Oct 24, 2022

Global junk-bond sales drop most ever with no signs of recovery

, Bloomberg News

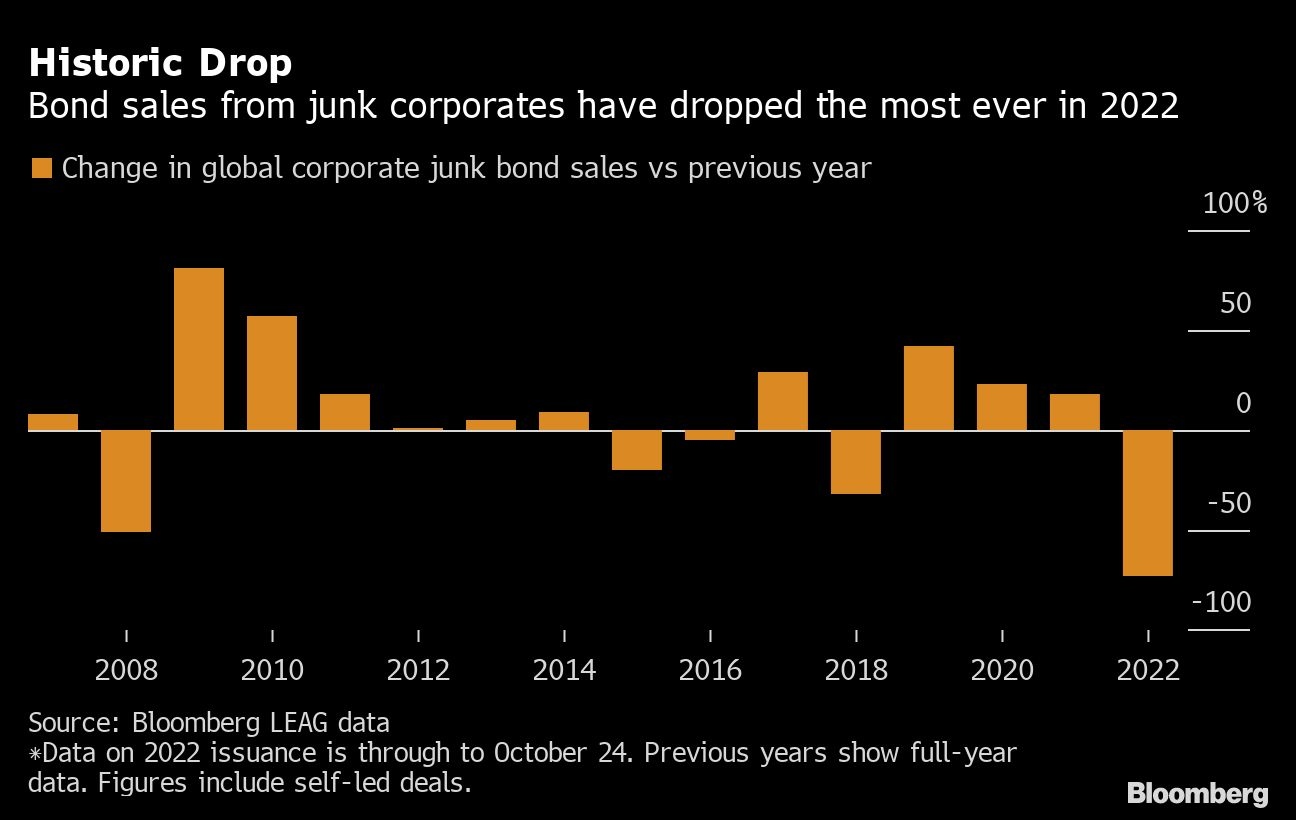

Junk bond sales are falling at an unprecedented rate globally as interest rates rise, a double blow to riskier companies in need of financing in the next few years.

Issuance for high yield corporates plummeted 73 per cent through Oct. 24 compared with the same period last year, according to LEAG data compiled by Bloomberg.

The decline highlights how money managers have been avoiding the high-yield space even as yields soar, fearing that borrowers could be vulnerable to inflation and the looming economic downturn. Worries about potential default risk have left junk-rated borrowers struggling to access capital via public markets.

