Nov 30, 2023

Markets today: S&P 500 has one of best November gains in century

, Bloomberg News

Buy Canadian banks, benefit in a year: Allan Small's top contrarian ideas

Stocks saw a late-day rebound — notching one of their biggest November gains on record — in a surge fueled by speculation the Federal Reserve will end its interest-rate hikes and cut rates next year.

This month’s US$3 trillion surge in the S&P 500 put the equity gauge 5 per cent away from its record. The Nasdaq 100 underperformed Thursday. The Dow Jones Industrial Average rose, led by gains in Salesforce Inc. and Boeing Co. U.S. 10-year yields jumped eight basis points to 4.34 per cent. The dollar advanced, but posted its worst month in a year.

U.S. consumer spending, inflation and the labor market all cooled in recent weeks — adding to evidence that growth is gradually slowing. The core personal consumption expenditures price index, the Fed’s preferred gauge of underlying inflation, met economists’ estimates.

“This is likely to cement expectations that the monetary policy inflection point is close, and the Fed will make at least one rate cut in the first six months of 2024,” said Sonu Varghese, global macro strategist at Carson Group. “Fed officials have already acknowledged that inflation is easing, and that can happen in the face of a strong economy and low unemployment, essentially laying the groundwork for rate cuts.”

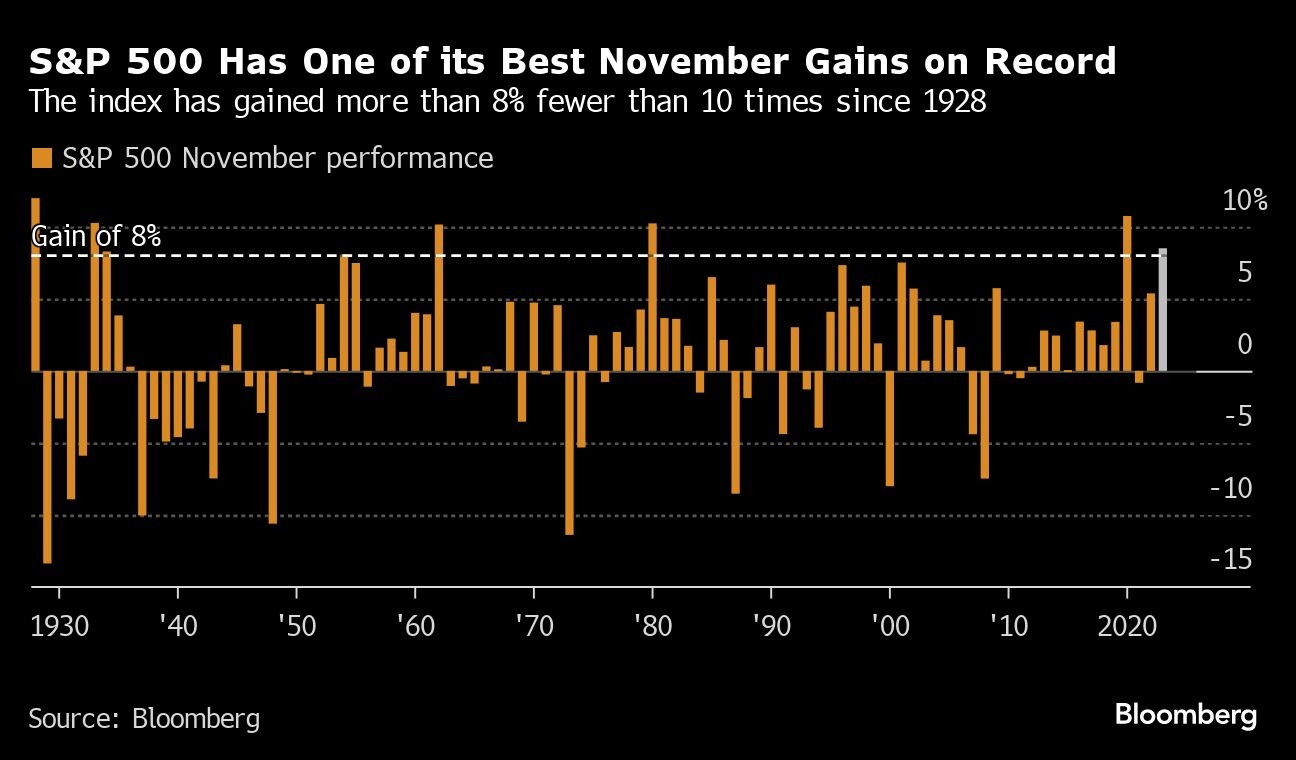

While that perception is essentially what’s triggered the rally across several asset classes in November, concern about an “overbought” market has kept many equity investors sidelined over the past week. The S&P 500 climbed more than 8 per cent — a feat achieved fewer than 10 times since 1928, according to data compiled by Bloomberg. It’s also the gauge’s best month since July 2022.

For now, it’s a bull market until proven otherwise, according to Callie Cox at eToro.

“Powell and Fed presidents are talking openly about the progress in inflation and the prospect for cuts. As long as the Fed’s narrative sticks, the yearning for rate cuts could continue through rate-sensitive sectors,” she said. “Tread carefully, though. The economy is slowing, and a recession is still a risk.”

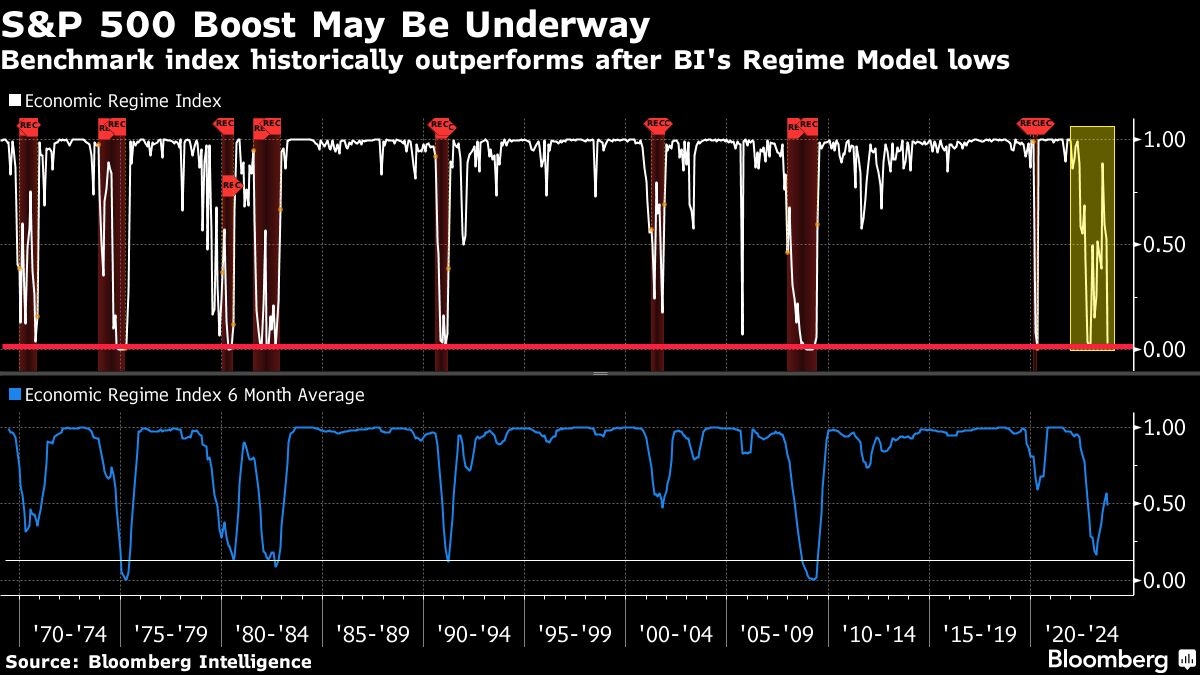

In a favorable sign for equity optimists, a Bloomberg Intelligence model known as the Economic Regime Index shows that the worst of America’s economic pain appears to have passed.

