Oct 21, 2022

Schlumberger Beats Profit Estimates as International Drilling Ramps Up

, Bloomberg News

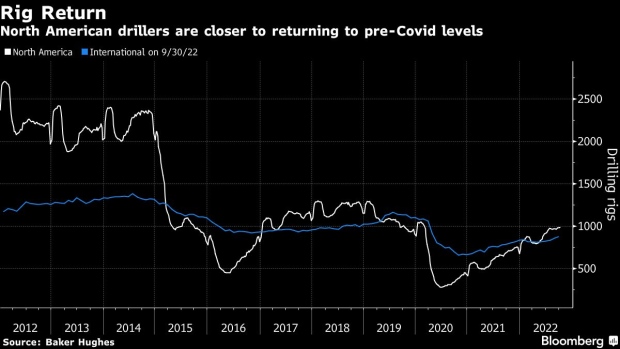

(Bloomberg) -- Schlumberger shares soared after posting its best profit in seven years and raising guidance for the rest of 2022 as overseas drillers put oil and gas rigs back to work, following North America’s lead amid tight global supplies.

The world’s biggest oil-services provider said sales in the final three months of the year should grow in the mid-20% range compared with the same period last year.

The Houston- and Paris-based company joined smaller rival Baker Hughes Co. in forecasting an international sales expansion for the remainder of the year. Schlumberger’s third-quarter adjusted net income rose to $907 million, the highest since 2015. The shares rose as much as 9.3% for the biggest intraday jump since March 8.

“We’re already witnessing the next phase of growth with an acceleration in pace in the offshore and international markets, that was very visible in the third quarter,” Chief Executive Officer Olivier Le Peuch told analysts and investors Friday on a conference call. “The next phase of global market inflection is expected to be driven by increasing activity in the Middle East.”

Schlumberger and its peers are cashing in as the energy industry’s multiyear expansion outpaces available supplies of labor and equipment in the world’s oil and gas fields. As a result of the higher service prices, drillers are expected to boost spending by double digits globally next year, Baker Hughes told investors this week.

The hike to Schlumberger’s sales forecast is slightly more bullish than the 19.3% growth expected by analysts, according to data compiled by Bloomberg.

More global oil and natural gas investment is needed to rebalance markets and rebuild spare capacity, Le Peuch said in a statement announcing the results.

“All of these are exacerbated by geopolitics and increasing instances of supply disruptions,” he said. “These dynamics and the urgency to restore balance are resulting in a supply-led upcycle.”

Though the invasion of Ukraine has thrown global energy markets into disarray, Schlumberger hasn’t gone as far as rivals Baker Hughes and Halliburton Co. in disengaging from Russia. Le Peuch has said the company’s unique corporate structure gives it flexibility to work in Russia while fully complying with US and EU sanctions. The company, based in Houston and Paris, has $400 million in unpaid bills stranded in Russia as the country’s international isolation deepens, it said in late July.

Schlumberger, which is an industry bellwether because of its unmatched global footprint and extensive international order book, previously forecast its biggest jump in annual sales in more than a decade. While the international rig count remains 25% lower than three years ago, the company’s sales have already topped revenue from that period.

“This comparison highlights the significant gains we have made in strengthening our market participation and our continued growth potential as rigs mobilize internationally in the quarters to come,” Le Peuch said.

Shares of Baker Hughes surged on Wednesday as the company affirmed analysts’ estimates that earnings per share will jump 50% in the fourth quarter from the current one. Halliburton, the world’s biggest frack-services provider, will round out earnings for the Big 3 oilfield contractors when it reports next Tuesday.

(Updates with comment from CEO in third paragraph.)

©2022 Bloomberg L.P.