Jul 20, 2023

Tesla sinks as Musk warns of more blows to profitability

, Bloomberg News

First Look With Surveillance: Tesla Profits, Apple AI

Tesla Inc. shares fell after the carmaker warned of more hits to its already-shrinking profitability.

Chief Executive Officer Elon Musk said Tesla will have to keep lowering the prices of its electric vehicles if interest rates continue to rise. Months of markdowns have already taken a toll on automotive gross margin, which fell to a four-year low in the second quarter.

In addition to potentially having to budge further on pricing, Tesla is pouring money into new models, including the behind-schedule Cybertruck, plus Dojo, the in-house supercomputer Musk plans to spend at least US$1 billion on by the end of next year. While Tesla remains on track to produce around 1.8 million vehicles in 2023, output will dip this quarter due to factory upgrades.

Tesla's gross margin recovery “may be slower than anticipated” as it relies on discounting to drive volume higher, said Dan Levy, a Barclays analyst with the equivalent of a hold rating on the stock. “We also expect earnings pressure from higher opex as TSLA accelerates investment in AI and other growth endeavors.”

Tesla shares fell four per cent at 9:36 a.m. in New York on Thursday. The stock has more than doubled this year, setting a high bar for results.

While Musk downplayed the thinner profit margins as short-term speed bumps, several analysts noted that Tesla removed a reference to maintaining industry-leading operating margin from its outlook.

“It does make sense to sacrifice margins in favor of making more vehicles, because we think in the not-too-distant future they will have a dramatic valuation increase,” Musk said, referring to his belief Tesla will eventually offer autonomous-driving capability that will make already-sold cars worth more.

While Tesla exceeded expectations for both earnings per share and revenue, the results undermined confidence that margins have bottomed, Jefferies analyst Philippe Houchois said in a note to clients.

The carmaker's profit, excluding some items, came to 91 cents a share, more than the 81 cents that analysts estimated. Revenue rose 47 per cent to US$24.9 billion, better than the consensus expectation for US$24.5 billion.

In January, Chief Financial Officer Zachary Kirkhorn said Tesla expected to maintain a more than 20 per cent automotive gross margin, excluding revenue from regulatory credits. He walked back that forecast in April, after the company dipped below the threshold at the start of the year.

Automotive gross margin excluding credits slipped further to 18.1 per cent last quarter, the lowest since the second quarter of 2019.

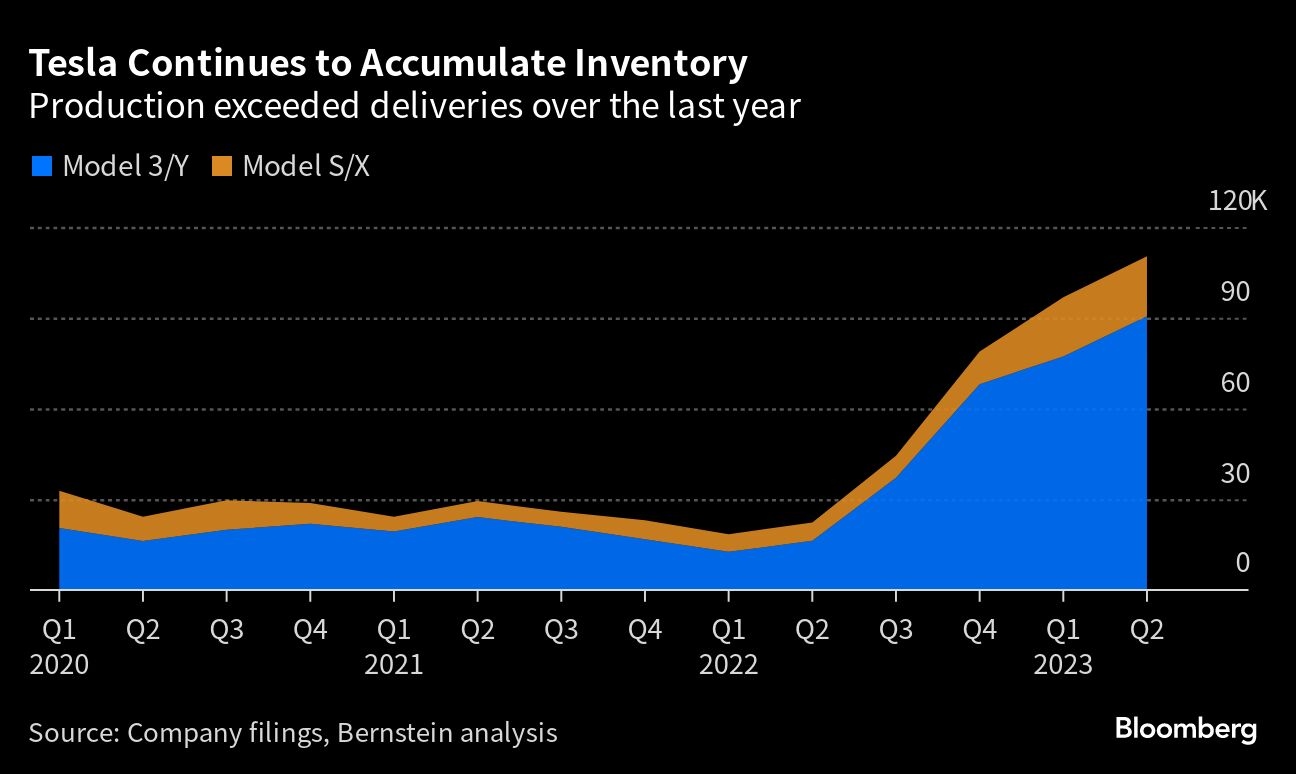

Inventory Buildup

Adding to Tesla's challenges is its growing inventory of cars. The Austin-based company said it now has 16 days' worth of supply globally, up from 15 days last quarter and just four days a year ago.

Inventory continued to build despite steep discounts on Tesla's best-selling models, and perks including free charging that the carmaker offered consumers.

Musk declined to go into details on the degree to which Tesla's production will drop in the third quarter. In January, he said there was potential for the company to make closer to 2 million cars this year.

Cybertruck

While analysts have said new models like the Cybertruck could help Tesla maintain its sales-growth rate, the pickup won't be available in large volumes until next year. The first vehicle rolled off the line in Tesla's Austin factory just recently, the company said over the weekend.

On Wednesday, Tesla clarified that Cybertrucks being built now are actually “release candidates” and not for sale. The company didn't offer any updates about pricing or specifications and reiterated that it expects to start deliveries later this year.

Musk also touted progress toward Tesla potentially making its driver-assistance software available to other automakers. The CEO said Tesla is in early discussions about licensing its system to a major manufacturer that he didn't name.