Feb 20, 2023

Son Now Has 35% of His SoftBank Shares Pledged as Collateral

, Bloomberg News

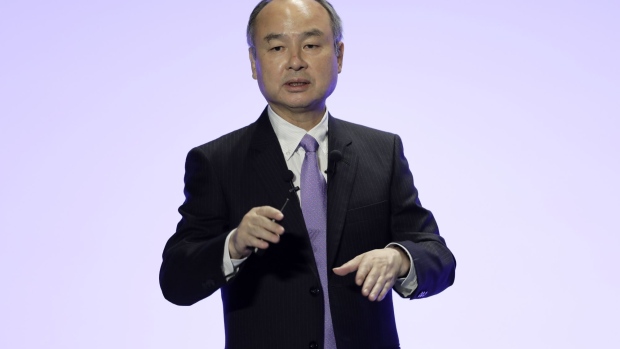

(Bloomberg) -- SoftBank Group Corp. founder Masayoshi Son increased the amount of stock pledged as collateral to financial institutions to 175.25 million shares, or about 35% of his total stake in the Japanese conglomerate.

The 65-year-old billionaire disclosed an increase of about 4.3 million shares as of Feb. 13, worth about 24.5 billion yen ($183 million) at current prices. This factors in collateral and shares held under entities affiliated to Son such as Son Asset Management LLC. Bloomberg calculated the change from an earlier May disclosure.

Due to mounting losses at SoftBank’s core Vision Fund investment business, Son is personally on the hook for about $5.1 billion on side deals he previously set up to boost his compensation, Bloomberg News reported this month.

SoftBank earlier this month posted a net loss of $5.9 billion for the December quarter, with the Vision Fund segment contributing the majority of that drop on declining startup valuations. Chief Financial Officer Yoshimitsu Goto said the company applied “extremely strict” standards in writing down investment losses.

Some of the largest increases in collateral were at Mizuho Bank Ltd. and SBI Shinsei Bank Ltd. Almost 21 million shares are now pledged at Mizuho compared with 18.35 million shares as of May, while 12.7 million shares are pledged at Shinsei compared with 8 million previously.

©2023 Bloomberg L.P.