Aug 29, 2022

U.S. stocks, bonds retreat on Fed’s tough rates message

, Bloomberg News

BNN Bloomberg's closing bell update: August 29, 2022

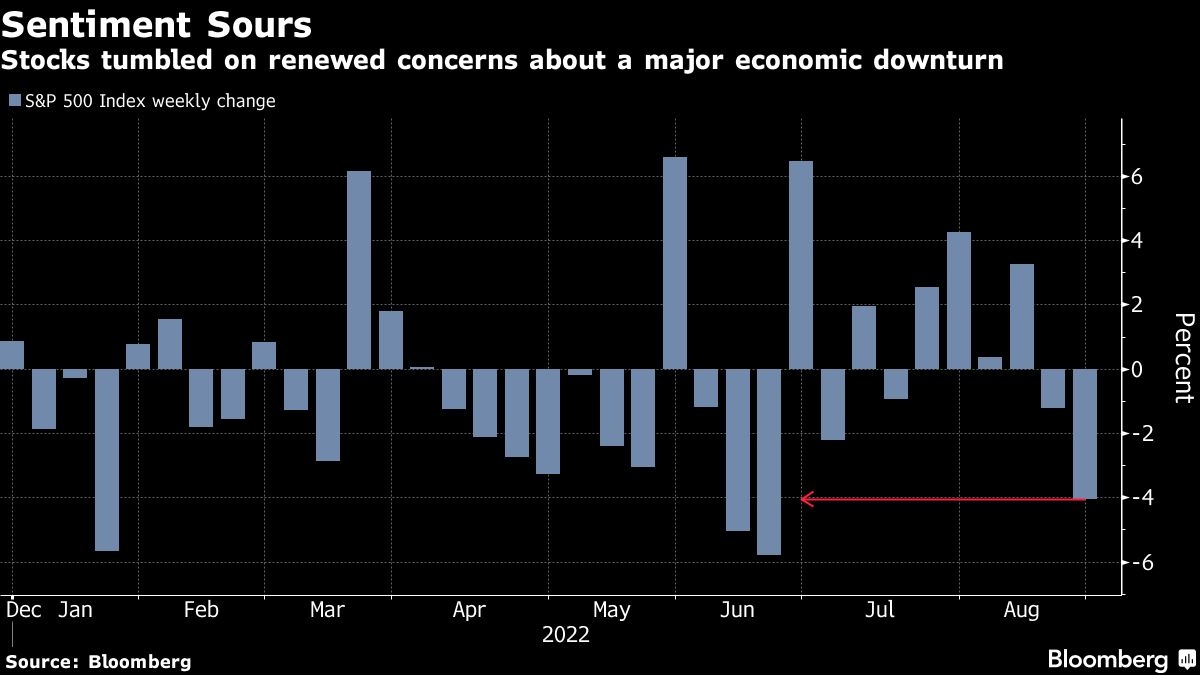

US stocks and Treasuries fell again Monday as the realization that interest rates are likely to remain elevated for an extended period continued to force a repricing across assets.

The S&P 500 and the Nasdaq 100 dropped a second day, adding to the rout that started Friday when Jerome Powell made it clear the Fed is willing to let the economy suffer as it fights inflation. Treasury yields rose, with the 10-year rate hovering around 3.11 per cent. The two-year yield had climbed to its highest level since 2007 earlier in the day before paring the advance. Oil notched gains on supply risks.

Powell’s speech during the Jackson Hole symposium underscored that expectations for any reversal of Fed tightening next year was unlikely unless inflation reverted toward the central bank’s long-term target. The latest consumer price reading in the US put inflation above 8 per cent. He had also warned of the potential for economic pain for households and businesses as the central bank continues to be aggressive.

“The Fed Friday took away the punch bowl from the party and equities were the drunkest asset class at the party,” Jeff Schulze, investment strategist at ClearBridge Investments, said in an interview. “We’re going to deal with the hangover as a consequence. So I think investors are reassessing recession risks and are recognizing that the Fed is prioritizing price stability over economic stability.”

Minneapolis Fed President Neel Kashkari said the recent stock-market losses show that investors have understood that Powell and his colleagues are serious about tackling inflation.

August and September also tend to be the worst months for the S&P 500 Index, with the index averaging declines of 0.6 per cent and 0.7 per cent, respectively, over the past 25 years.

“Since World War II, the S&P 500 posted the worst average monthly price change in September, joining February as the only two months to register declines,” Sam Stovall, chief investment strategist at CFRA wrote in a note. “Yet, September stands alone as the only month in which the market fell more frequently than it rose. What’s more, the best September return places it in the bottom quarter of all months, while its deepest one-month decline was among the four worst.”

Going forward, weaker earnings -- not higher interest rates -- could pose the largest threat to US stock prices, Morgan Stanley strategists led by Michael J. Wilson said in a research note Monday. The bank’s leading earnings model, which projects a steep fall in earnings per share growth over the next several months, confirms that view.

“The path for stocks from here will be determined by earnings, where we still see material downside,” the strategists said. “As a result, equity investors should be laser focused on this risk, not the Fed.”

Seema Shah, chief global strategist at Principal Global Investors, echoed the sentiment.

“While earnings season has been positive, persistent challenges indicate an increasingly difficult operating environment, likely limiting profit persistence in the second half of the year,” she wrote.

Here are some key events to watch this week:

- US consumer confidence, Tuesday

- New York Fed President John Williams due to speak, Tuesday

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- China PMI, Wednesday

- Euro-area CPI, Wednesday

- Russia’s Gazprom set to halt Nord Stream pipeline gas flows for three days of maintenance, Wednesday

- Cleveland Fed President Loretta Mester due to speak, Wednesday

- China Caixin manufacturing PMI, Thursday

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.7 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 1 per cent

- The Dow Jones Industrial Average fell 0.6 per cent

- The MSCI World index fell 2.3 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.1 per cent

- The euro rose 0.3 per cent to US$0.9995

- The British pound fell 0.3 per cent to US$1.1703

- The Japanese yen fell 0.8 per cent to 138.70 per dollar

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 3.11 per cent

- Germany’s 10-year yield advanced 11 basis points to 1.50 per cent

Commodities

- West Texas Intermediate crude rose 4.2 per cent to US$96.97 a barrel

- Gold futures were little changed