Jan 12, 2022

Russian Supply Curbs Fuel European Gas Surge Before NATO Meeting

, Bloomberg News

(Bloomberg) -- European gas prices rebounded as supplies remain limited just as geopolitical tensions are running high before a North Atlantic Treaty Organization meeting to discuss Russia’s intentions in Ukraine.

Benchmark European gas jumped as much as 9.2% after falling in the past three days. Russia continues to curb supplies via two key pipelines into Europe just as the weather turns colder, with traders remaining on edge before the NATO-Russia Council discusses the situation in Ukraine later this morning.

Europe is grappling with an energy crunch, with gas prices more than tripling last year and electricity costs doubling. While Europe had recently attracted a wave of liquefied natural gas cargoes from the U.S., the shutdown of parts of Chevron Corp.’s Gorgon LNG export facility in Australia this week could tighten the global market again, exacerbating competition with Asia for spot cargoes.

Front-month gas in the Netherlands, Europe’s benchmark, jumped to 86 euros a megawatt-hour before trading 8% higher at 85 euros by 8:51 a.m. in Amsterdam.

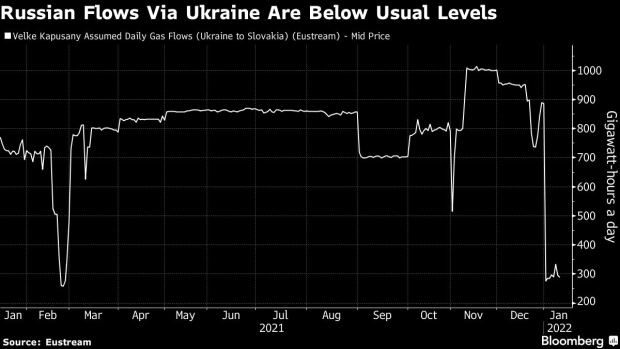

Russia supplies via the Yamal-Europe gas pipeline are moving eastward from Germany to Poland for a 23rd day, the reverse of the usual direction. Flows via Ukraine are also lower than normal and come at a time temperatures are expected to remain slightly below seasonal norms through the rest of the week.

Tensions are high as Russia has been building troops on the border with Ukraine, a move that U.S. intelligence says it could signal an invasion early this year. While gas supplies to Europe via Ukraine weren’t disrupted when Russia annexed Crimea in 2014, there were temporarily cut during gas-price disputes in 2006 and 2009.

Chevron Corp plans to shut Train 2 at its Gorgon LNG export facility in Australia this week. In addition, flows at U.K. South Hook import terminal will be cut on Jan. 19.

©2022 Bloomberg L.P.