Aug 4, 2022

Pound to Weaken Whether BOE Hike Is Big or Small, Analysts Say

, Bloomberg News

(Bloomberg) --

With UK interest rates poised to head higher today, the view from some analysts is that the pound will only move in the opposite direction when the decision is announced at noon local time.

Their argument: that no matter what the extent of Bank of England tightening, the central bank will step back from flagging the need for further big rate rises in the coming months, causing markets to pare back expectations for hefty lifts in the future.

“The bar for markets to be surprised on the hawkish side is so high that it’s not going to be met in any circumstance,” said Simon Harvey, head of foreign-exchange analysis at Monex Europe Ltd. “We’re looking at an underwhelming meeting for money markets, and we think cable will also react.”

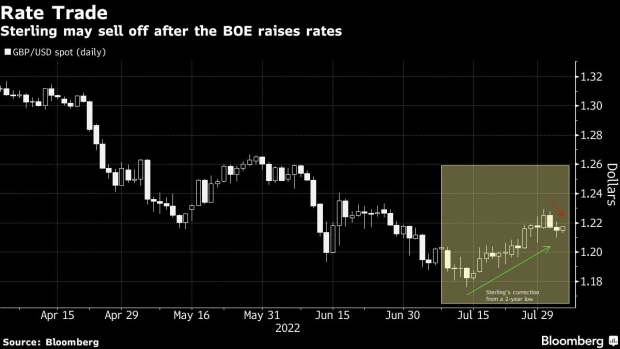

The pound has rallied since mid-July, hitting a five-week high of around $1.23 at the start of the week, partly on anticipation that the Bank of England would start to ramp up the pace of monetary tightening this month.

But the consensus remains negative. Analysts at TD Securities see downside risks on Thursday as traders “buy the rumor, sell the fact.” The BOE has held back from raising rates as aggressively as the Federal Reserve and others amid risks to the economy, pushing sterling roughly 10% lower versus the dollar since the start of the year.

At the moment, money markets are pricing in around 150 basis points of UK rate rises between August and December, meaning that even if the BOE hikes by 50 basis points today, it would have to deliver an additional full percentage point in tightening at its next three meetings to reflect market pricing.

Such aggressive action would further slow growth in the UK economy, which is teetering on the brink of a recession just as energy bills are expected to jump further in October, adding to inflation and exacerbating a cost-of-living crisis.

According to UBS Group strategists, a combination of rising prices, a gas supply shortage in Europe and UK political uncertainty will push sterling to a two-year low of $1.15 in the next three months, a view that isn’t uncommon.

“Whatever the Bank decides today, we will still be looking for sterling/dollar to head down to the $1.15 region in coming months,” Steve Barrow, head of G-10 strategy at Standard Bank, wrote in a note.

©2022 Bloomberg L.P.