Nov 9, 2022

Pension Funds, Investors Cashed in £70 Billion in Market Chaos After Mini-Budget

, Bloomberg News

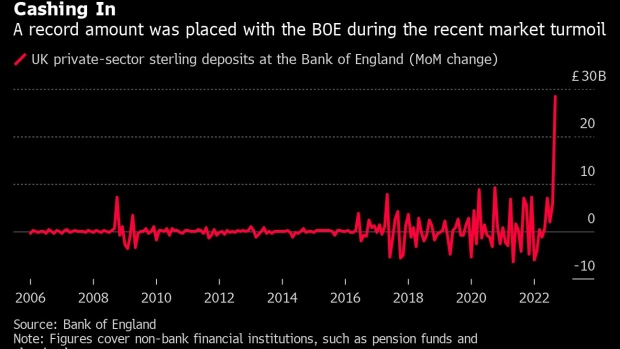

(Bloomberg) -- Pension funds and other investors cashed in almost £70 billion ($80 billion) as they scrambled to sell assets in the last days of September during the panic in liability driven investment funds before the Bank of England intervened.

Official figures from the central bank show that non-bank financial institutions, such as pension funds and clearing houses, placed a record £28 billion of sterling cash deposits with the BOE at the end of September, three times greater than any other time in the 32 years the central bank has been keeping records.

Another £39 billion was placed at commercial banks by pension funds, fund managers and financial intermediaries as assets were liquidated to meet collateral calls following the market shock triggered by former Prime Minister Liz Truss’s tax cut plan on Sept. 23.

The size of the cash calls in just seven days underscore the financial shock that was facing the BOE. Annualised broad money creation in September grew at its fastest rate since the massive quantitative-easing program in the pandemic as investors moved into cash.

Andrew Hauser, executive director for markets at the BOE, told lawmakers in October: “This was a situation that went from, ‘We are ringing you to let you know,’ to shouting on the phone to us within two days. This was a full-scale liquidation event.”

While there is no direct evidence that the cash calls were entirely due to the LDI crisis, which prompted the BOE’s biggest financial stability intervention since 2008, the central bank is understood to believe it was down to the extreme market volatility of the period.

On Sept. 28, the BOE started buying gilts off market participants to help get cash into the system and stabilize markets before they caused an economic crisis. It only bought £2.4 billion before the end of September, however, which suggests that the vast majority of cash calls were done privately and in the days before the BOE stepped in.

Simon Ward, an economist at Janus Henderson Investors who uncovered the numbers, said the BOE may have been “involved in facilitating the supply of liquidity to the funds, over and above its gilt-buying operation.”

His analysis suggests that the central bank may have provided cash through commercial banks via its discount window. Banks could then “onlend to funds,” he said.

His calculations using BOE balance sheet data suggest it may have provided around £20 billion in the days before its gilt market intervention, through the discount window.

The BOE declined to comment.

Ward added: “Sterling cash-raising related to the LDI crisis may have totalled about £67 billion –- the sum of the £39 billion increase in commercial bank deposits of insurance companies, pension funds, fund managers and dealers and the £28 billion placed at the Bank.”

“LDI funds were also scrambling to raise foreign currency liquidity. The rise in foreign currency deposits of the same group of institutions rose by £25 billion in September.”

--With assistance from Greg Ritchie.

©2022 Bloomberg L.P.