Feb 9, 2022

Solar Stocks Get a Big Boost From Enphase’s Blockbuster Results

, Bloomberg News

(Bloomberg) -- Solar stocks jumped to their highest in nearly a month on Wednesday after Enphase Energy Inc.’s blockbuster results and strong forecast suggested a deft navigation of the supply-chain crisis.

The Invesco Solar ETF rose as much as 7.1%, touching the highest level since Jan. 14, adding more than $2 billion to its market valuation as of 10:30 a.m. The fund had retreated for three straight months through January.

“There was likely some investor apprehension heading into Enphase’s fourth-quarter earnings call as the calendar turning to 2022 has done little to assuage concerns over 2021’s supply chain issues,” BMO Capital Markets analyst Ameet Thakkar wrote in a note to clients. Instead, the results suggested there is no longer a component shortage holding back the company, even though it now needs to contend with high logistic costs and longer transportation lead times, the analyst said.

“It appears the company has been able to continue to pass on a portion of these costs through price increases,” Thakkar added.

Enphase, one of the first solar companies to report earnings, supplies components that convert the energy from panels into alternating current and travel over power lines. Its results boosted optimism for peers as earnings indicate strong demand for panels this year after supply constraints in 2021 hindered shipments and delayed projects.

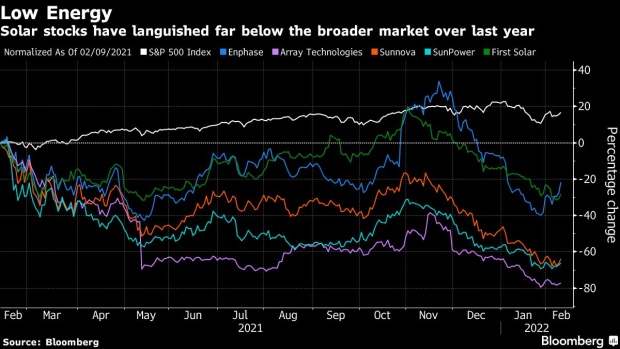

Enphase in recent months has seen its shares languish along with peers, even as the broader market powered on. Despite Wednesday’s rally, Enphase shares are down 32% over the past six months, at a time when the S&P 500 Index fell 2.5%.

Competitors Array Technologies Inc. and Sunnova Energy International Inc. have both retreated 54% over the same period, SunPower Corp. declined 48% and First Solar Inc. fell 37%.

©2022 Bloomberg L.P.