Feb 13, 2023

Asian Issuers Seen Turning to Convertible Bonds for Cheap Funding

, Bloomberg News

(Bloomberg) -- Asian companies are turning to convertible bonds as an appealing cheap instrument to raise funds and refinance debt while interest rates remain high, according to bankers in the region.

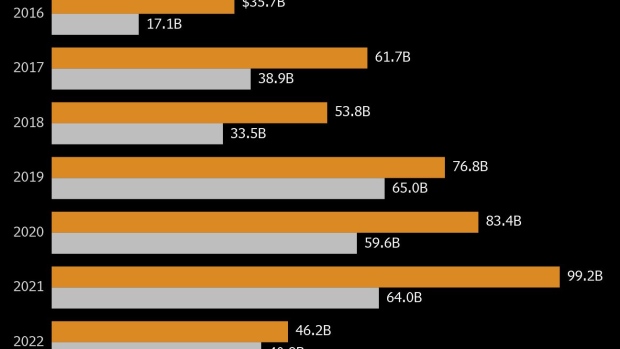

Popular early in the pandemic, Asia’s issuance of the equity-linked notes last year slowed to about $46 billion, the lowest amount since 2016, according to data compiled by Bloomberg. Activity has picked up in the first weeks of 2023, with companies from Japan to Singapore and Taiwan tapping the market.

“In a higher interest-rate environment, this is a good instrument. The product is growing and increasingly getting more attention from issuers,” said Christian Lhert, a managing director responsible for equity-linked origination in Asia ex-Japan at Goldman Sachs. In the next few months, “we will see more existing CB issuers seeking to refinance prior notes,” he said in an interview.

Convertibles allow companies to borrow at lower rates than regular debt — in some recent cases for free. The notes also give investors the chance to profit from a rise in the underlying share price, which is attractive in volatile markets.

While Chinese companies are expected to dominate convertible sales in Asia this year, investors should also see a more diverse pool of issuers, including Southeast Asia-based sellers, according to Lhert. High-rated companies that traditionally can tap bond markets are “are now considering equity-linked notes due to the cost advantage they offer”, he added.

Firms tend to refinance convertible bonds a year or two before they mature. With interest rates elevated, companies have been “increasingly considering” equity-linked notes as a low-coupon alternative to refinancing debt, according to Rob Chan, head of equity-linked origination for Asia Pacific at Citigroup Inc.

Earlier this month Park24 Co. Ltd., a Japanese parking lot operator, said in a filing that it plans to sell about 35 billion yen ($265 million) of five-year convertible bonds mainly in Europe and Asia to repurchase equity-linked notes due in 2025. Meanwhile, Taiwanese electronics company BizLink Holding Inc. last month sold $150 million of zero coupon notes due in 2028.

Exchangeable bonds, similar equity-linked instruments where investors can swap their holdings into shares of a different company, have also been in vogue.

Singapore’s The Straits Trading Co. in late January sold S$370 million ($279 million) in bonds that can be exchanged into shares of Hong Kong-listed ESR Group Ltd. The sale saw demand for twice of what was offered and represented about a third of the issuer’s market capitalization at the time. Goldman Sachs was the sole bookrunner for the offering.

This month, Citigroup Global Markets Holdings Inc. raised HK$2.35 billion ($299 million) from the sale of bonds bearing no interest that can be exchanged for shares of AIA Group Ltd.

Read More: UBS Favors China Onshore Convertible Bonds Amid Faster Reopening

“From the investors’ perspective, convertibles represent an opportunity for a defensive investment in equity upside. This should be appealing exposure in a volatile market environment,” said Citigroup’s Chan. “We expect investors will be selective, and focus on higher quality issuers, as issuance activity recovers.”

--With assistance from Sean Michael Lim.

©2023 Bloomberg L.P.