“We are so far off everything recorded in the last 10 to 12 years,” said Nick Kraemer, head of ratings performance analytics at S&P Global Ratings. “Companies at some point will have to return to primary markets, but for now the pipeline is still thin and upcoming maturities in the next few months appear to be very limited.”

Issuance stood at US$206.7 billion on Oct. 24 compared with US$775.5 billion at the same time in 2021, according to the Bloomberg data, a fall that surpasses the one recorded during the financial crisis. It comes after a record year for junk-bond issuance last year, with US$878 billion sold globally.

The stark decline shows just how quickly the global economy has taken a turn for the worse, as policy makers have shifted their interest-rate strategy at an unprecedented pace. The market has gone from multiple deals per day last year to weeks now going by without a single high-yield bond being offered.

With more central bank rate hikes likely as inflation shows no signs of slowing down, it makes it even more unlikely that the riskier corners of credit markets will see a rush of deals returning anytime soon.

Those deals that do get away carry a heavy price to draw buyer interest. Cruise ship operator Carnival Corp. sold US$2 billion of bonds at a 10.75 per cent yield last week. AMC Entertainment Holdings Inc. earlier this month paid an eye-popping 15 per cent yield for a US$400 million sale to refinance debt held by a subsidiary.

LOOKING AHEAD

The high-yield pipeline is fueled by the refinancing of existing bonds and by debt that needs to be allocated to support new leveraged buyouts. The outlook for both suggests deal volume will remain thin.

