Apr 19, 2023

ASML Sales Outlook Beats Estimates as Demand Remains Strong

, Bloomberg News

(Bloomberg) -- ASML Holding NV shares fell in Amsterdam trading on concerns that falling demand in the broader semiconductor industry would have a long-term impact on its results.

“We continue to see mixed signals on demand from the different end-market segments as the industry works to bring inventory to more healthy levels,” Chief Executive Officer Peter Wennink said in the company’s earnings statement on Wednesday. “The overall demand still exceeds our capacity for this year and we currently have a backlog of over €38.9 billion ($42.6 billion).”

Even as ASML is able to bank on its large order backlog, the slump in some of its customers in the chip market has yet to bottom out, as rising interest rates, surging inflation and the ongoing banking crisis continue to dent consumer sentiment. Taiwan Semiconductor Manufacturing Co., ASML’s biggest customer, missed sales estimates last week for the second consecutive quarter in a sign of continued weakness in global electronics demand. ASML said first-quarter bookings dropped 46% to €3.75 billion from a year earlier, raising concerns about its long-term outlook.

ASML’s shares slid as much as 4.9% after the earnings report and were trading 2.2% lower at €575.80 apiece as of 10:10 a.m. in Amsterdam. The stock has gained 14% this year.

While ASML’s results were better than expected, it “showed considerable lumpiness in the orders taken suggesting some of the customer capex cuts are impacting,” Morgan Stanley analyst Lee Simpson said in a note. “This suggests some headwinds to growth for 2024-2025, something we think investors were already nervous of.”

Still, the company forecast second-quarter sales that beat analysts’ estimates amid continued strong demand for its machines.

Revenue will rise to €6.5 billion to €7 billion this quarter, the Dutch company said in a statement on Wednesday. That compared to analysts’ average estimate of €6.42 billion. Europe’s most valuable technology company also said total demand continues to outstrip capacity for its exclusive machinery this year.

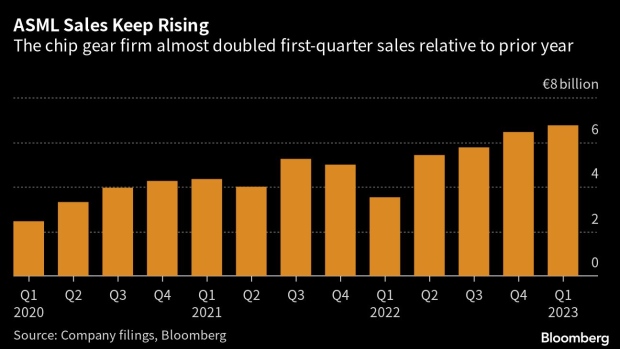

First-quarter net sales of €6.7 billion and gross margin of 50.6% were also above its guidance due to higher-than-anticipated income from advanced extreme ultraviolet and deep ultraviolet lithography machines. Chipmakers are installing and adopting its hardware at a rapid clip, even while they are adjusting to faltering orders and inventory buildup from a market slowdown.

Governments around the world are still racing to build more chip plants at home to avert future supply disruptions. The US has received more than 200 applications from companies for a $39 billion program to boost chip production, while Japan, India and the European Union are also all offering financial incentives to attract investments from major chipmakers.

China accounted for about 8% of ASML sales in the first quarter and about 20% of its order backlog, the company said. ASML sees significant pickup of revenue from China this year, though some sales may eventually be affected by Dutch export control measures.

The restrictions are expected to prevent shipments of three immersion deep ultraviolet lithography machines, people familiar with the matter told Bloomberg previously. ASML is already prohibited from selling its most cutting-edge technology, so-called extreme ultraviolet lithography, to Chinese companies.

“We are still waiting for the final detailed guidance from the Dutch authorities,” Chief Financial Officer Roger Dassen said in a separate statement, in reference to the planned widening of trade curbs. “What this does for us is that we expect that we will require export licenses for advanced immersion tools,” he said. “Our interpretation of advanced immersion tools would be for the NXT:2000 and subsequent versions.”

Read more: New Dutch Curbs on China Sales Target Three ASML Chip Machines

ASML, which has cornered the market for the most advanced equipment needed to make cutting-edge semiconductors, has been impacted by the US bid to curb exports of leading-edge technology to China, its third-biggest market. After pressure from President Joe Biden’s administration, the Dutch government last month announced plans to restrict exports of some of ASML’s chipmaking machines. The Veldhoven-based company has tried to reassure investors, saying the measures will not have a material effect on its financial outlook for 2023, or in the long term.

What Bloomberg Intelligence Says

ASML’s 1Q net bookings, down 46% from a year ago, might be shy of market expectations. Its sales in 2024 could temporarily lose steam, despite potentially growing 25% this year. The slowdown in its order bookings, announced April 19, is probably in line with the wider chip-making tool industry and could be followed by a strong recovery toward 2030.

— Masahiro Wakasugi, BI senior industry analyst

©2023 Bloomberg L.P.