Oct 4, 2022

Pimco Says Bond Returns Look ‘Compelling’ Given Rise in Yields

, Bloomberg News

(Bloomberg) -- Bond giant Pacific Investment Management Co. thinks it’s now time to start buying debt.

The fixed-income specialist, whose managers oversee around $1.8 trillion in assets worldwide, expects high-quality bonds to start delivering returns much more consistent with long-term averages. In contrast, it sees downside risk for global equity markets.

“The return potential in bond markets appears compelling given higher yields across maturities,” Pimco’s Tiffany Wilding and Andrew Balls said in a note to clients. “We believe the case is now stronger for investing in bonds.”

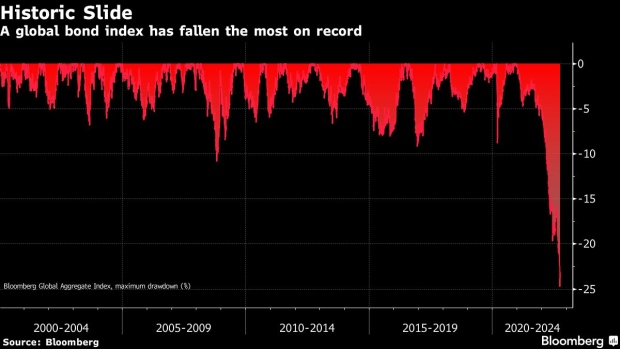

The view comes as both bonds and stocks rallied for a second day Tuesday on bets that a peak in interest rates is nearing. Aggressive interest-rate hikes spurred the worst fixed-income rout on record this year, driving yields across major markets to the highest in decades.

The steep fall after years of solid gains has encouraged buyers to emerge in recent sessions, with JPMorgan Asset Management among those saying they are adding bonds slowly. Still, there have been several false dawns for bond bulls this year as yields kept heading higher.

For equities, the Pimco report said high valuations and earnings expectations may not account for central bank tightening and increased risk of recessions. But for bonds, the authors think the front end of yield curves in most markets already price in sufficient tightening.

Pimco, which is owned by German insurer Allianz SE, said it sees “abundant opportunities to look to harness this growing value in bond markets.”

©2022 Bloomberg L.P.