Mar 10, 2022

Volatility Breaks Out in Europe as War, Rate Risk Ensnare Assets

, Bloomberg News

(Bloomberg) -- Everywhere you look, from stocks to bonds, European assets are in the throes of outsize volatility as the Ukraine conflict rages -- outpacing gyrations in key U.S. markets.

With Germany’s DAX soaring 8% Wednesday, swings in the region’s equities are near the highest relative to S&P 500 peers since 2016, while gauges of bond and currency volatility are at pandemic peaks.

That all points to a geopolitical risk premium for investing in Europe’s markets that are teeming with cyclical stocks acutely vulnerable to growth and inflation risks.

With the European Central Bank on Thursday signaling an end to asset purchases in the third quarter in a hawkish tilt, bonds from Germany to Italy are the latest whipsawing assets that are keeping traders on edge this week.

“We aren’t out of the woods yet from a markets perspective,” said Colin Graham, head of multi-asset strategies at Robeco Institutional Asset Management. “The market is too uncertain to change to a positive longer-term view on Europe given energy prices, recession risk rising, the response to conflict escalation.”

Here’s a look at the cross-asset turbulence in key charts:

Volatility Gap

The last time stock-volatility gauges in Europe and the U.S. diverged like this was in the June 2016 selloff -- when British citizens voted to leave the European Union. This time round, deep commercial and commodity ties with Russia are exposing Europe’s weakness.

“The full extent of the damage to the economy and the financial system is not yet foreseeable, the fighting continues unabated, and moreover, we remain skeptical with regard to the sincerity of Putin’s willingness to negotiate,” according to Stefan Kreuzkamp, chief investment officer at DWS.

No Panacea

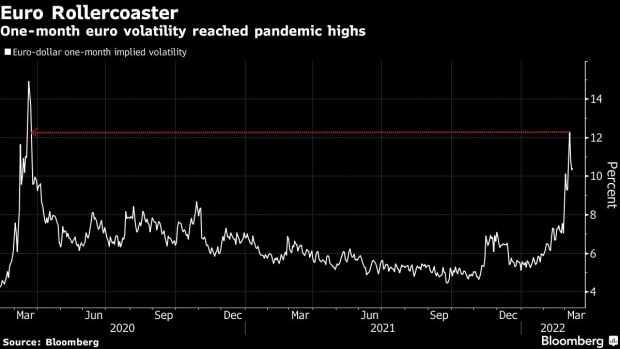

The euro too is whipsawing Thursday after the European Central Bank said it may end asset purchases in the third quarter. It follows a roller-coaster ride for the common currency, with one-month euro volatility touching the highest level since March 2020 last week.

After pushing back tightening bets following Russia’s invasion of Ukraine, money markets are now pricing in a quarter-point hike in October followed by another in the first half of 2023.

But should the war continue to drag on, Europe’s pandemic recovery and the timing of ECB rate hikes will be put into doubt, according to Seema Shah, chief strategist at Principal Global Investors.

“If the conflict is prolonged and elevated energy prices weigh heavily on household consumptions and confidence, the ECB will find it immensely tough to raise rates this year,” Shah said in a note. “Who would want to be a central banker in this situation?”

Bond Paradox

Questions about whether the region’s economy can continue to power ahead under soaring energy prices, inflation and tighter central bank policy are also making it hard to trade bonds. The trading range in German 10-year yields -- one measure of bond volatility -- widened to the most since the start of the pandemic this week.

“Such high levels of volatility have existed in the past rarely,” said Francois Savary, chief investment officer at Prime Partners SA. “We are not yet buying the dip as there are still too many uncertainties to deal with.”

©2022 Bloomberg L.P.