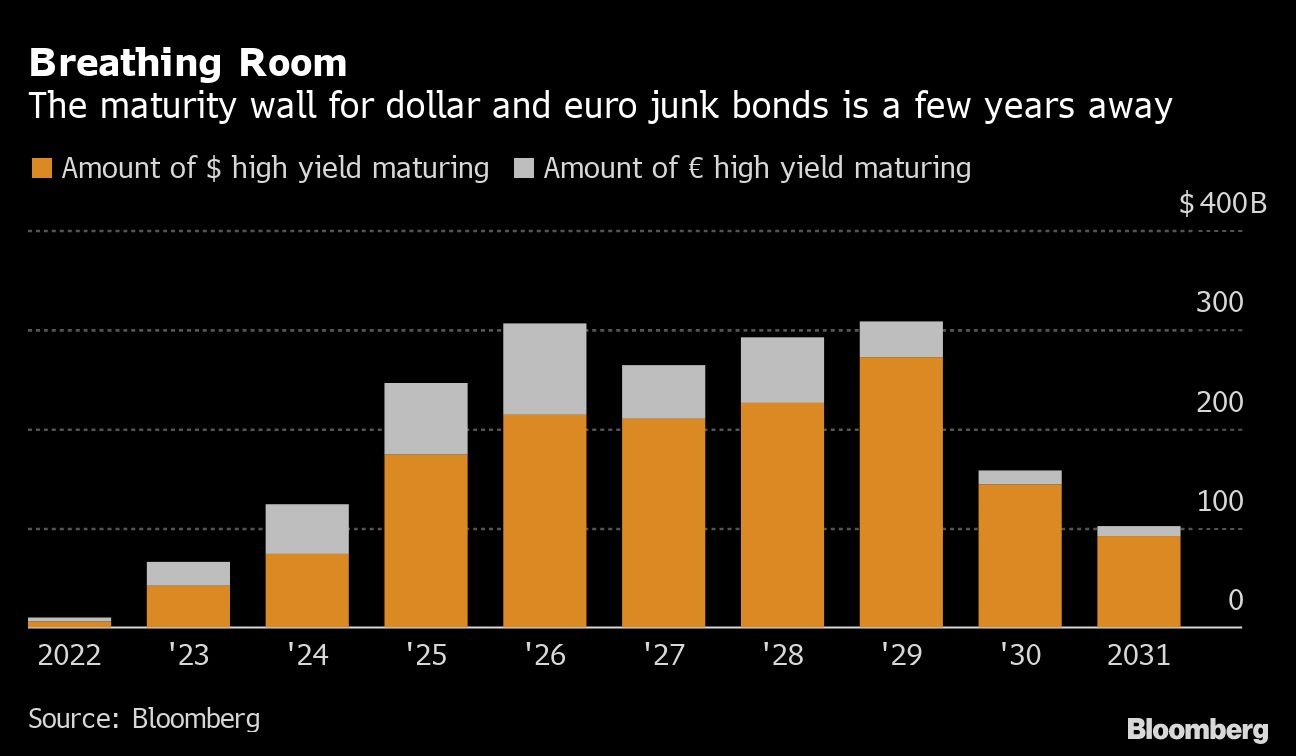

On paper, high-yield bonds are not set to hit a maturity wall any time soon. In fact, the peak year for U.S. corporate junk bond maturities isn't until 2029, with euro-denominated debt peaking in 2026, according to Bloomberg data.

That's because most issuers seized the opportunity during the second half of 2020 and 2021 to reschedule their debt deadlines. The few that didn't are looking at alternative ways to address upcoming maturities.

For example, Augusta Sportswear Inc. sold a US$347 million loan last week in an 'amend and extend' transaction. That pushed out the maturity of its revolving credit facility and term loan by 18 months to April 2025 after the company agreed to pay a hefty increase of 100 basis points on the coupon.

For U.S. leveraged loans, the maturity wall may be more of an obstacle than for junk bonds. The amount of the floating-rate debt maturing in two to three years makes up 14.2 per cent of the market, compared to 6.1 per cent in 2018, according to Barclays Plc data. UBS Group AG strategist Matt Mish, meanwhile, forecast that the default rate for leveraged loans could surge to nine per cent next year if the Federal Reserve stays on its aggressive monetary-policy path.

Banks are also reluctant to take on risk by underwriting new deals. They are still nursing losses incurred on transactions underwritten before credit markets deteriorated, such as Citrix Systems Inc.

“This is an environment where it behooves management to be prudent, but balanced,” James Gorman, chairman and chief executive officer of Morgan Stanley, said in a call with investors earlier this month. “Our wholesale retreat from the market is not called for, but at the same time, we must be more cautious in credit-sensitive parts of the business.”

Morgan Stanley and its peers across Wall Street and Europe still have about US$30 billion of underwritten financing on their balance sheet they need to dispose of.

Elsewhere in credit markets:

Americas

- As many as three issuers stood down from selling fresh debt in the U.S. investment-grade primary market on Monday as Treasury rates moved higher, increasing borrowing costs.

- Preliminary forecasts for this week suggest US$20 billion in new bond sales. As earnings roll on, domestic corporates that have reported results will be free to sell debt, and may account for the bulk of the volume

- The biggest banks on Wall Street may join companies exiting earnings-blackout periods to sell new bonds in the coming week as a rare moment of reprieve washes over high-quality debt markets.

EMEA

- Investment-grade issuers have sold 77 all-new syndicated tranches so far in October and 72 have full pricing information available. Of 72 tranches, 54.2 per cent are quoted tighter than their launch spread.

- A faltering global stocks rally and focus on what's expected to be another ECB rate hike later this week could prompt a mixed bag of activity across European credit markets.

- Corporate credit conditions are worsening, with the last of three key measures now “flashing red,” according to a traffic-light system used by Janus Henderson Investors.

Asia

- Yield premiums on Chinese high-grade dollar bonds widened and the country's stocks tumbled in Hong Kong to the lowest level since the depths of the 2008 global financial crisis, after President Xi Jinping filled leadership roles with loyalists in a reshuffle.

- China's new leadership lineup faces a challenging economic outlook and dwindling investor confidence across markets, but there's one asset class where things are much smoother -- local corporate bonds are near their strongest-ever levels.

- Concerns are starting to mount in Asia about real-estate financing, as surging global interest rates raise repayment concerns in a region already battered by China's property debt crisis.

- A Hong Kong court has issued an order that a Chinese developer's unit that defaulted on offshore debt be wound up, the first such instance against a major builder during the country's property-debt crisis.