

Oil extends fain on Israel war risks, stricter Russian sanctions

, Bloomberg News

Oil markets are not yet pricing in risk of major oil disruption if Iran gets involved: Clay Seigle

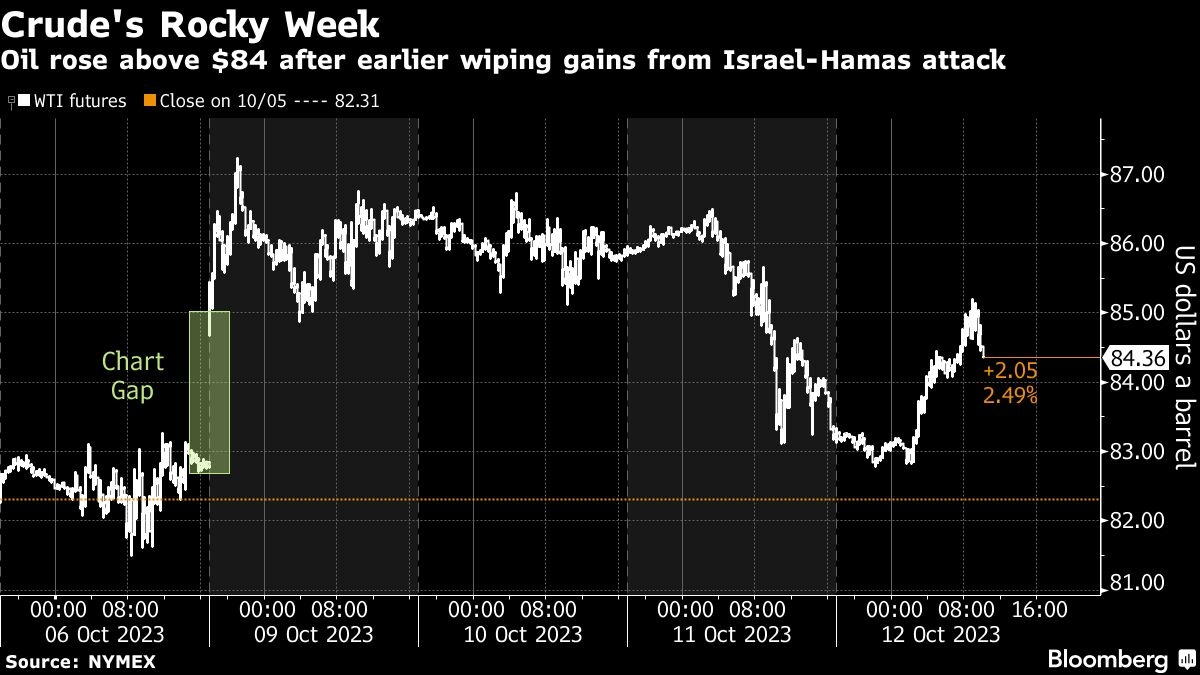

Oil rose as traders weighed the U.S.’s more stringent enforcement of Russian oil sanctions alongside heightened geopolitical risks in Israel and Gaza.

West Texas Intermediate rose above US$84 a barrel as Israeli military forces continued to amass along the border of the Gaza Strip ahead of an expected ground assault into the enclave. Speaking in a joint interview on Russian state television, Saudi Energy Minister Prince Abdulaziz bin Salman said oil producers will continue to act to support the market.

Meanwhile in the U.S., the Treasury Department sanctioned two companies and blocked ships accused of transporting Russian oil at prices above a cap instituted after its invasion of Ukraine. The move is a result of Russia having built its own fleet of vessels to sidestep the price cap.

“Any additional sanctions will be taken as bullish,” with demand currently outstripping supply, said Dennis Kissler, senior vice president for trading at BOK Financial Securities. “The only headwind I see is higher interest rates” and the potential for demand destruction if crude rises above $100 a barrel.

Despite the gains, crude experienced headwinds from the dollar after U.S. inflation data came in slightly hotter than expected. Additionally, an International Energy Agency report showed signs that demand in some regions was being destroyed.

U.S. inventory levels will also be in focus after the industry-funded American Petroleum Institute reported a jump of almost 13 million barrels in nationwide stockpiles. However, inventories at the Cushing, Oklahoma, hub dropped back toward critically low levels. Official figures are due later on Thursday.

Prices:

- WTI for November delivery rose 1.6 per cent to $84.81 a barrel at 10:36 a.m. in New York.

- Brent for December gained 1.7 per cent to $87.29 a barrel.

Oil has had a volatile week following the initial shock of the Hamas assault, with traders seeking to price in the potential repercussions. There are concerns that the conflict may spread across the region, endangering crude flows. In addition, prices have swung on data showing record-high U.S. production and the possibility of a deal between the U.S. and Venezuela that may boost crude flows.

This year, Saudi Arabia and Russia have spearheaded deep output cuts in a bid to drain inventories and boost prices. Their voluntary curbs have augmented a broader collective OPEC+ deal to pare production. The restrictions underpinned a major rally in the third quarter, with Brent at one point nearing $100 a barrel.