Oct 26, 2022

Oil Rises most in a week as petroleum exports soar to record

, Bloomberg News

Energy aspects says China's oil demand has been depressed by lockdowns

Oil rallied after the U.S. exported a record amount of crude and fuel last week, offering some upside clarity to a demand outlook recently dominated by economic concerns.

West Texas Intermediate futures rose more than 3 per cent, the most in a week, to settle near US$88 a barrel. Total U.S. petroleum exports reached 11.4 million barrels a day last week, according to the Energy Information Administration. The fuel outlook tightened as gasoline stockpiles fell and diesel inventories on the East Coast, already precariously low, sank further. A smaller-than-expected 2.59 million barrel build in crude inventories was largely brushed off by markets that honed in on the high export figure.

“Higher exports, falling gasoline inventories -- both of those signal that we’re going to need more U.S. oil down the road,” said Rob Thummel, a portfolio manager at Tortoise Capital Advisors, which manages roughly US$8 billion in energy-related assets.

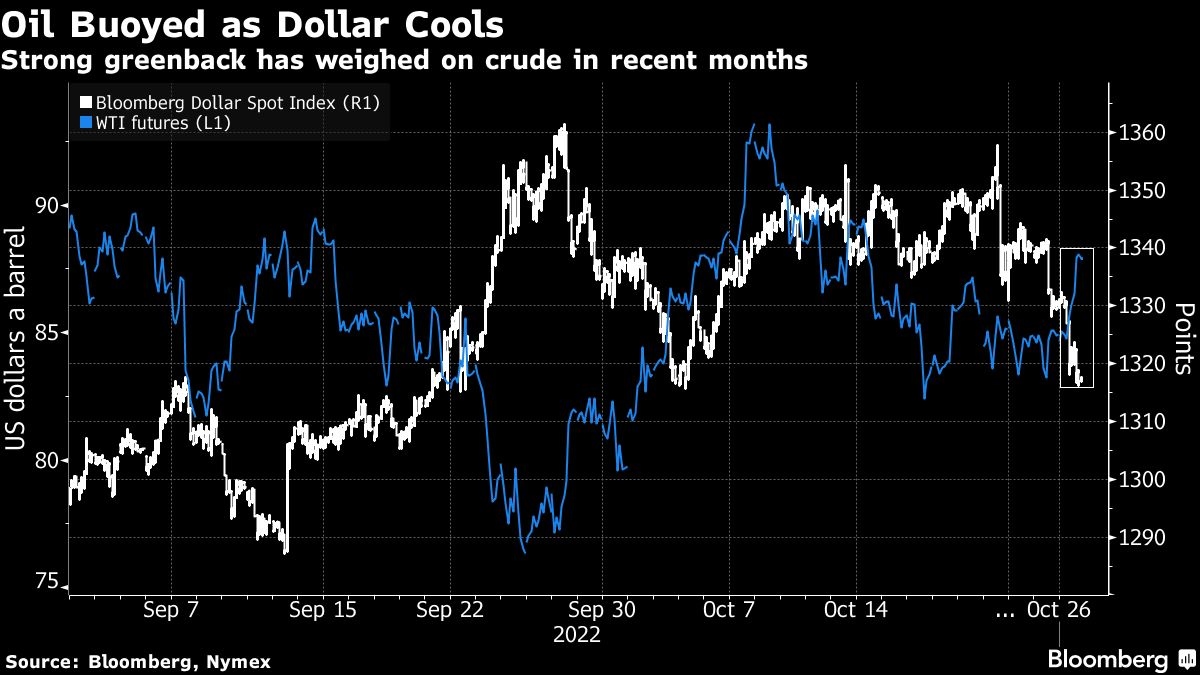

Meanwhile, a gauge of the dollar declined for a second day to its lowest level in three weeks, making commodities priced in the currency more attractive. Oil prices have been sinking ever since U.S. benchmark WTI peaked above US$120 in June, largely weighed down by strength in the greenback and ever-growing recession fears as central banks hike interest rates to combat inflation.

Crude markets have whipsawed as traders mull a dimming outlook for demand but see a tighter landscape for supply amid OPEC+ production cuts and European sanctions on Russian oil taking full effect.

Some are hopefully watching China for signs of a potential economic uptick, which would help offset lower demand as recession fears heighten elsewhere. But headwinds still persist in the country as signs of macro-economic weakness continue to emerge. The economy in China, the top crude importer, slowed in October, according to a Bloomberg index of early indicators, signaling last month’s pickup wasn’t enough to change the country’s grim economic picture.

Prices:

- WTI for December delivery climbed US$2.59 to settle at US$87.91 a barrel.

- Brent for December settlement rose US$2.17 to US$95.69 a barrel.

Tight supplies for both crude and oil products have pushed consumer prices up, prompting the Biden administration to release millions of barrels of crude from the nation’s strategic reserves in a bid to tame prices.

Traders have been watching the Strategic Petroleum Reserve closely, as the U.S. may soon have to purchase crude to refill its stockpiles. On Tuesday, Saudi Arabia’s energy minister criticized major importers for trying to tame prices by selling down their inventories, warning that depleted stockpiles would create pain in coming months.