Nov 22, 2019

Why the brokerage fee war likely won't be coming to Canada

, BNN Bloomberg

Canadians miss out on the online broker fee price war

Investors hoping the price war between American discount brokerages will migrate north of the border will likely end up disappointed, warns an industry observer.

There's been a wave of American brokerages moving to eliminate fees to trade U.S. stocks, exchange-traded funds and options, but the CEO of digital services consultancy firm Surviscor says Canada likely doesn't have the volume of trades to support a similar move among discount trading platforms.

"It's a volume-based business and if you have more volume, you can do more on your margins," Glenn LaCoste told BNN Bloomberg. "That helps a broker be able to withstand those pressures. However, the smaller players aren't backed by a big bank where if you take a margin away from one part - you have to be getting it somewhere else. Or else eventually it doesn't work out for you."

Lower Canadian stock trading volumes mean brokerages can't benefit from grouping trades together as they can in the U.S..

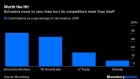

Charles Schwab ratcheted up pressure on its rivals when it announced it would begin offering commission-free online trading to American investors - prompting similar moves from TD Ameritrade and ETrade Financial.

Charles Schwab is reportedly closing in on a deal to buy TD Ameritrade for US$26 billion, which would create a firm with about US$5 trillion in assets combined.

"It makes sense in the U.S. because of the volume, if they can consolidate those two pieces together and have more trade volume going through - you can go down to that zero," LaCoste said.

While investors might cheer paying less in trading fees, LaCoste worries consumers will end up getting what they paid for – which means less service.

"So many firms have stopped what they're doing on the service side, and again, you're going to go zero somewhere - there's got to be something that cuts back somewhere," he said.