Mar 24, 2022

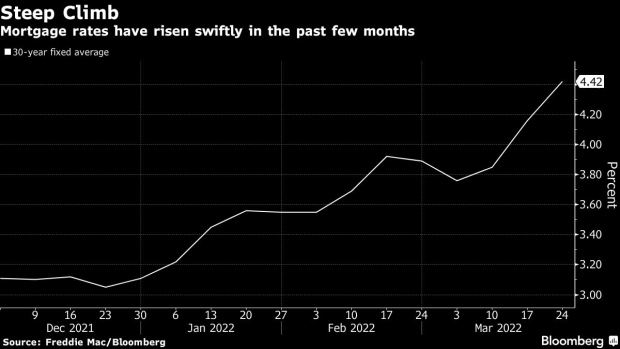

U.S. Mortgage Rates Surge to 4.42%, Highest Since January 2019

, Bloomberg News

(Bloomberg) -- Mortgage rates in the U.S continued their rapid rise, reaching a level not seen in more than three years.

The average for a 30-year loan was 4.42%, up from 4.16% last week and the highest since January 2019, Freddie Mac said in a statement Thursday.

Borrowing costs tracked another jump in 10-year Treasury yields. The Federal Reserve lifted the benchmark interest rate by a quarter percentage point last week, with more hikes possible in the coming months. Russia’s invasion of Ukraine has roiled supply chains and financial markets, raising the stakes of the Fed’s fight to tame inflation.

Home-loan costs are expected to climb further by the end of the year, though the global turmoil makes near-term moves hard to predict.

Buyers who jumped into the market earlier in the pandemic or owners who rushed to refinance were able to take advantage of record-low mortgage rates. Over the past few months, many Americans have shelved purchasing plans or have given up altogether as inflation and escalating home prices decimate buying power.

“The rise in mortgage rates, combined with continued house price appreciation, is increasing monthly mortgage payments and quickly affecting homebuyers’ ability to keep up with the market,” Sam Khater, Freddie Mac’s chief economist, said in the statement.

At the beginning of the year, the monthly payment on a $300,000 loan at the 30-year average would have been $1,301. Now, that has climbed to $1,506.

©2022 Bloomberg L.P.