Jun 9, 2022

Oil slips as Shanghai lockdowns potentially curb China's demand

, Bloomberg News

'Raising rates does not fix $120 oil': James Thorne

Oil edged lower as renewed lockdowns in parts of Shanghai potentially dampen global fuel demand and ease pressure on tight markets.

West Texas Intermediate futures fell 0.5 per cent on Thursday, after spending the session hovering near a three-month high as low fuel inventories underscore precarious supply balances. Shanghai is reinstating major restrictions on movement to stem the spread of COVID, calling into question the demand recovery in one of the world’s biggest oil-consuming countries. The financial hub lifted a two-month shutdown at the start of June.

“Crude futures are also in an overbought condition and a corrective phase is definitely due,” said Dennis Kissler, senior vice president of trading at BOK Financial “Prices have to take a breather at some time and the new possible COVID issues in China are assisting this morning.”

Crude has maintained its upward momentum this year as economies rebound from the pandemic, while Russia’s war in Ukraine has upended trade flows, leading to further tightening. Prices are still “nowhere near” their peak, according to key OPEC member the United Arab Emirates, which said Wednesday that China’s impending recovery may strain the market further.

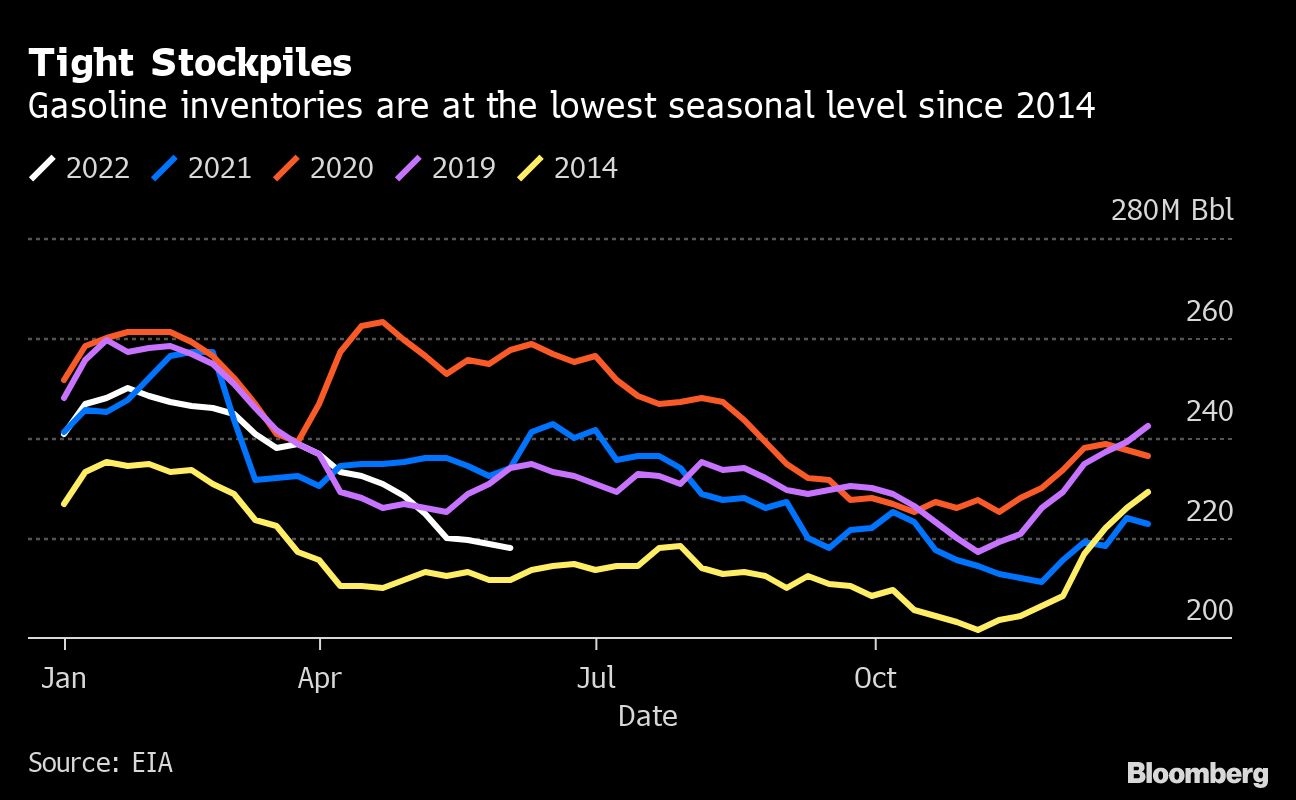

The renewed curbs are keeping prices in check after crude this week hit a three-month high amid strong product markets. U.S. gasoline inventories are at their lowest seasonal level in eight years, while consumption is rising even as retail prices for the motor fuel are already at a record.

Prices

- WTI for July delivery fell 60 cents to settle at US$121.51 a barrel in New York

- Brent for August was dropped 51 cents to settle at US$123.07 a barrel

Although Shanghai will lock down a district on Saturday for mass testing, China as a whole is cautiously emerging from strict virus curbs. China National Petroleum Corp., the country’s biggest oil and gas producer, has predicted oil demand will grow next quarter but warned of further disruptions this year due to more COVID-19 outbreaks.

Goldman Sachs Group Inc. said this week that prices needed to rally further to achieve the demand destruction required for market rebalancing. The bank increased its quarterly forecasts for this year and into 2023, raising its WTI estimate for the next quarter to US$137 a barrel.