Jul 12, 2022

Schonfeld Asia Hedge Fund Spinoff Raises More Than $750 Million

, Bloomberg News

(Bloomberg) -- A hedge fund spinoff from Schonfeld Strategic Advisors that focuses on Greater China stocks has raised more than $750 million within a few months, a rare feat in a year when slumping returns have deterred investors.

Keystone Investors Pte began trading on April 1 with backing from Schonfeld, while the majority of money was raised from other investors, the new venture’s Chief Executive Officer Ken Tonkinson said. The fund is closed to new capital to manage asset size and plans to reopen in the fourth quarter, he said.

The Singapore-based firm is one of the largest Asian hedge fund startups since the pandemic curbed investor travel to research new funds. Vincent Gao’s CoreView Capital Management, which began trading in February 2021 amid a perfect storm for Chinese technology companies, last year attracted some $3 billion in gross assets.

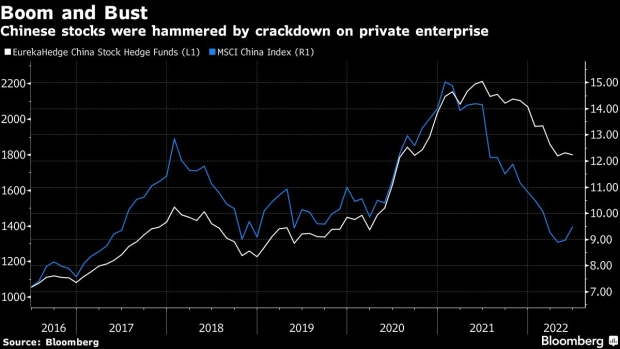

More recently, rising interest rates and slowing economic growth have triggered an investor exodus from growth stocks, while Chinese equities in industries from e-commerce to tutoring have been hammered by regulatory tightening. A Eurekahedge Pte index tracking stock hedge funds globally is headed for its worst annual performance since 2008.

Schonfeld, which manages $13.8 billion in outside capital, has backed spinouts over the years in the US and Europe. Keystone is the first of these in Asia-Pacific and the New-York based investment firm plans to expand through hiring and backing such funds in future, according to a person familiar with the matter, who asked not to be identified discussing private information.

Schonfeld declined to comment in an emailed statement.

The move to back offshoot funds is part of a broader trend. Multi-strategy firms including Schonfeld and Millennium Management employ a myriad of teams with varied investment strategies to help generate smoother returns from diverse sources. And with intense competition for talent, dangling the prospects of backing employees’ efforts to start their own hedge funds can be a way to attract top portfolio managers.

Keystone Returns

The Keystone team led by Chief Investment Officer Liu Xuan generated a return of 12% to nearly 30% each year from August 2017 through to the the end of 2021 at Schonfeld and Folger Hill Asset Management, whose Asia business the US firm acquired in 2019, according to information sent to potential investors. This year, the team lost 3.9% in the first five months, it showed. Tonkinson declined to comment on performance numbers, citing regulatory restrictions.

A Eurekahedge index tracking Greater China-focused stock hedge funds returned an annualized 11% between July 31, 2017 and the end of 2021, before dropping more than 12% this year through May.

In contrast with a set of Asia hedge fund startups in recent years which narrowly focused on technology, consumer and healthcare, Keystone invests in a broader range of industries and will trade stocks in the rest of Asia, US and Europe that are linked to its Greater China theme.

Liu is a generalist, assisted by analysts covering various industries, Tonkinson said. The firm aims to set up a Shanghai research office toward year-end, he said.

The fund aims to maintain low net exposure - the difference between the dollar value of bullish and bearish bets - to insulate performance from market downturns.

A mainland Chinese native who earned a scholarship to study quantitative finance at the National University of Singapore, Liu has subsequently spent his entire career at hedge funds. He started as an analyst under Ricky Liew at James Loh’s JL Capital in 2007. In 2009, he followed Liew to Steve Cohen’s SAC Capital Advisors, now known as Point72 Asset Management. Millennium recruited Liu as a portfolio manager in 2016. He joined Folger Hill the following year, according to his LinkedIn profile.

©2022 Bloomberg L.P.