Bankers Doing Bond Deals Caught Out by New Era of Issuer Clauses

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Joe Biden’s allies are racing to blunt the presidential campaign of Robert F. Kennedy Jr., casting his third-party effort as a stalking-horse bid designed to boost Donald Trump’s chances — even as his wide-ranging policy positions make him a threat to both.

Chengdu, a major city in the southwest China, removed home-buying curbs, joining dozens of peers in the country in an attempt to revive real estate demand and boost economic growth.

China Vanke Co. made a rare response to Moody’s downgrade last week, citing support from financial institutions and its biggest shareholder.

Billionaires who built their fortunes rolling out wireless networks when debt cost almost nothing are seeing their wealth crimped by higher borrowing costs and caution among money managers on the outlook for the industry.

Jan 7, 2020

, BNN Bloomberg

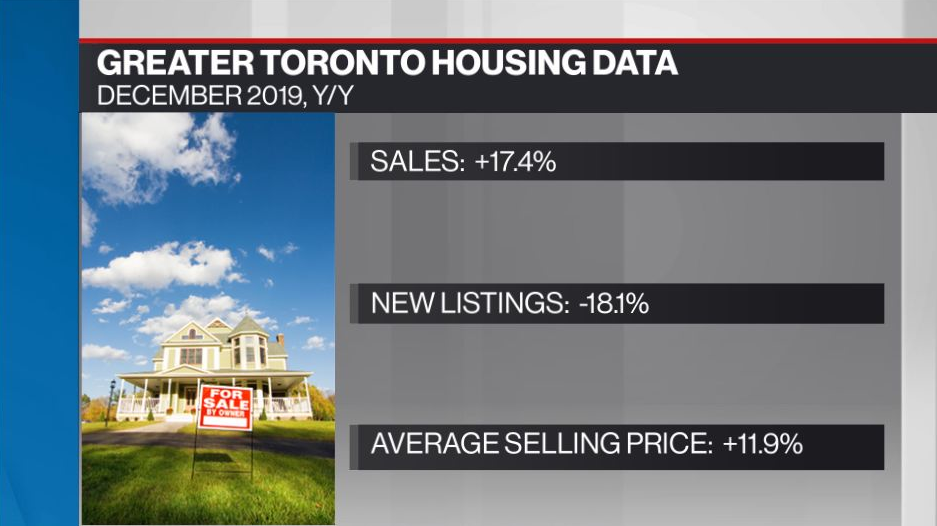

The Greater Toronto housing market ended 2019 with another double-digit sales increase.

The Toronto Real Estate Board says home sales rose 17.4 per cent in December compared to last year, with 4,399 properties changing hands.

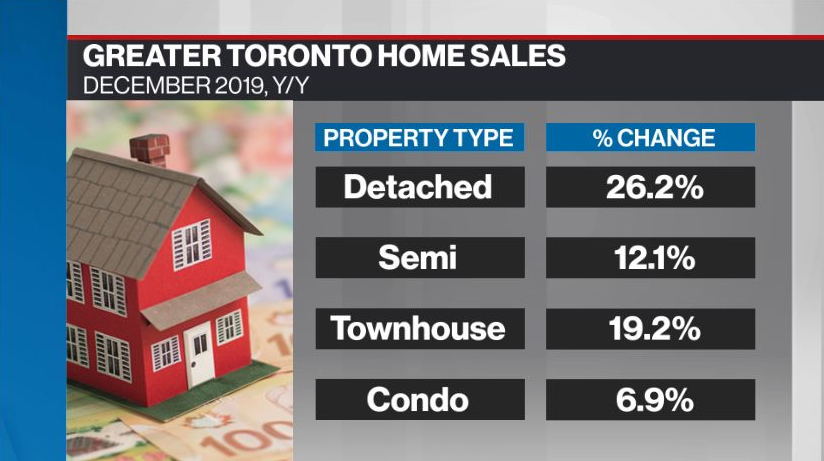

Single-family and semi-detached homes led the way.

It also caps off a year where the market recovered from its decade-low sales levels in 2018.

“As anticipated, many home buyers who were initially on the sidelines moved back into the market place starting in the spring. Buyer confidence was buoyed by a strong regional economy and declining contract mortgage rates over the course of the year,” TREB President Michael Collins said in a release.

The average selling price of a home also rose 11.9 per cent in December to $837,788.

Both new and active listings dropped in the month, prompting TREB to renew its call for more housing supply, and warned the market will continue to tighten until the housing inventory issue is addressed.

“Increasingly, policy makers, research groups of varying scope and other interested parties have acknowledged that the lack of a diverse supply of ownership and rental housing continues to hamper housing affordability in the GTA,” said Jason Mercer, TREB’s Chief Market Analyst. “Taking 2019 as an example, we experienced a strong sales increase up against a decline in supply. Tighter market conditions translated into accelerating price growth. Expect further acceleration in 2020 if there is no relief on the supply front.”