Dec 7, 2023

Alphabet Rallies as Gemini Release Eases Fears Over AI Position

, Bloomberg News

(Bloomberg) -- Alphabet Inc. shares jumped on Thursday as the release of the company’s Gemini AI model eased concerns about its position within the highly competitive market for artificial intelligence.

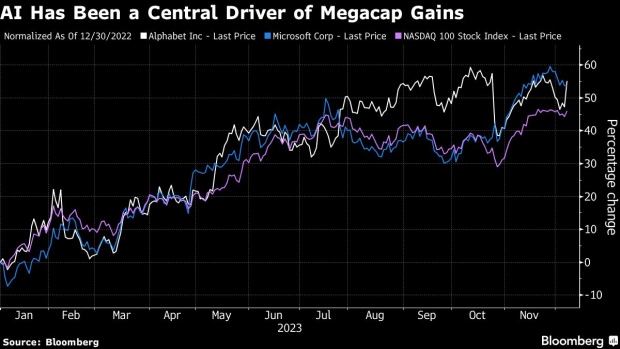

The stock gained 5.3%, its biggest one-day percentage gain since July, and the rally added more than $87 billion to the stock’s market capitalization. Shares are up 55% in 2023, compared with the 46% gain of the Nasdaq 100 Index, or the 55% rise in Microsoft Corp, considered a major AI competitor given its investment in OpenAI.

Despite their year-to-date advance, shares of the Google parent have traded in a range for the past few months, a reflection of how investors are closely monitoring any sign of weakness or strength in the AI landscape. In October, a disappointing read on Alphabet’s cloud unit — which has been attracting business from AI startups — triggered a steep decline in the shares. Microsoft’s results, in contrast, were seen as strong amid robust AI demand.

Within that context, analysts greeted the Gemini release with relief. KeyBanc Capital Markets called it “a flex of years of AI muscle development,” while Roth MKM expects “negative AI sentiment toward GOOGL to fade quickly leading to an uptick in its valuation multiple.”

Optimism surrounding AI has been a central driver of share prices this year, especially among megacap technology and internet stocks. In addition to Alphabet and Microsoft, the chipmaker Nvidia Corp has more than tripled amid robust demand for its AI processing chips. Advanced Micro Devices Inc., which unveiled a new line of AI chips earlier this week, has nearly doubled this year.

(Updates to market close.)

©2023 Bloomberg L.P.