Jun 16, 2022

Bets on Yen Rally Suggest Dovish BOJ May Finally Capitulate

, Bloomberg News

(Bloomberg) -- Currency options traders are betting that the Bank of Japan will join its global peers in delivering a surprise this week.

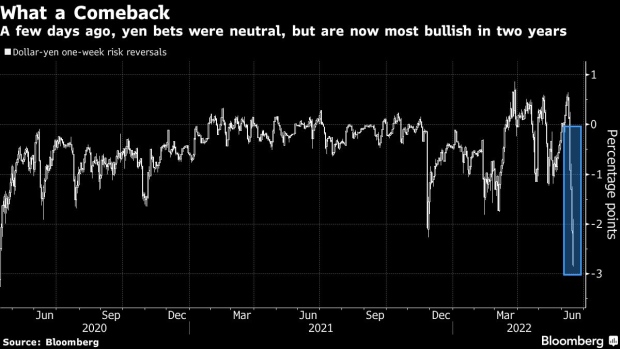

Demand to hedge one-day price swings in the yen ahead of the BOJ’s meeting Friday is the highest since the pandemic first rattled global markets in March 2020. Traders are also betting that the yen -- already surging -- could rally in the most compelling fashion since then.

While Japan’s policy makers are expected to continue with monetary easing, pressure on the central bank to alter its policy stance or outlook is growing following strong moves by the Federal Reserve and the Swiss National Bank. The yen rallied as much as 1.1% Thursday.

In a Bloomberg survey last week, all but one of 45 surveyed economists forecast no change in the BOJ’s main policy settings for its yield curve control and asset purchases. The central bank could catch markets wrong-footed by escaping negative rates territory, altering guidance that it “expects short- and long-term policy interest rates to remain at their present or lower levels,” or by reshaping curve control.

“Speculators have mounted a direct challenge to the YCC policy by selling JGB futures,” said John Hardy, head of currency strategy at Saxo Bank. “With the Fed raising the pace of its rate tightening yesterday and the ECB getting priced to move to a faster pace of hiking than previously anticipated, the pressure may become intolerable on the Japanese yen and force the BOJ to capitulate soon.”

- NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

©2022 Bloomberg L.P.