Apr 6, 2023

THG Strikes Fresh Deal for Online Beauty Commerce : The London Rush

, Bloomberg News

(Bloomberg) -- The week draws to an end with a sense of calm in the London market ahead of a four-day Easter break. In a sparse morning for corporate updates, THG announced a deal that could boost its Ingenuity platform, a higher-margin unit which helps rival retailers sell online. In Westminster, officials are still dealing with the fallout from a scandal at Britain’s best-known business group.

Here’s the key business news from London this morning:

In The City

Shell Plc: The energy major issued an update this morning, including production figures across segments, and said it expects integrated gas production in the 1Q of 2023 to be higher than in the previous quarter.

- Shell also said performance so far this year at its gas trading business has been similar to the prior three months, even with European natural gas prices far below August’s high

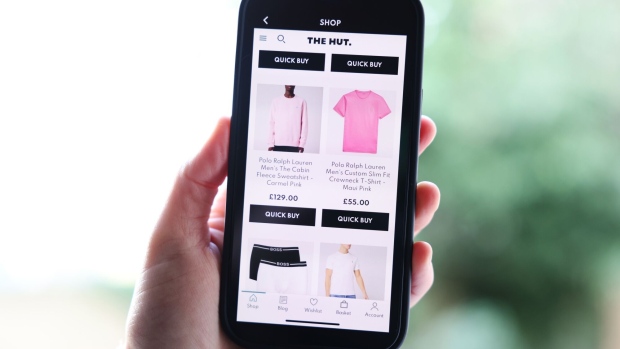

THG Plc: The struggling online shopping business entered a 10-year partnership with beauty e-commerce retailer Maximo Group and expects to add over £150 million gross merchandise value to the Ingenuity platform annually from the deal.

- The agreement will initially focus on re-platforming Maximo’s websites All Beauty and Fragrance Direct to the Ingenuity platform

Robert Walters Plc: The recruiter reported flat fee income year-on-year, blaming global macro-economic conditions which have affected recruitment activity across several of the company’s markets.

- “As reported with our recent year-end results, the market uncertainty we experienced in the latter stages of last year has tipped over into the first quarter of 2023,” its founder and departing CEO Robert Walters said in a statement

In Westminster

US President Joe Biden will travel to Northern Ireland and the Republic of Ireland next week. The visit will mark the 25th anniversary of the Good Friday Agreement.

Meanwhile, the UK government has sought to distance itself from the Confederation of British Industry following allegations of sexual harassment, drug use and rape among the business group’s staff. Major departments including the Treasury have suspended meetings with the lobby group.

In Case You Missed It

Vodafone Group Plc’s Spanish business is attracting takeover interest from potential buyers, including Apollo Global Management Inc., people with knowledge of the matter told Bloomberg. The unit could be valued at more than $4 billion.

And UK employers, desperate to recruit and retain Gen Z workers, are increasingly offering “early finish Fridays” in a bid to fill vacant roles. A post-pandemic labor crisis, plus demands from young employees for a better work-life balance, are forcing bosses to improvise.

Looking Ahead

In the week after the Easter break we’ll get updates from an array of consumer-facing companies including supermarket giant Tesco Plc, cigarette maker Imperial Brands Plc and bootmaker Dr Martens Plc.

For a more considered take on the UK's economic and financial news, sign up to Money Distilled with John Stepek.

--With assistance from Charles Capel.

©2023 Bloomberg L.P.