Dec 12, 2022

'Too far, too soon': Big 2023 credit rebound is already partly done

, Bloomberg News

Green bonds outperform in a selloff: BofA Global Research

Next year was supposed to mark a big rebound in corporate bond markets following historic losses. But an end-of-year rally is leaving investors asking how much more they can expect to make.

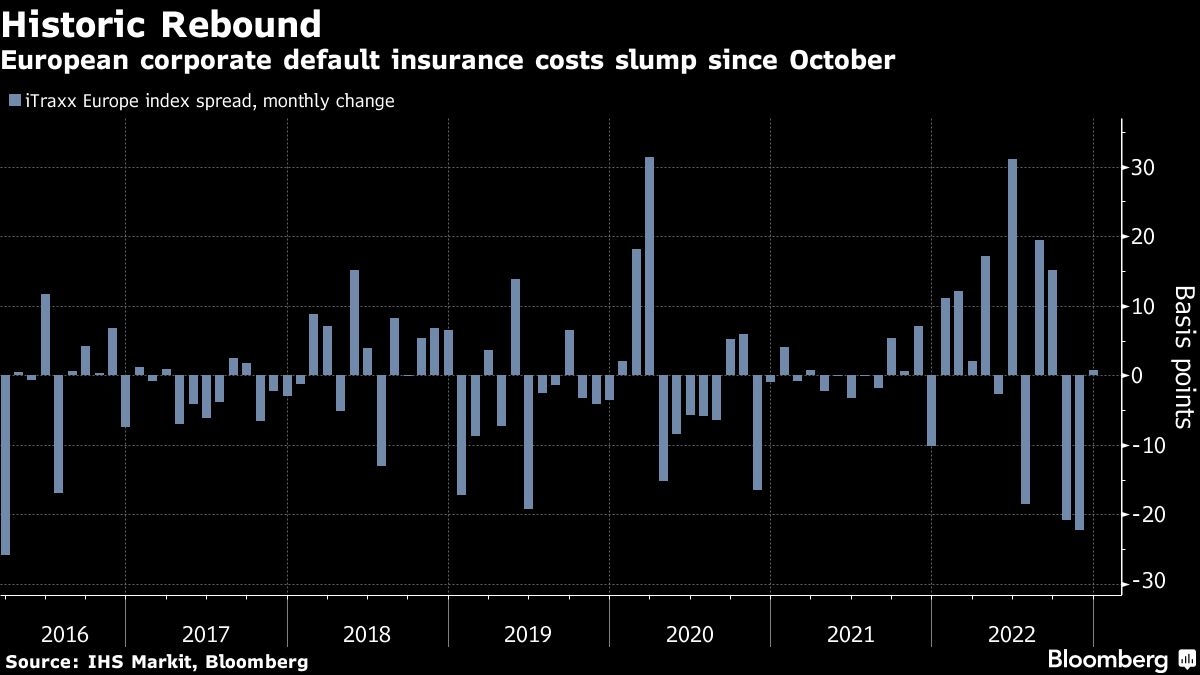

Risk premiums in European corporate bonds have tumbled to their lowest levels in months after softer U.S. inflation data in November raised hopes of less aggressive central bank policy and spurred a massive relief rally across assets. Last month, the cost of protection against defaults by European blue-chip firms recorded its biggest monthly drop since early 2016, based on data compiled by Bloomberg.

The rebound — which has left an index of European investment-grade debt down 11.6 per cent for the year compared with 16 per cent at its low — came as a chorus of analysts was predicting a strong recovery for the market next year. But the strength of the rally so far is forcing investors to revisit their bullish outlooks.

Long positions in credit “can absolutely become a crowded trade, and we've seen some of this happen in recent weeks,” said Brian Kloss, a portfolio manager at Brandywine Global Investment Management. “This risks limiting returns too fast, so you have to be careful about your allocations,” said Kloss, who helps oversee US$40.8 billion of fixed income assets.

Even some of the most enthusiastic analysts are now advising caution. UBS Group AG strategists led by Kamil Amin said in a note to clients last week that “credit spreads have rallied too far, too soon.” Last month, they were calling for double-digit euro credit returns that would surpass potential gains from equities in 2023.

UBS said the late-year rally has been driven by high-grade funds neutralizing underweight positions, buyers spending spare cash on new credit issues and strong purchases of exchange-traded funds. Their peers at ING Bank NV attributed spread tightening in junk bonds to “the proverbial fear of missing out on the Fed and market pivots.”

Euro investment-grade spreads were indicated at 174 basis points at Friday's close, down from 234 basis points in mid-October and near their lowest level since June, according to Bloomberg indexes. Junk bonds and sterling debt have seen similar moves.

“Our impression is that the speed of the rally has taken many investors by surprise, leading them to question whether this move is sustainable,” JPMorgan Chase & Co. strategists led by Matthew Bailey wrote earlier this month.

To be sure, most market participants still expect credit to end 2023 in a better spot. But it may be a bumpy road to get there.

“The entry point will be better in the second half” of 2023, said Martin Hasse, a fixed income analyst and portfolio manager at MM Warburg & Co., which oversees €79 billion (US$83 billion). “The market does not price in risks related to recession and we see a widening of spreads in the first half,” he said.

Elsewhere in credit markets:

EMEA

- Bankers have set initial price talk for an offering by junk-rated House of HR. No other issuers are set to tap Europe's primary bond market on Monday, as looming central bank decisions and a seasonal slowdown deter activity.

- A rally in Europe's debt is showing signs of faltering as the European Central Bank's plans to shrink its bond holdings risk burdening a market grappling with record supply and sticky inflation

- Schuldschein debt arrangers are preparing for a busy start to 2023, after the niche German market racked up a record €31 billion (US$33 billion) of sales in 2022

- Saint-Gobain has sold UK unit Jewson to CVC's Stark based on an enterprise value of £740 million, with the deal expected to complete in the first quarter of 2023

- Embattled real estate firm Adler Group said on Friday it got enough support to go ahead with a planned rescue deal even after a group of bondholders said they oppose it

Asia

- Short-dated credit yields in South Korea dropped for the first time in 20 months on Monday, a tentative sign of recovery after the market was roiled by the default of a property developer.

- Yields on three-month commercial paper fell one basis point early in Seoul on Monday, in the first daily decline since April 2021

- Korean officials unleashed measures including an aid package of at least 50 trillion won (US$38 billion) to reverse the biggest runup in short-term yields since the global financial crisis

- Elsewhere, dollar bonds of certain Chinese developers rose Monday after stock-sale plans were revealed, including Country Garden, Seazen Holding unit New Metro and Agile

- Hong Kong billionaire Richard Li is weighing investing around USUS$200 million in his insurance company FWD Group Holdings Ltd. as part of a funding round

Americas

- Thomas Bravo LLC is said to be in advanced talks to acquire Coupa Software Inc. after outbidding Vista Equity Partners, according to people familiar with the matter.

- Private credit funds are pulling together a debt package of around US$3 billion to support the potential leveraged buyout, according to a Bloomberg News report on Friday

- Microsoft is set to purchase a roughly four per cent equity stake in London Stock Exchange Group through the acquisition of shares from the Blackstone/Thomson Reuters Consortium, according to a statement

- Meanwhile, Barclays Plc expects returns for corporate bonds and loans to swing back into positive territory next year after losses in 2022 but sees the overall macro picture looking bleak for both asset classes and defaults climbing