Nov 28, 2022

Stocks Comeback Boosts Australian ETF Market to Near Record Size

, Bloomberg News

(Bloomberg) -- Australia’s exchange-traded funds market is on track to become bigger than ever by the end of the year, after a powerful equities rebound in October fueled a record month of growth.

The market cap of the country’s ETF industry surged 5.9% last month, jumping by A$7.3 billion ($4.9 billion) to A$131.7 billion, according to recent analysis by BetaShares. It was the biggest increase in dollar terms on record, and left it about A$5 billion short of its all-time high of A$136.9 billion, posted last December.

Crucially, most of the dollar gain came from a rally in Australian stocks, a move that’s extended into November -- meaning another big surge in market cap is likely already well underway.

A new record size for the industry would be the culmination of gathering trends in Australia, where investors are increasingly turning to the low-cost, often passive vehicles. It’s a snapshot of a global movement: PwC forecast the worldwide ETF market could top $20 trillion by 2026.

“Two decades ago if you went into an equivalent managed fund, it would be a million dollars and you’re looking at a fee of 34 basis points, versus an ETF now of 10 basis points,” said Enid Lal, head of superannuation and partnerships at Stockspot. “That’s driven everyday Australians to go, ‘well hang on, I can be in the investment industry.’”

Australia’s financial services sector has faced a reckoning in recent years. A 2018 inquiry found the industry put the pursuit of profits ahead of customers’ interests. Lal, who previously spent almost two decades at Vanguard Group, said the outcomes of that inquiry had boosted the popularity of ETFs.

The Era of the Bond ETF Has Finally Arrived as Mutual Funds Wilt

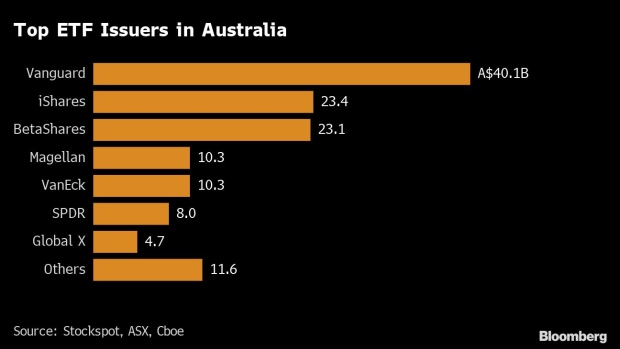

The largest ETF issuer in Australia is Vanguard, which has A$40.1 billion under management and 30.5% of the market’s share.

“It has such a basic role to play in opening up access to diversify funds for most investors, that it’s going to continue to grow,” Vanguard’s superannuation director and financial services industry veteran Jeremy Duffield said at a Bloomberg Intelligence event in Melbourne. “And I have no doubt about that.”

Elsewhere, there’s BlackRock Inc.’s iShares -- which accounts for about A$23.4 billion and a 17.8% market share. Then comes BetaShares, with A$23.1 billion and a 17.5% slice of the market.

Other funds are also muscling in. In August, VanEck announced five new hires as demand for the firm’s ETFs grew 19% in the 12 months to June 30. It also outlined plans to launch Australia’s first carbon credits ETF.

‘Big Opportunity’

Global X is also pinning its hopes on grabbing a larger share of Australia’s A$3.3 trillion pension savings pot, known locally as superannuation. The company re-branded after it was acquired by Korea-based Mirae Asset Global Investments in June.

“Everyone knows the size and the magnitude of the Australian superannuation market on a global scale is massive,” Global X ETF Chief Executive Officer Evan Metcalf told Bloomberg in an interview last month. “There’s a big opportunity there for all asset managers but I think ETF issuers in particular have a big opportunity to try and work with those clients more closely.”

Still, the growth hasn’t always come easily. Raging inflation, rising interest rates and the subsequent global economic turmoil have put a cap on the industry’s expansion, according to Stockspot, the investment advice and portfolio management platform. Senior Bloomberg Intelligence ETF analyst Rebecca Sin agrees that hurdles remain.

“The rising rate environment is definitely very challenging, especially for foreign investors,” she said. “Historically, a lot of foreign investors would come to Australia for their dividend, for their high yield, the property market did really well. But with the currency where it is right now, you know, that’s affected returns.”

Metcalf acknowledged the challenges, but expects them to be temporary. The October surge in assets seems to support that view. ETFs in Australia have grown at about eight times the rate of actively managed funds over the past five years, according to Stockspot.

“Of course there’ll be variations,” he said. “The current year with market conditions is potentially one of those.”

--With assistance from Sam Potter and Chris Bourke.

©2022 Bloomberg L.P.