Jun 12, 2023

UK Bond Yields Rise as Mann Warns on Persistent Inflation

, Bloomberg News

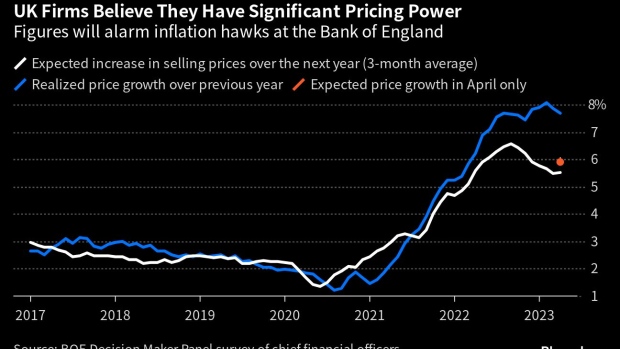

(Bloomberg) -- Bank of England policy maker Catherine Mann said she’s still “very concerned” about persistent pressures pushing up UK inflation, a remark that firmed up expectations for higher interest rates.

Mann, the most hawkish member of the BOE’s interest-rate setting Monetary Policy Committee, drew particular attention to high wages for new hires, “sticky” core inflation, and uncomfortable levels of price rises in the UK’s dominant services industry.

Money markets boosted bets on how much further the BOE stands to raise borrowing costs this year. They’re pricing a peak rate of just over 5.6% by year-end, the highest since May.

Investors dumped UK short-end bonds — among the most sensitive to changes in monetary policy — lifting the two-year yield as much as 12 basis points to 4.66% and putting them within a whisker of the September peak that followed then-Prime Minister Liz Truss’s budget.

Mann noted that wage hikes for new hires — a “harbinger of what we are ultimately going to see on average pay growth” — were not as drastic as seen in the immediate aftermath of the pandemic when there was huge demand for workers. She pointed to data from KPMG and the Recruitment and Employment Confederation that put those gains at about 4% currently.

But “wage increases at 4% are going to challenge us getting to a 2% (inflation) objective in the medium term,” Mann said Monday on a webinar hosted by consultancy firm Signum Global Advisors.

Read more: Wages Rise 10% Across England, Finally Catching Up to Inflation

She added that “even though we do not project a recession, nevertheless, for some parts of the population, it’s going to be pretty tough” because the 1% future economic growth rate predicted by the central bank “is not a great rate of growth.”

Her comments echo those made by fellow BOE policy maker Jonathan Haskel in an column for the Scotsman newspaper published Monday morning. He said it was important that “we continue to lean against the risks of inflation momentum.”

Markets will be keeping a close eye on further comments made by Mann’s colleagues on Tuesday, as new MPC appointee Megan Greene addresses Parliament’s Treasury Committee and BOE Governor Andrew Bailey fields questions from the House of Lords Economic Affairs Committe. Dovish policy maker Swati Dhingra later in the day will deliver a speech.

UK labor market data will also be released on Tuesday morning, with economists expecting a mixed bag. While unemployment is expected to edge up for the three months to April, showing that demand for workers may be starting to ease, wage growth is also expected to pick up again, underlining inflation concerns.

Despite her worries over inflation persistence, Mann said there was hope to be taken from the fact that inflation expectations among UK businesses and households were coming down.

“Good news — medium term inflation expectations have drifted down,” Mann said. “We’d like to see that continue.”

But she added that she was particularly interested to observe how consumer spending was squeezed as higher interest rates began to filter through to mortgage repayments. In May, the BOE said it thought only around a third of the impact from its string of rate hikes had currently passed through to the real economy, as the majority of British home owners are now on fixed-term mortgage deals set for two or five years.

At the last MPC meeting in May, Mann voted with the majority for a 25 basis point hike.

Read more:

- UK Forecasters See Stronger Growth and Less Risk of Recession

- BOE’s Catherine Mann Says UK Government Needs Longer-Term Agenda

- Larry Summers Sees UK Recession After ‘Historic Error’ on Brexit

--With assistance from James Hirai, Andrew Atkinson and Elina Ganatra.

(Updates with comments from Mann and market reaction.)

©2023 Bloomberg L.P.