Jul 18, 2022

Bank ETF Sees Record Outflow Streak as Recession Fears Mount

, Bloomberg News

(Bloomberg) -- Exchange-traded fund investors are balking at bank stocks as concerns about a recession grow.

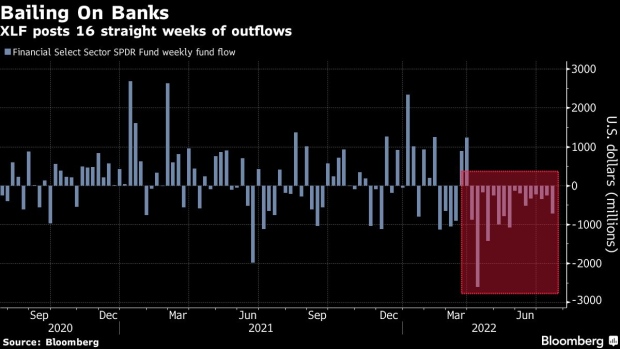

The $28.4 billion Financial Select Sector SPDR Fund (ticker XLF) has seen outflows for 16 straight weeks, the longest such streak in its 23-year history, according to data compiled by Bloomberg. Almost $11 billion has been wiped away in that span, shrinking the fund’s total assets by roughly 28%.

Soaring inflation and the Federal Reserve’s aggressively monetary-policy tightening have driven some long-term interest rates below short-term ones, showing anxiety that economic growth will stall. That so-called inversion of the yield curve can also be bad for banks, which profit by borrowing short-term to make longer-term loans.

“You’re seeing the selloff there primarily because of the fears of a recession,” said Chuck Cumello, president and chief executive officer of Essex Financial Services. He says investors are losing interest in bank stocks because “the Fed’s raising rates, we have an inverted yield curve right now, and if the economy does slow down, that generally provides more of a headwind for those companies.”

A handful of big banks have reported earnings for the second-quarter and the results have been mixed. JPMorgan Chase & Co. temporarily halted share buybacks as earnings fell short of estimates and Morgan Stanley said investment-banking revenue plummeted in the previous quarter. Meanwhile, Goldman Sachs Group Inc. reported results that were better than expected in nearly every area and Bank of America Corp. announced an increase in net interest income.

Despite the economic growth fears, bank CEOs have been reluctant to sour on the US outlook because of the relatively strong financial position of consumers. And while investors have focused on the threat of a recession, Cumello is convinced the selloff in financials is “a little bit overdone” as the first-half market rout hit investment banking hard.

“They’re in a great position from a capital point of view,” Cumello said of banks. “They’ve got strong dividends, low P/Es by and large, and it’s one of those areas where if you’re looking for an entry point -- XLF is down more than 17% year-to-date.”

©2022 Bloomberg L.P.