The index dropped back into recession territory last month after showing nearly a full rebound earlier this year from its trough in late 2022. While the model still signals potential economic weakness ahead, as long as it stays above its lows the outlook is favorable for the S&P 500, says Gina Martin Adams, chief equity strategist at BI.

“As an exceptional November comes to a close, among the frequent client questions on the road this week was whether a very strong November historically steals performance from the typical December Santa Claus rally,” said Chris Verrone at Strategas. “Not really.”

There’s a clear bias that a very weak November performance has been followed by a strong December showing, he noted. But there’s very little difference in the remaining 90 per cent of the data. December performance is about even following very strong gains in November versus the average November, Verrone added.

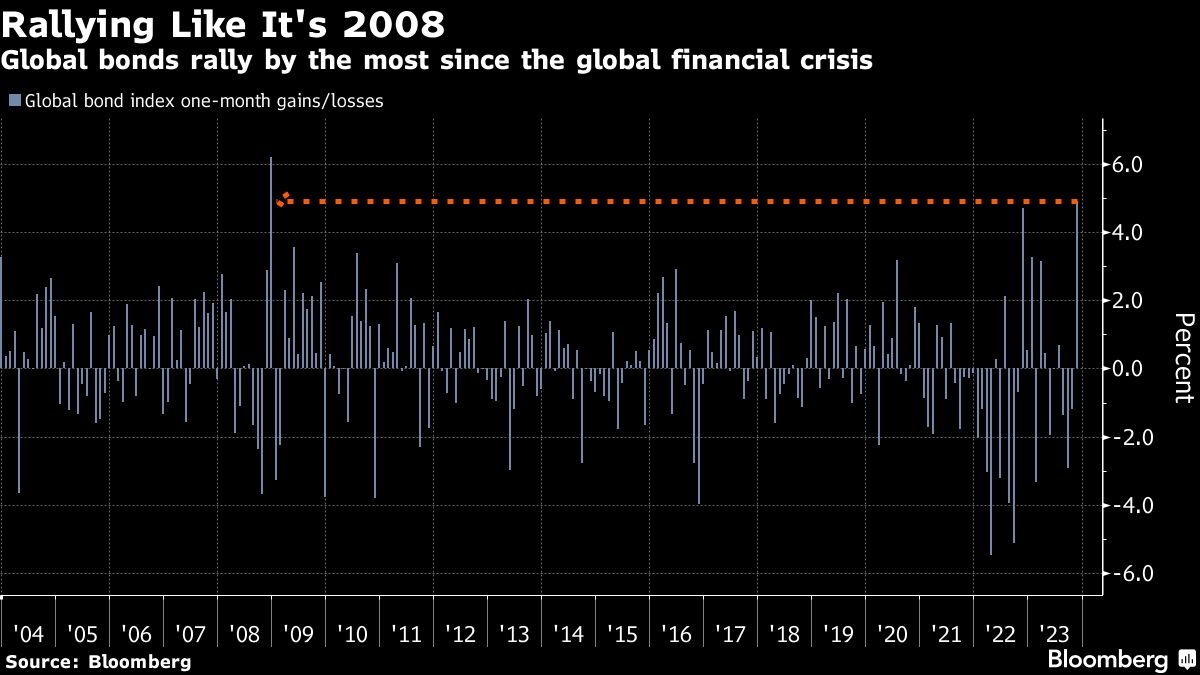

Bonds also lost steam Thursday after investors piled heavily into the market this month.

The Bloomberg U.S. Aggregate index — which tracks investment-grade government and corporate debt — has gained almost 5 per cent in November and heading toward its best performance since the 1980s. The gauge recently flipped higher for the year after posting a record loss of 13 per cent in 2022.

“Buy the rumor, sell the fact,” said Andrew Brenner at NatAlliance Securities. “Everyone was expecting a good PCE number, but when it happened everyone was already long. Indigestion.”

