Apr 2, 2024

Pound Nears Four-Month Low as BOE Seen Cutting Rates Before Fed

, Bloomberg News

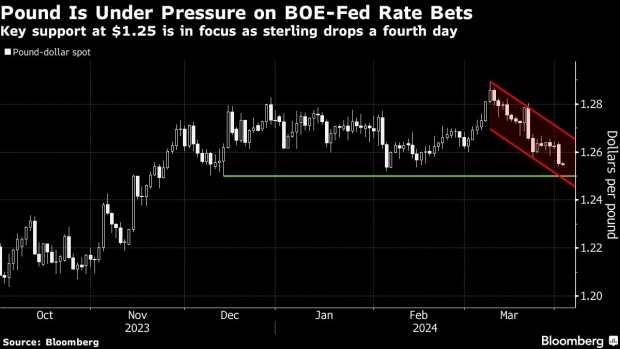

(Bloomberg) -- The pound fell toward $1.25, a level last seen in December, as traders increased bets the Bank of England will deliver more interest-rate cuts than the Federal Reserve this year.

Sterling slipped 0.1% to $1.2540, matching a six-week low hit on Monday after data showed US factory activity unexpectedly expanded in March for the first time since September 2022.

It’s a sharp reversal for the currency, which traded as high as $1.2894 in early March before coming under pressure after two of the most hawkish BOE members dropped their calls for rate hikes at the central bank’s latest policy meeting.

More signs that the US economy is firing on all cylinders could boost the dollar further in the near term, pushing the pound lower, said Erik Nelson, a macro strategist at Wells Fargo.

“There is some risk that we could see a break of $1.25, but it really hinges on seeing further strong US data, not just OK data,” he said. A “clearer, hawkish pivot” from Fed policymakers could prompt a decisive break lower in the pair, he added.

Money markets currently price 65 basis points of rate cuts in the US this year, compared to 70 basis points in the UK. The chance of a BOE quarter-point reduction in June is at around 63%, while that of a similar move by the Fed briefly fell below 50% on Monday.

In options, traders looking to hedge against a weaker pound need to pay a sizable premium across tenors. Market sentiment toward the currency’s performance this week is near the most bearish level since late October.

Technical signs also point to the possibility that the pound may break out of the $1.25-$1.28 range it has stuck to for much of the year. A closely watched technical indicator, the so-called weekly Bollinger Width, has dropped to levels last seen in 1977, pointing to a high probability that the pound is in for a big move versus the dollar in either direction.

--With assistance from Naomi Tajitsu.

(Updates price in second pargraph; adds analyst comment starting in third paragraph; adds technical indicators in final paragraph.)

©2024 Bloomberg L.P.