Nov 16, 2023

US Continuing Jobless Claims Rise to Highest in Almost Two Years

, Bloomberg News

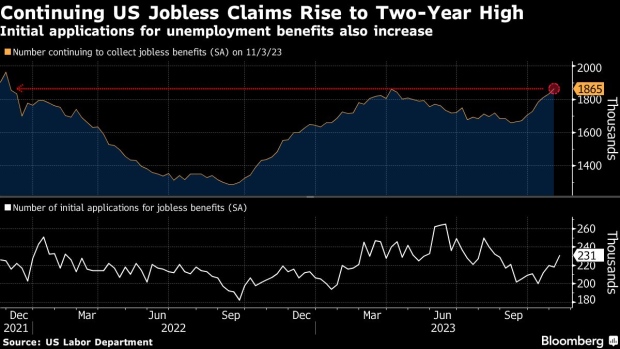

(Bloomberg) -- Continuing applications for US unemployment benefits rose to the highest level in almost two years, underscoring the increasing challenges unemployed workers are facing in finding new jobs.

Recurring jobless claims, a proxy for the number of people continuously receiving unemployment benefits, jumped to 1.87 million in the week ended Nov. 4, according to Labor Department data out Thursday. That marked an eighth straight week of increases.

Initial jobless claims also rose, to 231,000 in the week ending Nov. 11. That was the highest since August.

Although it’s difficult to draw conclusions from volatile weekly numbers, the rise in jobless claims, combined other data out this week, indicate some cooling in the labor market, in price pressures and in consumer spending.

A separate report Thursday showed that US factory production fell in October by more than expected, largely reflecting a strike-related pullback in activity at automakers and parts suppliers. And homebuilder sentiment dropped to the lowest level this year in November as high mortgage rates kept a lid on housing demand.

The reports reinforced speculation among traders that the Federal Reserve is done with raising interest rates.

Read More: Slipping US Retail Sales, Cooling Prices Point to Soft Landing

While a resilient labor market has been supporting economic growth this year, many economists expect it to lose steam under the weight of higher borrowing costs. Companies are now adding jobs at a slower pace, unemployment is rising and wage growth has decelerated, leading to some pullback in spending ahead of the holiday season.

The jobless claims data tend to be especially choppy around the holidays, and last week included Veterans Day. The four-week moving average of initial claims, which smooths out some of that volatility, rose to 220,250.

What Bloomberg Economics Says...

“The jump in initial claims, combined with the persistent rise in continuing claims, is translating to a durable softening in the labor market. The report signals the unemployment rate is on track to edge higher in November from 3.9% in October, signaling the Fed is done hiking rates this year.”

— Eliza Winger, economist

To read the full note, click here

On an unadjusted basis, initial claims also picked up, with Massachusetts and New York logging the biggest increases. Unadjusted continuing claims fell for the first time in four weeks, led by California and Michigan.

“If the numbers trend sharply higher, that would be a signal that needs to be noted, but a single outlier reading this time of the year is best ignored until or unless the direction of weekly moves start to consistently stack up in one direction,” Stephen Stanley, chief economist at Santander US Capital Markets, said in a note.

This week’s claims figures correspond with the reference period for the monthly employment report published by the Bureau of Labor Statistics.

--With assistance from Chris Middleton, Vince Golle and Reade Pickert.

(Updates with data earlier this week.)

©2023 Bloomberg L.P.