Jun 20, 2022

Tax Reform Seen as Key for Japan’s $74 Billion Startup Push

, Bloomberg News

(Bloomberg) -- Tax reform is essential for Japan’s push to funnel 10 trillion yen ($74.4 billion) of investment into startups every year, according to the head of a ruling party group supporting emerging high-growth firms.

The government is set to put together a five-year plan by the end of 2022 that will seek to increase money going to startups tenfold, according to proposals from the ruling party.

The plan should include revisions to crypto-related taxation, as well as an update on stock option rules and levies on angel investment, according to Takuya Hirai, who sees Japan’s startup eco-system as lagging behind those of other countries. Venture capital also has a key role to play, he added.

“We have to revamp taxes and regulations to create a startup-friendly environment,” said Hirai, who served as Japan’s first digital minister from late 2020. Encouraging startups has great significance as a growth strategy, together with investment in green and digital technology, he said.

Revamping the country’s attitude to nascent technologies and firms appears to be a key part of Prime Minister Fumio Kishida’s New Capitalism plan. If Kishida is to succeed in pulling off his dual vision of growth and distribution, he will need sources of concrete economic expansion.

Hirai said the current system that taxes firms’ crypto asset holdings on paper gains needs to be revamped so that only realized gains face corporate tax. He also called for a new set of laws that focuses more specifically on the needs of startups, rather than applying rules meant more generally for small and medium-sized firms.

“There should be a proper startup visa system,” said Hirai. “We need laws to define what exactly a startup is.”

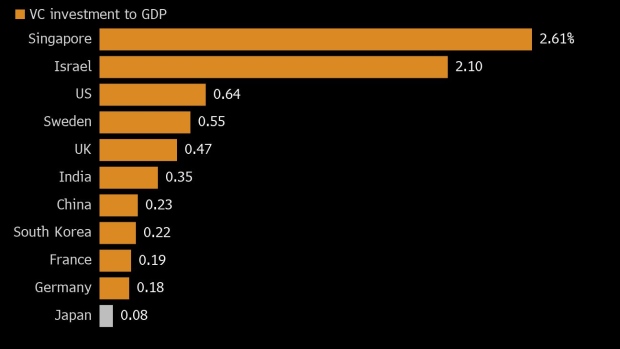

Venture capital investment in Japan relative to gross domestic product trails behind the other Group of Seven nations and beyond, he added. Firms that have key venture capital investment tend to have 60% higher productivity compared with those that don’t, Hirai said.

“The rate of acceleration’s totally different,” said Hirai, referring to the growth rate of big tech companies in the US helped by venture capital. “Look at GAFA, look at the US. Size is one thing, but there’s also speed.”

The ruling party has already suggested the Government Pension Investment Fund invests 1% of its assets in venture capital, as part of its digitalization proposals released in April. That would amount to around 2 trillion yen being poured into venture capital.

Another recommendation is to seek investment of 1 trillion yen into startups by foreign venture capital, an idea modeled on a similar program in Israel.

“If you look at institutional investors abroad, their returns are very high,” said Hirai, arguing that more risk could be taken as long as the approach was sufficiently explained to the general public. “It wouldn’t be surprising to have venture capital in the pension fund’s portfolio.”

©2022 Bloomberg L.P.