Dec 16, 2021

U.K. Bank Investors Set for Another Nail-Biting Rate Decision

, Bloomberg News

(Bloomberg) -- U.K. bank stocks face potential turbulence on Thursday from another too-close-to-call Bank of England policy decision.

NatWest Group Plc, Lloyds Banking Group Plc and Barclays Plc are among companies that could benefit from a rise in rates, potentially helping profit margins from lending and the money earned from investing deposits.

“Rate rises transform the profitability of these banks,” Fahed Kunwar, a banks analyst at London broker Redburn said by phone. “They make their consensus numbers, and their multiples, much more attractive. It means almost everything.”

Speculation of a hike in the central bank’s key rate intensified on Wednesday as data showed a consumer price surge in Britain hit the highest level for more than a decade. The statistics, along with Tuesday’s strong labor market data, “should tilt the Monetary Policy Committee’s decision marginally towards lift-off,” Deutsche Bank AG economist Sanjay Raja wrote in a note.

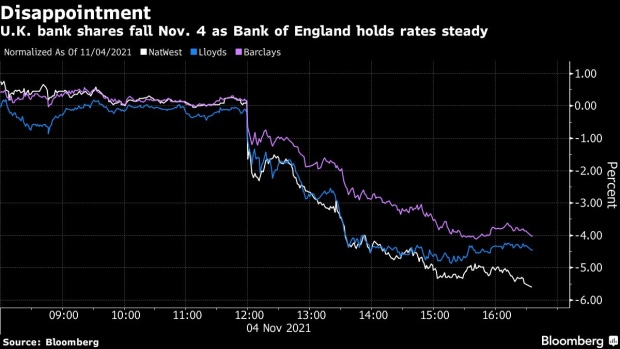

Still, with economists divided, nothing is certain. Investors were left disappointed last month, as rates were held steady and lenders’ shares dropped. An index tracking U.K. bank stocks is down about 6% since that decision, as analysts factored slower-than-expected hikes into their forecasts, in part due to the emergence of the omicron virus strain and its effect on the economy.

However, more gradual rate rises could also be a positive for U.K. banks, according to Kunwar, who says it would mean fewer borrower defaults and thus reduced loan losses.

“In a way, if they did it at a more steady pace, that’s the higher quality rate rise scenario,” Kunwar added.

©2021 Bloomberg L.P.