Nov 30, 2022

Xpeng’s Electric Vehicle Sales Contract Again and Outlook Is Dim

, Bloomberg News

(Bloomberg) -- Xpeng Inc. expects its electric-car deliveries to remain weak through the final quarter of the year, as China’s drawn out battle against Covid continues to impact vehicle production and sales.

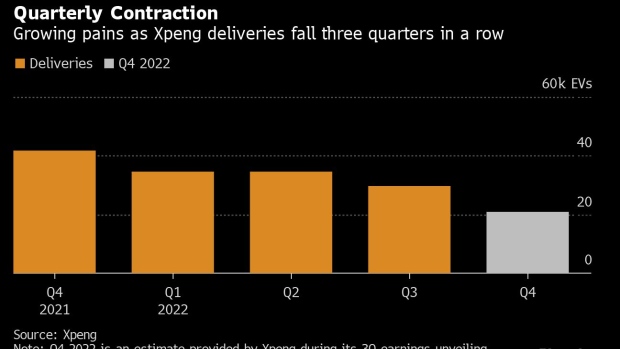

US- and Hong Kong-listed Xpeng said Wednesday it expects to sell 20,000 to 21,000 electric vehicles in the three months through Dec. 31, which would be a fourth-straight quarter-on-quarter decline. The Guangzhou-based company delivered only 5,101 vehicles in October. Revenue in the fourth quarter will be 4.8 billion yuan ($677 million) to 5.1 billion yuan, it said.

Xpeng made the forecast in a statement on its third-quarter results, which showed revenue rose 19% from a year earlier to 6.8 billion yuan, but its loss was worse than expected, at 2.38 billion yuan versus the 1.83 billion yuan deficit forecast by analysts. Xpeng delivered 29,570 vehicles in July-September.

“The current business environment, largely contributed by Covid outbreaks and lockdowns, has had a strong negative impact on our sales, delivery, and service,” Xpeng President Brian Gu said in an interview with Bloomberg News. “The production of some key components of our G9 SUV were also disrupted, preventing it from ramping up as we expected.”

Gu said Xpeng was also feeling some sales pressure on earlier models as it transitions to new models and has made a “series of adjustments” to make cars more “market oriented” rather than “tech-led only.”

The company will continue to focus on pure electric models, intelligent technologies and charging technologies, and will suspend or cut features “that aren’t core, or won’t generate efficient output,” he said. Without naming what functions or units will go, Gu said Xpeng will try to improve capital efficiencies and be more prudent around cost control.

“Hopefully the overall production issues will be solved in the beginning of the next year,” he said, adding he’s still confident Xpeng can break even in 2024.

Founded in 2014, Xpeng has yet to make a quarterly profit. The company, which produces EVs that compete more directly with Tesla Inc. and BYD Co. rather than US-listed rivals Nio Inc. and Li Auto Inc., has pledged to break even by late 2023 or 2024. Xpeng’s signature model is the P7 sedan.

Like many automakers, Xpeng’s production has been disrupted by Covid, with the southern manufacturing hub of Guangdong hit by one of China’s worst outbreaks and subjected to restrictions such as targeted lockdowns. Virus curbs have also made it harder for potential customers to get to showrooms. The industry has been saddled with supply-chain disruptions as well.

“We have already carried out organization restructuring and changed some of our strategies,” Chief Executive Officer He Xiaopeng said in the statement.

Xpeng announced earlier Wednesday it would guarantee the price of EVs that customers paid deposits on through the end of the year and have yet to pay for their purchase in full. The move comes as subsidies for EVs are due to be phased out at the end of 2022 -- which is forcing some brands, like market leader BYD, to raise prices.

While Xpeng’s shares jumped 16% in Hong Kong on Wednesday, they’re still down more than 80% this year.

--With assistance from Danny Lee.

(Updates with executive quotes from 4th paragraph.)

©2022 Bloomberg L.P.