Feb 16, 2024

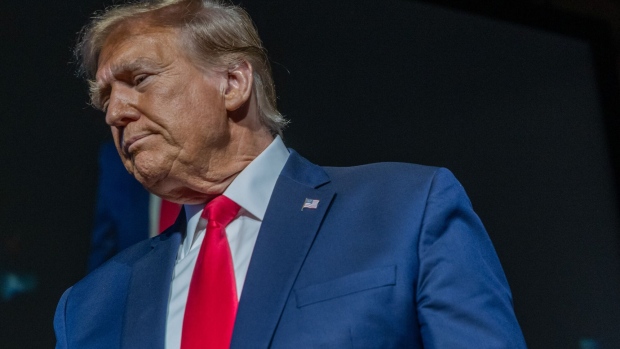

Trump Fraud Case Ends With $364 Million Fine, Three-Year Ban

, Bloomberg News

(Bloomberg) -- Donald Trump and his real estate company suffered a major defeat in New York’s civil fraud suit over his inflated asset valuations, after a judge barred the former president from running any business in the state for three years and ordered $364 million in penalties plus interest.

The 92-page verdict Friday by Justice Arthur Engoron in Manhattan is a significant victory for New York Attorney General Letitia James, who said in a social media post after the decision that with interest the fine tops $450 million.

Engoron’s ruling is a threat to Trump’s real estate empire and the latest legal setback as the Republican frontrunner campaigns to return to the White House. His two eldest sons, Donald Trump Jr. and Eric Trump, were also found liable and barred from being officers of a company in New York for two years.

During a three-month trial, James claimed Trump inflated asset values on annual financial documents for more than a decade to dupe Deutsche Bank AG and other lenders into giving him better terms on hundreds of millions of dollars in loans.

“Their complete lack of contrition and remorse borders on pathological. They are accused only of inflating asset values to make more money. The documents prove this over and over again,” Engoron wrote. “They did not rob a bank at gunpoint. Donald Trump is not Bernard Madoff. Yet, defendants are incapable of admitting the error of their ways.”

Trump is sure to appeal, potentially dragging out a final resolution of the case well beyond the November election. Even if he appeals, he would be required to put up a large chunk of the damages in the form of an escrow or bond.

The judge also found former Trump Organization chief financial officer Allen Weisselberg and former company comptroller Jeffrey McConney liable in the suit.

The fine was close to the $370 million sought by the attorney general, who also requested that interest be repaid on the illegal profit. It also exceeded the $250 million included in the original complaint, which she increased based on additional evidence presented at trial.

The fine was mostly based on the $168 million Trump saved by getting lower interest rates on four loans by lying about his wealth. It also includes the $127 million profit from the Old Post Office hotel deal in Washington and $60 million from the sale of Ferry Point golf course in New York, which the state says he wouldn’t have been able to purchase without inflating the value of his assets. The sum also includes the return of bonuses paid to employees who participated in the fraud.

“This verdict is a manifest injustice - plain and simple,” Trump attorney Alina Habba said in a statement. “It is the culmination of a multi-year, politically fueled witch hunt that was designed to ‘take down Donald Trump,’ before Letitia James ever stepped foot into the Attorney General’s office.”

A few hours after the verdict, the Trump campaign seized on the opportunity to fundraise, pleading with supporters to donate over “undeniable election interference.” The former president has had to drain his war chest for legal fees and is on track to run out of money mid-year.

The $364 million fine comes just weeks after a federal jury in Manhattan ordered Trump to pay $83.3 million in damages to writer E. Jean Carroll for defaming her when she went public with claims that he raped her in the 1990s. The pair of financial hits threaten to consume most — if not all — of the cash Trump has testified to having on hand. In a deposition in the case last year, Trump said he had more than $400 million in cash. The Bloomberg Billionaires Index has Trump’s net worth at $3.1 billion, including total liquid assets at about $600 million.

Read More: Trump Cash Stockpile at Risk From $450 Million Dual Verdicts

The judge already held the former president liable for fraud ahead of the trial, and ordered the cancellation of his business certificates, putting at risk his future control of the sprawling real estate empire. In his order Friday, the judge modified his September order, saying he would allow an independent compliance officer to renew the cancellation in consultation with the outside monitor “based on substantial evidence.” The order was temporarily put on hold in October by an appeals court while Trump challenged it.

Engoron also ordered that Barbara Jones, a former federal judge he appointed in 2022 to serve as an independent monitor overseeing Trump’s company, continue in her role for at least three more years and directed Jones to submit a report to him about “enhanced monitorship” over the company within 30 days.

The Trumps have already complained about Jones, rejecting her post-trial findings of continued financial discrepancies at the Trump Organization. The defense lawyers responded in a Jan. 29 letter to Engoron, disputing Jones’ findings and accusing her of trying to enrich herself by extending her appointment. The monitor has already received more than $2.6 million in fees for her work, the Trumps said in the letter.

Engoron didn’t impose a lifetime ban preventing Trump from doing business in New York, as sought by the state. But the three-year ban on Trump’s participation as an officer in a business in the state industry is a symbolic blow for the former president, whose career blossomed in New York City. He announced his candidacy for the presidency in 2015 after descending from an escalator in the lobby of his Manhattan headquarters. While Trump has moved to his Mar-a-Lago estate in Florida, New York City is still central to his persona.

Documents at the center of New York’s fraud case allegedly show Trump’s net wealth was inflated by as much as $3.6 billion a year from 2011 to 2021. According to the state, values were boosted by counting luxury homes and other improvements that didn’t yet exist; appraising land as if there were no restrictions on development; and counting as cash proceeds that Trump didn’t have control over.

For years, Trump tripled the square footage of his Trump Tower penthouse apartment to claim it was worth more than $300 million, until Forbes magazine called him out.

This isn’t the first time Trump’s business interests have been stunted by the New York attorney general. In November 2016, then-President-elect Trump agreed to pay $25 million to settle the state’s civil fraud lawsuit against his Trump University, which had been accused of ripping off thousands of students.

Engoron oversaw the trial without a jury, hearing from dozens of witnesses and analyzing thousands of pages of evidence. Trump took the stand as a state witness, and spent his time under oath clashing with the judge and angrily denying that he’d done anything wrong. His sons also testified, downplaying any role they had in preparing their father’s financial statements.

Christopher Kise, the lead Trump lawyer at the trial, said in a statement that the fine was “draconian and unconstitutional” and called the verdict a “tyrannical abuse of power.”

“When a Court willingly allows a reckless government official to meddle in the lawful, private, and profitable affairs of any citizen based on political bias, America’s economic prosperity and way of life are at extreme risk of extinction,” Kise said.

--With assistance from Tom Maloney and Kyle Kim.

(Corrects figure in headline of story originally published Feb. 16)

©2024 Bloomberg L.P.