Feb 5, 2020

Virus Forces Nomura to Rethink Bets on Low-Yielding Currencies

, Bloomberg News

(Bloomberg) -- Follow Bloomberg on Telegram for all the investment news and analysis you need.

The rapidly-spreading coronavirus has prompted Nomura Holdings Inc. to flip some of its top currency calls for 2020 just a month into the year.

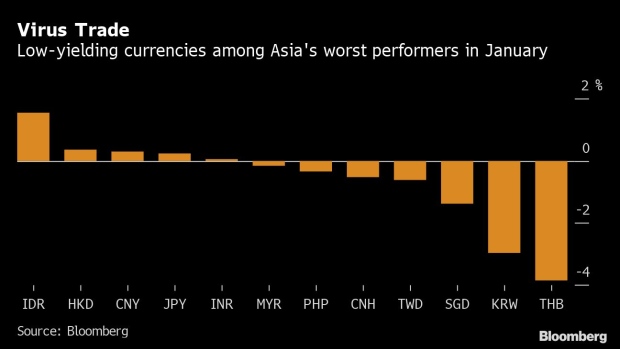

Japan’s biggest securities firm recommends long-dollar positions against Thailand’s baht and the Chinese yuan. Back in December, shorting the greenback versus these low-yielding Asian currencies was among its top trades for this year. Nomura is also advising selling the Singapore dollar against a basket of its trading partners.

The shift comes as investor optimism over improving U.S.-China trade relations and a nascent recovery in global growth has been replaced by fears about the economic impact of the viral outbreak. The baht, won and Singapore dollar are taking the biggest hit as measures to stem the spread of the disease disrupt trade, tourism and supply chains worldwide.

“It was about low yielders outperforming in December,” said Craig Chan, Nomura’s global head of FX strategy in Singapore. “It’s kind of shifting and most currencies linked to China are suffering. There are lot of currencies in the low-yielding space which are looking to break key levels.”

The epidemic has jeopardized China’s economic recovery, with scores of millions of citizens barred from travel, and companies, factories and retail outlets shuttered for a period of weeks. The death toll has risen to at least 560.

Nomura had in December predicted the offshore yuan to strengthen to 6.89 per dollar by the end of March. It forecast the won to reach 1,150 and the baht to advance to 29.7 against the greenback. The currencies ended at 6.9754, 1,191.40 and 30.970, respectively, on Wednesday.

While Indonesia’s rupiah and India’s rupee -- two of emerging Asia’s highest-yielding currencies -- have outperformed their peers so far this year, Chan isn’t buying them just yet.

READ: Rupiah Bonds Top in Asia Boosted by Central Bank’s Debt Buys

“It’s really about observing the intensity of this viral outbreak,” he said. “We may go into high-yielders like India and Indonesia once the global external backdrop begins to stabilize a bit.”

A potential “V-shaped recovery” from the virus impact will provide scope for Nomura to reinstate its trades on low-yielders in the future, Chan said.

To contact the reporter on this story: Subhadip Sircar in Mumbai at ssircar3@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Shikhar Balwani, Ravil Shirodkar

©2020 Bloomberg L.P.