Jul 25, 2023

Options Traders Wager on Fastest Ever U-Turn From the ECB

, Bloomberg News

(Bloomberg) -- Traders in the options markets are betting the fragility of euro-zone economy will force the European Central Bank into its fastest ever monetary-policy U-turn.

Money-market pricing points to two more rate rises — a 25 basis point hike this week, while odds favor a further increase to a record-high 4%. But options markets — which give investors a cheap way to wager on alternative outcomes — suggest there won’t be a second hike, and cuts could come as soon as September to avoid too harsh a blow to growth.

That would be a quicker about-face than in 2008, when European policy makers sought to rapidly undo the damage of the previous run of hikes, heralding a phase of aggressive monetary-policy easing as the global financial crisis unfolded.

A raft of alarming data recently has encouraged the alternative bets.

The ECB’s quarterly survey added to concern about the economic damage from more tightening as company demand for loans plunged by the most on record in the second quarter due to monetary-policy tightening. S&P Global, meanwhile, showed the euro-area private-sector economy contracted more than anticipated this month.

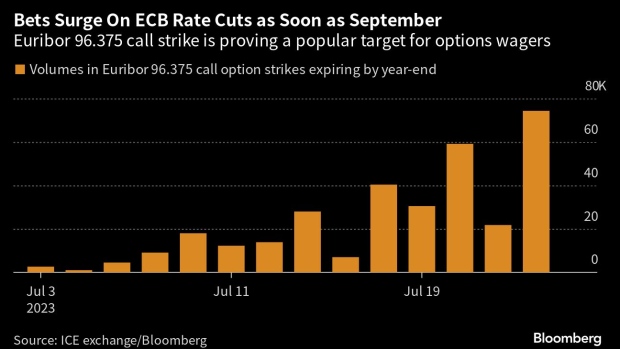

Traders are buying options on futures contracts tied to thee-month Euribor — a benchmark based on the average rate that banks can borrow in the money-market. Their bets are centered around the 96.375 strike which is a proxy for an interest rate of about 3.625%. They pay if this week’s ninth hike proves to be the last and is followed by a rate cut this year or expectations for easing very early in 2024.

The 96.375 call was the most actively traded Euribor option as of 11:50 a.m. London time on Tuesday.

Whether the options wagers play out, remains to be seen. They’re a long way off money-market expectations for 45 basis points of rate hikes by year-end. And the first rate cut isn’t expected until June, according to swap contracts tied to policy-meeting dates.

(Adds Euribor option volume in the seventh paragraph. An earlier version of the story corrected headline to show it would be the fastest-ever policy U-turn.)

©2023 Bloomberg L.P.