Oct 23, 2019

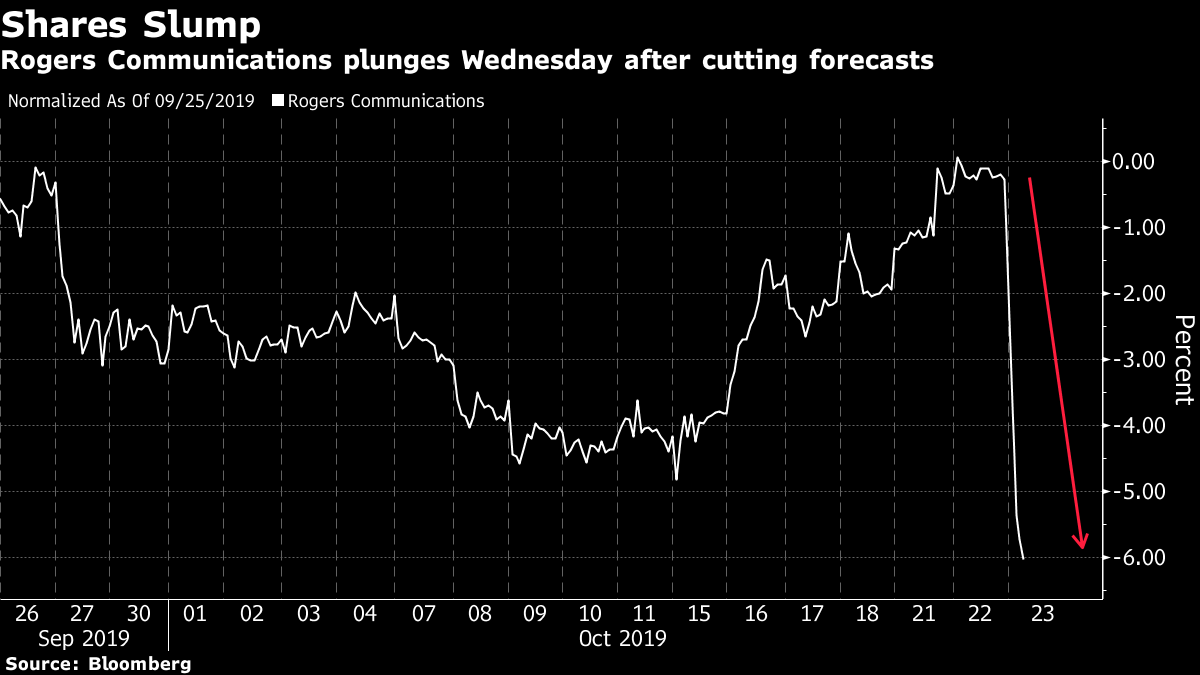

Rogers falls most since January 2016 after cutting forecast

, Bloomberg News

Rogers cuts guidance amid popularity of unlimited data plans

Rogers Communications Inc. shares fell the most in almost four years after cutting forecasts for revenue and capital spending and as third-quarter earnings missed analysts’ estimates.

The Toronto-based telecommunications company fell 5.6 per cent to $62.68 at 9:58 a.m. trading in Toronto, the biggest intraday decline since Jan. 27, 2016, according to data compiled by Bloomberg. Shares of Rogers’ rivals BCE Inc. Telus Corp. and Shaw Communications Inc. also fell.

Rogers cited accelerated demand for new unlimited mobile data plans for cutting annual forecasts on key financial measures Wednesday in its earnings statement. Revenue for 2019 is now forecast to range between a one-per-cent decrease and a one-per-cent increase, down from previous guidance of a three-per-cent to five-per-cent gain. Capital expenditures are expected to be $2.75 billion to $2.85 billion for the year, from as high as $3.05 billion.

“The downward adjustment primarily reflects faster-than-expected adoption of our new Rogers Infinite unlimited data plans and the related reduction in overage revenue, lower wireless equipment revenue resulting from the highly competitive environment, and certain efficiencies recognized this year on capital expenditures,” Rogers said.

The company also cut its forecasts for adjusted earnings and free cash flow.

“This impact comes faster and at a greater impact than even we had cautiously expected, and is apt to linger until 2021 as customers continue to migrate to the new plans,” analysts Adam Ilkowitz and Michael Rollins of Citigroup Global Markets said in a note to clients.

Rogers posted $593 million in net income, or $1.14 a share, compared with $594 million, or $1.15 a year earlier. Adjusted earnings of $1.19 a share missed the $1.31 estimate of analysts surveyed by Bloomberg.

Canadian telecom companies also face new political pressure, with the latest federal election campaign targeting the wireless providers for their data plans. Prime Minister Justin Trudeau, whose Liberal Party was re-elected Monday with a minority government, pledged to cut wireless services costs by 25 per cent within four years.

The Canadian Wireless Telecommunications Association said that competition is already creating value and lowering data prices.

“With the vigorous competition among wireless carriers, the cost of wireless data in Canada is already declining significantly,” the association said in an emailed statement. “Today, Canadians in every region of the country can get unlimited data plans starting from $50-$75 a month. This is a significant decline in the price of data from just a year ago.”