Apr 3, 2023

Trudeau spending seen drawing out Bank of Canada inflation fight

, Bloomberg News

Canadian businesses are worried about consumer demand: Chief economist

High government spending may hamper the Bank of Canada’s ability to control inflation for years to come, despite assurances from fiscal authorities that they’re acting with sufficient restraint.

Most consumers see elevated government expenditures impeding the central bank’s bid to rein in prices for another three years or more, according to a quarterly Bank of Canada survey released Monday. A third of respondents see the impact lasting longer than five years.

The data add to worries among economists that government spending is making the central bank’s task more complicated. In addition to fueling demand, the steady flow of funds may also be thwarting a re-anchoring of consumer expectations for inflation.

“The federal government’s decision to add even mildly stimulative policies to this year’s budget, in addition to similar actions by some provincial governments, works counter to the Bank of Canada’s desire to dampen excess demand and bring inflation back to target,” Benjamin Reitzes, a rates and macro strategist at Bank of Montreal, said by email.

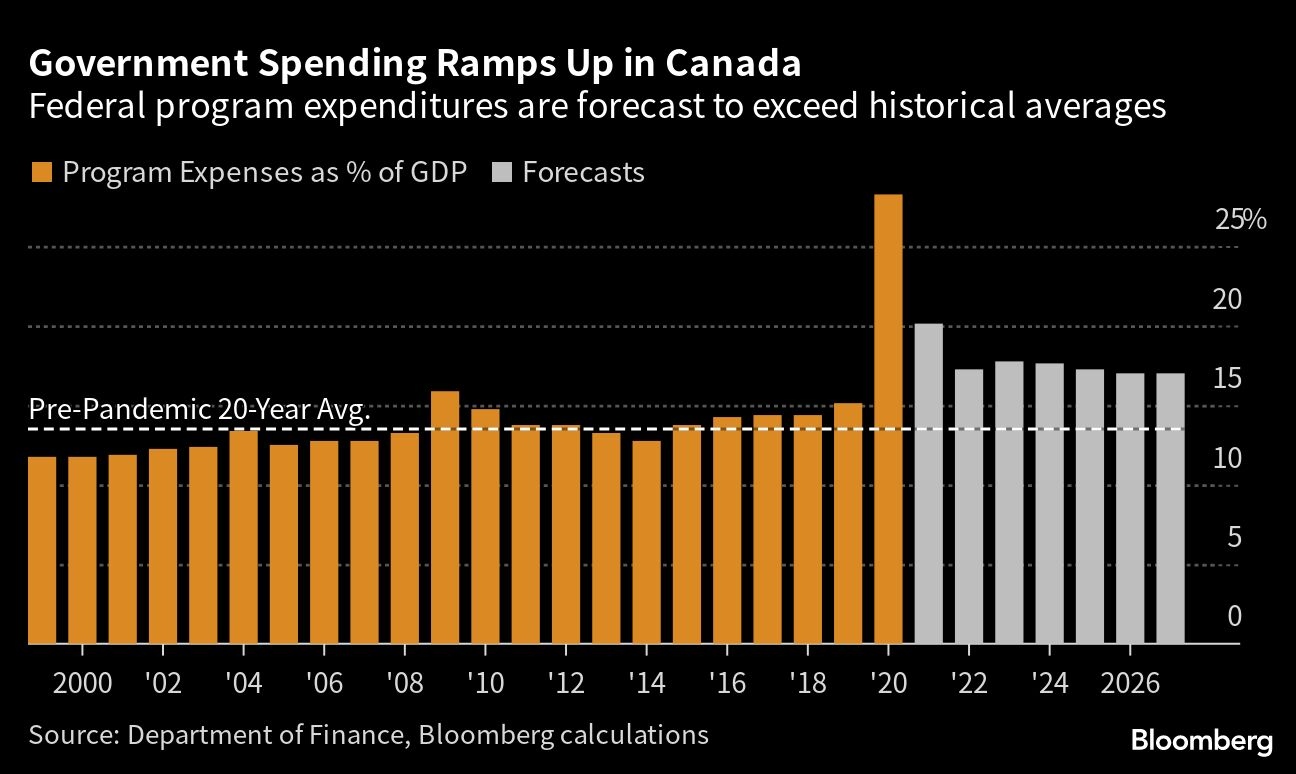

Last week, Prime Minister Justin Trudeau’s government released a budget that sent Canada deeper into deficit with $43 billion (US$32 billion) in net new costs over six years, which it says aren’t inflationary. Expenditures are expected to reach 17.7 per cent of gross domestic product in the fiscal year that began April 1, compared with an average of 13.5 per cent in the 20 years before the pandemic.

The Bank of Canada’s mandate agreement, which was renewed by Finance Minister Chrystia Freeland at the end of 2021, includes reference to the “joint responsibility” of the central bank and the government in achieving the 2 per cent inflation target and promoting maximum sustainable employment.

Inflation in Canada peaked at 8.1 per cent last year, and has since fallen to 5.2 per cent. Last month, the Bank of Canada paused its aggressive hiking cycle after raising the benchmark interest rate by 425 basis points over eight consecutive meetings.

Freeland said repeatedly in the lead-up to the budget that new spending would be restrained and targeted, arguing she didn’t want to complicate the Bank of Canada’s job and force it to raise rates higher than necessary. “We know that one of the most important things the federal government can do to help Canadians today is to be mindful of our responsibility not to pour fuel on the fire of inflation,” she said in February.

The finance minister’s office defended the new spending, which is focused on bolstering the health-care system and staying competitive with US clean-technology subsidies. “The federal deficit will continue to fall, both in terms of absolute dollars and as a percentage of GDP, every year for the next five years,” Freeland’s press secretary, Adrienne Vaupshas, said by email. “This is a very powerful proof point that we have managed to find a really challenging balance between the essential investments outlined in Budget 2023 and fiscal responsibility.”

To be sure, provincial governments have also ratcheted up spending relative to pre-pandemic levels, with some outright deploying cash to their citizens. Last year in Quebec, Premier Francois Legault twice sent checks to households, which were billed as an “anti-inflation shield” intended to help families cope with the rising cost of living.

During deliberations for their March 8 decision to hold the overnight rate steady at 4.5 per cent, Bank of Canada officials flagged stronger-than-expected growth in government spending and warned that, if sustained, it could further boost domestic demand. They said both the federal and provincial budgets would be factored into updated forecasts due for release when they next set rates on April 12.