May 11, 2021

The options market may be fueling the turbulence in tech shares

, Bloomberg News

McCreath: High correlation between Ark Innovation and unprofitable tech stocks

Inflation, valuations, rising rates -- all are being suggested as causes for this week’s tech implosion, but a less-publicized catalyst may be the market for stock options.

This alternate theory has it that Wall Street derivatives dealers are exacerbating market swings through hedging their books to offset brisk demand for protection against a selloff, through what’s known as gamma hedging. That’s when options market makers buy or sell an underlying stock to manage their risk as the price of the shares moves.

An academic study last year found evidence that options dealers indeed contribute to intraday volatility as they balance their exposures in this way. The volatility has been on full display lately, with the Nasdaq 100 slumping as much as 2 per cent Tuesday before erasing most of the loss. It ended lower for a second day after Monday’s rout, sending a measure of implied volatility for the gauge to the highest since March.

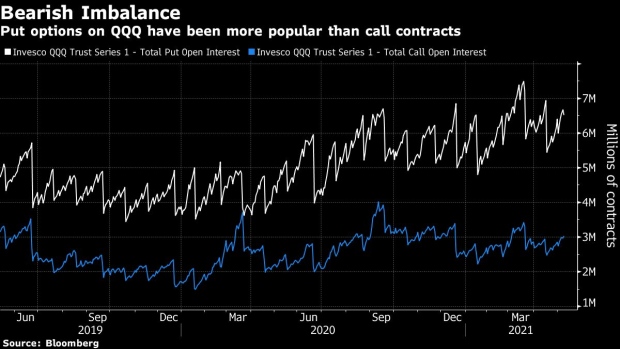

The thinking goes that a rush for puts on the biggest tech ETF, known as QQQ, has left dealers with a lopsided number of short positions. In order to balance their books, these options market makers buy Nasdaq futures when they rise, and sell when they fall, a volatility-intensifying practice known as “negative gamma.”

With negative gamma currently affecting the QQQ fund, “the high volatility will remain for this week,” said Brent Kochuba of options analytic service SpotGamma.

It wouldn’t be the first time the options market was blamed for pushing around stocks. Last year’s meteoric increase in retail call activity, alongside institutional buying by the likes of Softbank Group Corp., fanned theories that the derivatives market had started to whipsaw stocks like never before.

Read more: Wall Street Dealers in Hedging Frenzy Get Blamed for Volatility

Open interest in puts on the US$155 billion Invesco QQQ Trust Series ETF has been rising at a much faster clip than the same measure for calls, which suggests that dealers indeed may have been caught offsides. It also suggests investors have been bracing for declines in the tech benchmark.

Charlie McElligott of Nomura Securities has also highlighted the imbalance, noting Tuesday that dealer hedging flows are acting as an “accelerant” and QQQ registers an extremely negative gamma reading.

Not everyone pins the blame primarily on the options market, however. Susquehanna’s Chris Murphy acknowledges the existence of these positioning dynamics, but lays the majority of the blame for this week’s volatility on more traditional culprits.

“I think it’s all about risk-off in the highest flying tech stocks and the focus on the potential for higher inflation and rates (the simple, boring answer),” said the derivatives strategist.

For those who do buy the primacy of the options market as an explanation for this week’s moves, the good news is that the storm may pass soon. About a third of the put option exposure that’s fueling the swings sits in contracts that expire on May 21, according to SpotGamma’s Kochuba.

As we approach that date, “those put options decay which incentivizes dealers to cover their short hedges, which may lead the Nasdaq to rally back,” he said.