Jul 27, 2023

Shell Pledges Extra Buybacks, Hikes Dividend as Profit Drops

, Bloomberg News

(Bloomberg) -- Europe’s oil and gas companies are sticking to multibillion-dollar buyback plans even as their profits tumble from the record highs seen last year.

Shell Plc, TotalEnergies SE and Repsol SA announced combined buybacks of almost $6 billion on Thursday, despite posting an average decline in adjusted net income of more than 50%. It was further proof that the industry continues to prioritize payouts to investors as energy markets normalize after last year’s crisis.

“This quarter doesn’t have the fireworks of last year, but it’s an inflection point as how the sector is being perceived as more reliable” in its shareholder returns, Christyan Malek, head of energy strategy at JPMorgan Chase & Co., said by phone.

The results were broadly in line with earlier reports from industry peers Chevron Corp. and Equinor ASA, where the decline in oil and gas dragged earnings lower even as production increased.

The drop in profitability isn’t only a reflection of lower prices, but also reduced volatility. Shell and TotalEnergies both highlighted the weaker performance of their gas-trading units, which last winter generated big returns diverting cargoes of liquefied natural gas to energy-starved Europe.

The continent is in a much better place this year, with gas storage likely to be about 90% full by the start of winter, Shell Chief Executive Officer Wael Sawan said on a call with reporters.

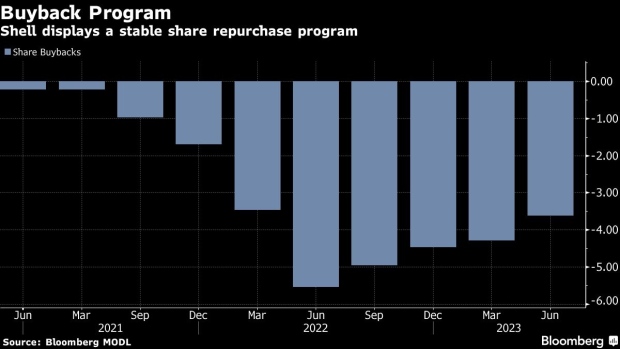

Shell increased its dividend as previously announced and said it would buy back $3 billion worth of shares over the next three months and at least $2.5 billion after that. That’s slightly ahead of the $5 billion of repurchases previously pledged for the second half.

TotalEnergies committed to buying back another $2 billion of shares for the third quarter in a row. Repsol said it would repurchase as much as €850 million ($943 million) of shares.

Despite the increased returns, the response from investors ranged from muted to negative. Shell shares dropped 1.2% to 2,368 pence as of 1:47 p.m. in London. TotalEnergies was little changed at 54.33 euros and Repsol rose 0.9%.

Shell’s buyback was in line with expectations but its operational guidance suggested some downside to consensus estimates for the third quarter, said Jefferies analyst Giacomo Romeo. TotalEnergies’ results were broadly neutral, with the company probably deferring any major announcements to its capital markets day in September, said RBC analyst Biraj Borkhataria.

Eni SpA and Exxon Mobil Corp. will publish their second-quarter earnings on Friday. Sawan has made it a priority to narrow Shell’s valuation gap with the US giant by maintaining “ruthless” financial discipline and refocusing the company on the higher returns of its core oil and gas business.

Over time, the European majors should make progress on this ambition, said JPMorgan’s Malek. “These companies are showing an ability to generate bigger cash returns. This consistency could start attracting generalists back in,” he said.

©2023 Bloomberg L.P.