Mar 20, 2024

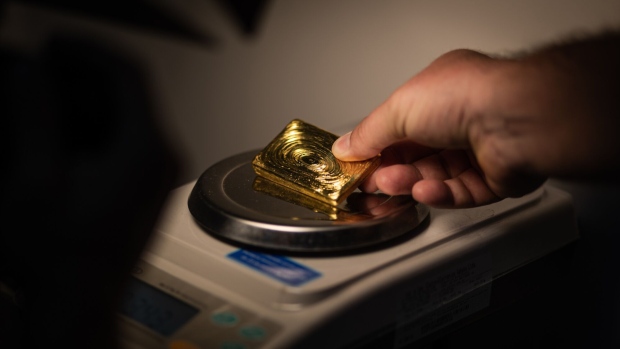

Spot Gold Rises to $2,200 an Ounce for the First Time

, Bloomberg News

(Bloomberg) -- Gold retreated after surging above $2,200 an ounce for the first time on conviction that the Federal Reserve will cut interest rates this year.

The precious metal rose as much as 1.6% to a record $2,220.89 in early trading before erasing gains to drop as much as 0.9%. Gold has rallied nearly 10% since mid-February as the outlook for looser US monetary policy triggered fresh investor bets on bullion.

While the speed of gold’s rally caught some market watchers off guard, the Fed appeared to reaffirm those bullish expectations on Wednesday. The central bank maintained its outlook for three rate cuts this year, suggesting it isn’t alarmed by a recent uptick in inflation.

Read More: The Fed’s New Dot Plot After Its March Policy Meeting

“What we saw last night was the green light really for gold traders to come back in,” said Chris Weston, head of research for Pepperstone Group Ltd. Fed officials have said “they’re tolerant of the inflation that we’ve seen, they’re tolerant that the labor market strength is not going to be the impediment.”

Gold’s gains over the past five weeks have also been underpinned by long-standing supports including heightened geopolitical risks and buying by central banks, led by China. Chinese consumers have also been stocking up, purchasing gold coins, gold bars and jewelry as a way to safeguard their wealth from a property downturn and losses in the country’s stock market.

Read More: Chinese Buying Set the Stage for Gold’s Latest Record Run

The precious metal has been trading for months around the $2,000 mark, a level only breached for the first time in 2020 as the global pandemic raged. Even more unusually, prices have traded at such elevated levels despite sky-high real interest rates that are typically bad for gold, which doesn’t pay interest.

The Swiss franc — another traditional haven — tumbled after a surprise rate cut by the country’s central bank.

Spot gold slipped 0.2% to $2,182.76 an ounce as of 2:08 p.m. in New York. The Bloomberg Dollar Spot Index was steady. Silver and palladium fell, while platinum edged higher.

Gold’s move toward $2,300 an ounce is a “reasonable technical target,” said Marcus Garvey, head of commodities strategy at Macquarie Group Ltd.

“I think the Fed not taking the opportunity of recently firmer inflation to lean hawkish at their meeting yesterday means gold is now going into a short-term overshoot scenario,” he said.

Holdings of SPDR Gold Shares, the world’s largest physically backed gold exchange-traded fund, rose for a fourth day on Wednesday, the longest winning streak since March 2022, according to data compiled by Bloomberg. Should the pattern hold, it could propel bullion to a fresh record high.

Investor holdings in gold ETFs generally rise when bullion prices gain, and vice versa. ETFs had been a key driver in gold’s rally during the pandemic to a record high at the time. Since then, there’s been a glaring disconnect between the two.

(An earlier version corrects gold’s record high price level in headline.)

©2024 Bloomberg L.P.