Dec 16, 2023

Wall Street’s China Stock Bulls Seek Redemption After a Humbling Year

, Bloomberg News

(Bloomberg) -- For the China bulls on Wall Street, 2023 is a year to forget.

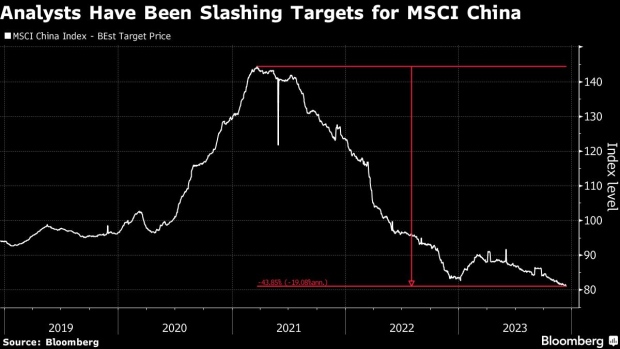

Global investment banks turned almost unanimously optimistic on the market around this time last year, only to be confounded by a 14% drop in the MSCI China Index.

Now, as policymakers ramp up efforts to arrest a housing slump and extend funding support for the broader economy, hopes are building again that 2024 will be better. But it’s a case of once bitten, twice shy. This time around, expectations are much more modest.

“It’s like we’ve stood still in time for 12 months. The thing that changed, though, is people’s perceptions. They have gone from very optimistic to very pessimistic,” said Steve Wreford, a portfolio manager at Lazard Asset Management Ltd. “Being optimistic a year ago was the wrong thing to do. And I wonder if maybe now being pessimistic is also the wrong thing to do.”

What a difference a year can make. Back in late 2022, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley were predicting at least 10% annual gains for the MSCI gauge as Beijing dismantled stringent Covid controls. A Bank of America Corp. survey showed funds were rushing to boost exposure to Chinese shares in anticipation of a robust economic reopening.

Reality bit hard. While US, Japanese and Indian stocks rallied this year, those in China have languished to make it the world’s worst-performing major market. Equities onshore are poised to see a record fifth straight month of foreign outflows in December.

In hindsight, Wall Street’s misplaced optimism likely resulted from an under-appreciation of the magnitude of headwinds ranging from weak consumption to prolonged housing woes as well as geopolitical tensions, and an overestimation of authorities’ willingness to ramp up fiscal spending in an indebted economy. But it also reflects the difficulties in navigating a market where policymaking has become increasingly opaque and unpredictable.

As an initial reopening rally fizzled and hopes for a bazooka stimulus program evaporated, some of the China bulls started adjusting to the new reality. JPMorgan was among the first to act, dialing back its view around the middle of the year. Morgan Stanley followed suit in August by downgrading China to equal-weight.

READ: China Stock Bulls Hit Reset Button After $1.5 Trillion Rout

Goldman Sachs waited until November to cut its recommendation on Hong Kong-listed Chinese stocks to neutral, citing modest earnings growth. The bank remains overweight mainland Chinese shares.

“We did call for risk-on in April. Unfortunately that did not work. So that was the wrong call,” said Wendy Liu, JPMorgan’s chief Asia and China equity strategist. “Since May 2023, we became a lot more cautious on the growth downside,” and as people’s expectations for a strong stimulus were belied, she said.

Morgan Stanley’s chief Asia and emerging market equity strategist Jonathan Garner said the bank has been “effectively cautious on China” for most of the time since early 2021, while Goldman Sachs did not respond to a request for comment.

Policy Response, Consumers

To some China bulls, including strategists at non-US banks like HSBC Holdings Plc’s Herald van der Linde, China’s economic slowdown and its property troubles had been well anticipated. What surprised him the most was that policymakers’ response was “very slow and cautious,” he said. “That was the most difficult to forecast.”

Others blame the market’s dismal performance on the absence of “revenge spending” by Chinese consumers.

“They went through a very traumatic experience with Covid. They were locked up much more” than elsewhere, said Rajeev De Mello, a global macro portfolio manager at GAMA Asset Management, who reduced his China holdings as the reopening rally faded. “So probably the households are more cautious.”

Looking ahead to 2024, most Wall Street banks remain sanguine on Chinese stocks even as many have toned down their forecasts and are expecting just single-digit gains for the MSCI China gauge.

Ironically, their argument looks remarkably similar to last year’s: further policy support, improved earnings momentum and cheap valuations. And there’s little guarantee that they will be right this time: while Beijing has notably intensified efforts to ease funding woes among the country’s cash-strapped property developers, deflation remains a threat and top leaders have signaled continued reluctance to adopt more forceful stimulus.

As the MSCI China index posted its first advance in four months amid a global equities surge in November, Liu of JPMorgan said she expects the “relief rally” to continue into early 2024, backed by an easing of Sino-US tensions and an improvement in revenue growth.

Van der Linde’s team expects China to outperform and drive regional stocks higher in 2024. “We’re sticking to our guns for the moment,” he said. “The global macro is starting to work in China’s favor now. While the call wasn’t completely right over the last six months, the same reasons probably now start to be all in place.”

Some other investors say analyzing China’s market by fundamentals is less meaningful than before, because the regulatory environment has become more capricious and policymaking less transparent in recent years.

“I think a lot of people in the West have stopped looking at corporate earnings for Chinese stocks,” said Jian Shi Cortesi, a fund manager at GAM Investment Management. The market is “very much driven by news flow, and most investors do not have the time or effort to really look deep into it.”

READ: China Is Becoming a Data Black Hole, Short Seller Aandahl Says

--With assistance from Iris Ouyang, Tassia Sipahutar and April Ma.

©2023 Bloomberg L.P.