Feb 7, 2024

Arm Soars After Expansion Into New Markets Buoys Forecast

, Bloomberg News

(Bloomberg) -- Arm Holdings Plc shares surged 48% on Thursday after artificial intelligence spending helped bolster the chip designer’s forecast. And the company’s chief executive officer said the remarkable opportunity presented by AI is still in its early stages.

“AI is not in any way, shape or form a hype cycle,” Rene Haas said in an interview on Bloomberg Television. “We believe that AI is the most profound opportunity in our lifetimes, and we’re only at the beginning.”

The remarks followed a blockbuster earnings report Thursday, when Arm projected revenue of $850 million to $900 million for the March quarter. That far surpassed analysts’ projections of $778 million. Earnings will be roughly 30 cents, excluding some items, well ahead of Wall Street’s 21-cent estimate.

Arm’s technology is going into an ever-widening array of products, from phones to cars to appliances. The scramble to add AI technology promises to accelerate that expansion, Haas said. In some cases, electronics makers don’t yet know how they’ll fully harness AI — they just want to make sure they have enough computing capacity to handle whatever is coming.

Arm once concentrated on technology for smartphones, but now that market accounts for about a third of sales. Phones today also contain more of the company’s technology per device, helping lift the royalties that manufacturers pay to Arm.

“This is the result of strategies that were put in place a number of years ago that are coming to fruition,” Haas said in the interview. “A lot of folks didn’t really understand the company well and where we fit in: But we’re in a Tesla vehicle, a Ford F-150, we are in a smart camera, a Samsung TV, the smart appliances.”

Arm’s bullish outlook, delivered late Wednesday, helped send the shares on their biggest single-day rally since an initial public offering last September. The stock closed at $113.89, adding tens of billions of dollars to Arm’s market valuation.

Another tailwind: The company’s customers are shifting to a new version of its technology called V9, which carries twice the royalty rate of its predecessors. They’re also using more Arm computing cores per device — more than 100 in Microsoft Corp.’s new server chips, for example — which amplifies royalties. Arm is also gaining market share from rival technology in the data-center and automotive markets, executives said.

Arm now expects sales of $3.16 billion to $3.21 billion in fiscal 2024, which runs through March. That’s up from a previous range that topped out at $3.08 billion.

Revenue grew 14% to $824 million in the fiscal third quarter. Excluding some items, profit was 29 cents a share. Wall Street had predicted revenue of $760 million and earnings of 25 cents a share.

Arm’s joint venture in China was a “nice positive surprise” as well, according to Chief Financial Officer Jason Child. It contributed 25% of total revenue.

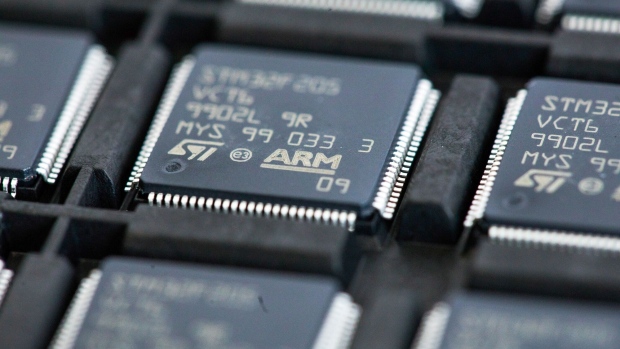

Arm has an unusual role in the semiconductor industry. It licenses the fundamental set of instructions that software uses to communicate with chips. The company also provides so-called design blocks that companies such as Qualcomm Inc. use to build their products.

Under Haas, Arm has been moving toward providing more complete layouts that can be taken directly to the manufacturing stage. That shift makes it more useful to some customers, such as cloud computing companies like Amazon.com Inc., but also more of a rival to some traditional clients, like Qualcomm.

Cambridge, England-based Arm is still 90%-owned by SoftBank Group Corp., which acquired the business in 2016 for $32 billion. An IPO in 2023 raised $4.9 billion, marking the biggest debut on a US exchange in 2023.

Read More: SoftBank Swings to Profit and Refocuses Its Strategy Around Arm

Arm’s licensing sales rose 18% to $354 million last quarter, and royalty revenue gained 11% to $470 million.

Arm’s customer list spans the technology industry. Apple Inc. uses its instruction set for the processors that power the iPhone and Mac computers. Amazon relies on Arm designs for its Graviton server processors for data centers. And Qualcomm and MediaTek Inc. are major users of Arm’s blueprints for smartphone processors.

--With assistance from Subrat Patnaik, Caroline Hyde and Ed Ludlow.

(Updates shares starting in first paragraph.)

©2024 Bloomberg L.P.