Traders continued to keep a close eye on the latest remarks from U.S. officials. Fed Bank of New York President John Williams reiterated the benchmark lending rate is at or near its peak and said policy is “quite restrictive.” His San Francisco counterpart Mary Daly said rates are in a “very good place” to control inflation, though she’s not thinking about cuts and that it was too soon to say if hikes are finished.

“It is still too early to eliminate the tightening bias in the Fed’s forward guidance,” said Brian Rose, senior U.S. economist at UBS Global Wealth Management. “Fed Chair Jerome Powell will make a public appearance on Friday, and we expect him to be careful to avoid sounding too dovish.”

To Jose Torres at Interactive Brokers, the soft economic data may have set markets for a rally if Powell provides more dovish comments. However, recent progress only provides a medium-sized window of optimism as Powell has already emphasized the Fed wants to see evidence that inflation is slowing for the long haul before the central bank starts slashing rates.

“If he maintains his hawkish stance and dashes hopes of rate cuts early next year, then today’s data may be similar to the teasing nature of an unseasonably warm day in February,” Torres said. “While it’s easy to assume such a day is a sign of Spring’s arrival, it’s often just a reprieve from shoveling snow and heavy winter clothing that resembles the Michelin tire man.”

“Likewise, if Powell maintains his hawkish stance, the deep chill of pessimism regarding potential rate cuts early next year could spark volatility, Torres added.

Elsewhere, oil fell as OPEC+’s output reduction failed to convince traders.

Euro-zone inflation cooled more than expected, putting the 2 per cent target in sight as investors step up bets that the European Central Bank will cut interest rates sooner than officials suggest. Upside risks to the inflation outlook dominate and another interest-rate hike can’t be excluded, European Central Bank Governing Council member Joachim Nagel said.

Corporate Highlights:

- OpenAI is sticking with a plan to let employees sell shares in the company through what’s known as a tender offer, and it’s giving would-be participants an extra month to decide whether to take part, according to several people with knowledge of the matter.

- Canada has finalized a deal to order as many as 16 military surveillance aircraft from Boeing Co. as part of a $7.7 billion investment, rejecting a homegrown rival proposed by private-jet manufacturer Bombardier Inc.

- Ford Motor Co. restored financial guidance, saying profits would come in lower than earlier projections due to rising labor costs from its new contract with the United Auto Workers union.

- Billionaire Nelson Peltz’s Trian Fund Management LP plans to seek board representation at Walt Disney Co. following the entertainment company’s rejection of its request for seats.

- Meta Platforms Inc. sued the U.S. Federal Trade Commission claiming its in-house trials violate the Constitution and asked a court to immediately halt the agency’s bid to change a 2020 privacy settlement.

- AbbVie Inc. agreed to acquire ImmunoGen Inc. for $10.1 billion in a move aimed at gaining access to some of the hottest new drugs in the growing cancer market.

- Occidental Petroleum Corp. is in talks to buy closely held shale driller CrownRock LP, according to people familiar with the matter, as consolidation in North America’s most prolific oil field gathers pace.

- Snowflake Inc. gave a product sales outlook for the current quarter that beat expectations, fueling hope that revenue has stabilized after the software maker experienced a dramatic slowdown in growth during the past year.

Key events this week:

- China Caixin Manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, Friday

- U.S. construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.4 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.2 per cent

- The Dow Jones Industrial Average rose 1.5 per cent

- The MSCI World index rose 0.2 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.4 per cent

- The euro fell 0.7 per cent to $1.0887

- The British pound fell 0.5 per cent to $1.2626

- The Japanese yen fell 0.7 per cent to 148.22 per dollar

Cryptocurrencies

- Bitcoin was little changed at $37,757.5

- Ether rose 0.8 per cent to $2,044.88

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 4.34 per cent

- Germany’s 10-year yield advanced two basis points to 2.45 per cent

- Britain’s 10-year yield advanced eight basis points to 4.18 per cent

Commodities

- West Texas Intermediate crude fell 3.1 per cent to $75.44 a barrel

- Spot gold fell 0.4 per cent to $2,035.57 an ounce