Apr 26, 2022

A Third of China’s Economy Lagged the Nation in First Quarter

, Bloomberg News

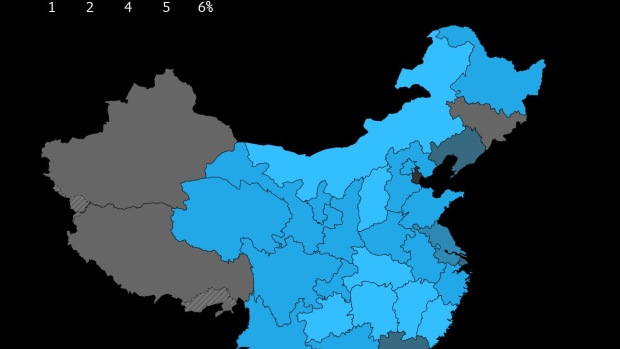

(Bloomberg) -- Regions making up a third of China’s economy expanded slower than the national growth rate in the first quarter, underscoring the extent of the damage caused by a worsening Covid outbreak and widening lockdowns.

Six provincial-level jurisdictions -- all of which suffered a rise in infections in the January-to-March period -- lagged behind the national gross domestic product growth rate of 4.8%, according to local statistics bureaus.

That included Guangdong and Jiangsu provinces, two of the country’s biggest provincial economies, which grew 3.3% and 4.6%, respectively.

In Guangdong, the technology hub Shenzhen was locked down for a week in March, while manufacturing base Dongguan salvaged factory activity by keeping workers in so-called closed loops, where they lived on site and were tested frequently. Several cities in Jiangsu, including the key electronics hub Suzhou near Shanghai, also tightened controls as infections rose.

The other laggards included Henan, Liaoning, Shanghai and Tianjin. The latter, a port city that recorded China’s first community spread of omicron in January, expanded just 0.1% and had been struggling before the latest outbreak. The quarter finished before the bulk of Shanghai’s ongoing lockdown.

The first-quarter data made public so far includes 28 of China’s 31 provincial-level jurisdictions. Jilin, Xinjiang and Tibet, which contributed just 3.13% of national GDP, have yet to disclose results.

Consumer spending in the hardest-hit provinces was also weak, with several falling short of the national quarterly retail sales growth rate of 3.3%. Guangdong’s retail sales grew 1.7% in the first quarter from a year prior, while sales in Jiangsu ticked up just 0.5%. Sales in Shanghai contracted 3.8%. Tianjin’s sales were down 3.9%.

Jiangxi province was the quarter’s best performer, with its economy growing 6.9%. The southeastern province, known for the production of fine porcelain, is home to 45 million people and recorded retail sales growth of 8.9%. Investment and industrial production in Jiangxi were also strikingly strong, up 15.6% and 9.5%, respectively.

China’s overall growth outlook is weakening, though, as lockdowns in places like Shanghai drag on and as cases now start to rise in Beijing, prompting fears of strict curbs there. Economists have slashed their growth forecasts on the country’s strict adherence to its Covid Zero policy. GDP is expected to grow 4.9% in 2022, according to the latest survey conducted by Bloomberg News, far short of the government’s target of about 5.5%.

As market confidence slips and pressure on the economy mounts, the government has made frequent pledges of support -- though investors have been weary about a lack of follow through.

The Communist Party’s Politburo -- its top decision-making body -- has an opportunity to signal changes this week during its quarterly economic meeting.

©2022 Bloomberg L.P.